We are sure that Forbes magazine has had plenty of cover stories about successful entrepreneurs who survived the front-cover curse and remained successful. However, the magazine has also featured a few rising stars who subsequently crashed and burned. The latest Forbes front cover features Michael Saylor of Microstrategy and is titled "The Bitcoin Alchemist." It's not a ringing endorsement. In any event: We have been warned.

The markets certainly didn't give a ringing endorsement to Trump 2.0 tariffs announced on Friday: 25% each on Canada and Mexico and 10% on China. During his presidential campaign, Trump talked about 60% on China. Stocks sold off in the afternoon. Bond yields didn't budge much. The dollar strengthened a bit. Gold and bitcoin prices remained steady near their recent record highs. The Canadian dollar and Mexican peso weakened (chart).

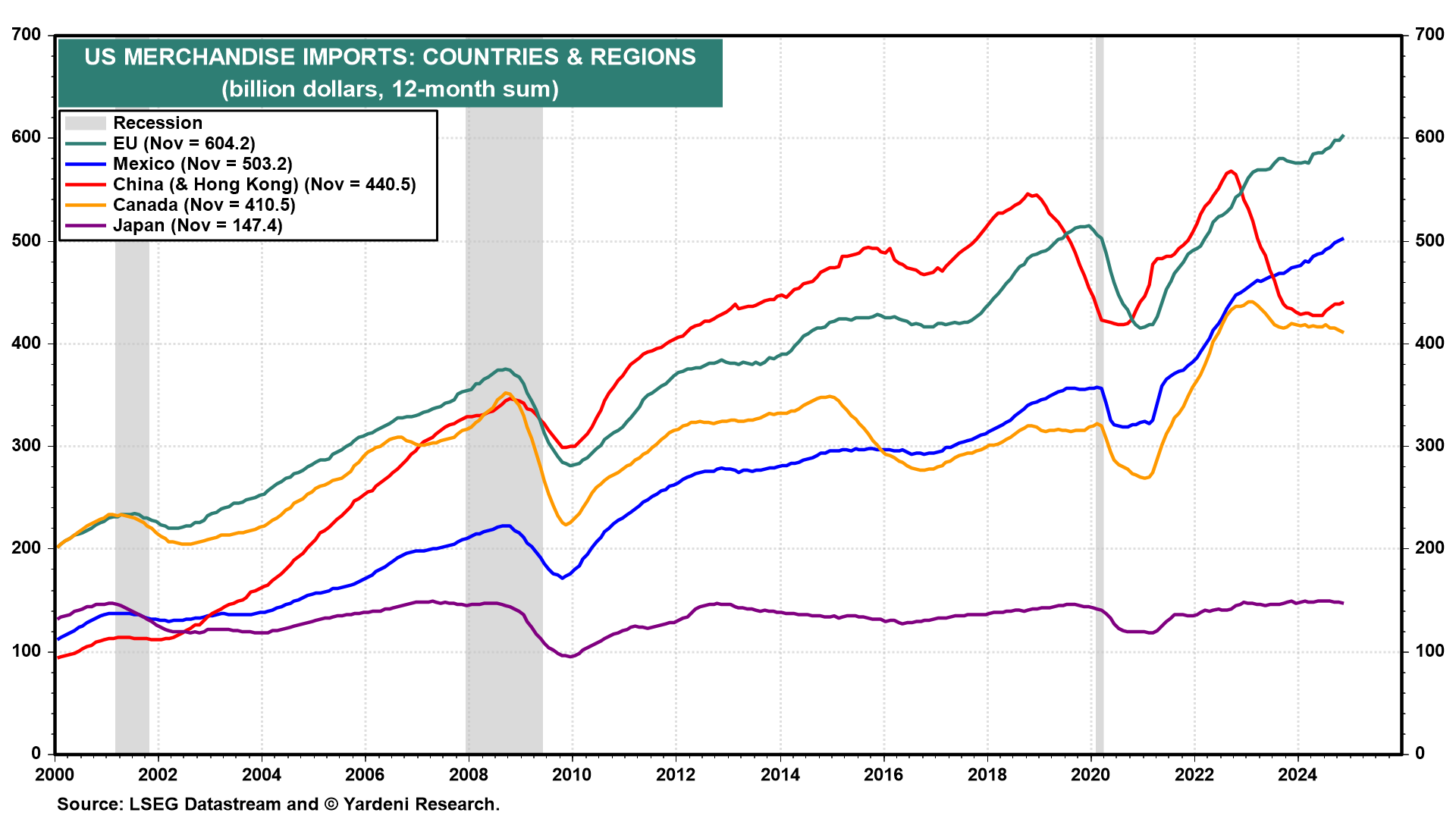

The US is also considering imposing tariffs on the European Union (EU). Over the past 12 months through November, the US imported the most merchandise from the EU, Mexico, China, Canada, and Japan in that order (chart).

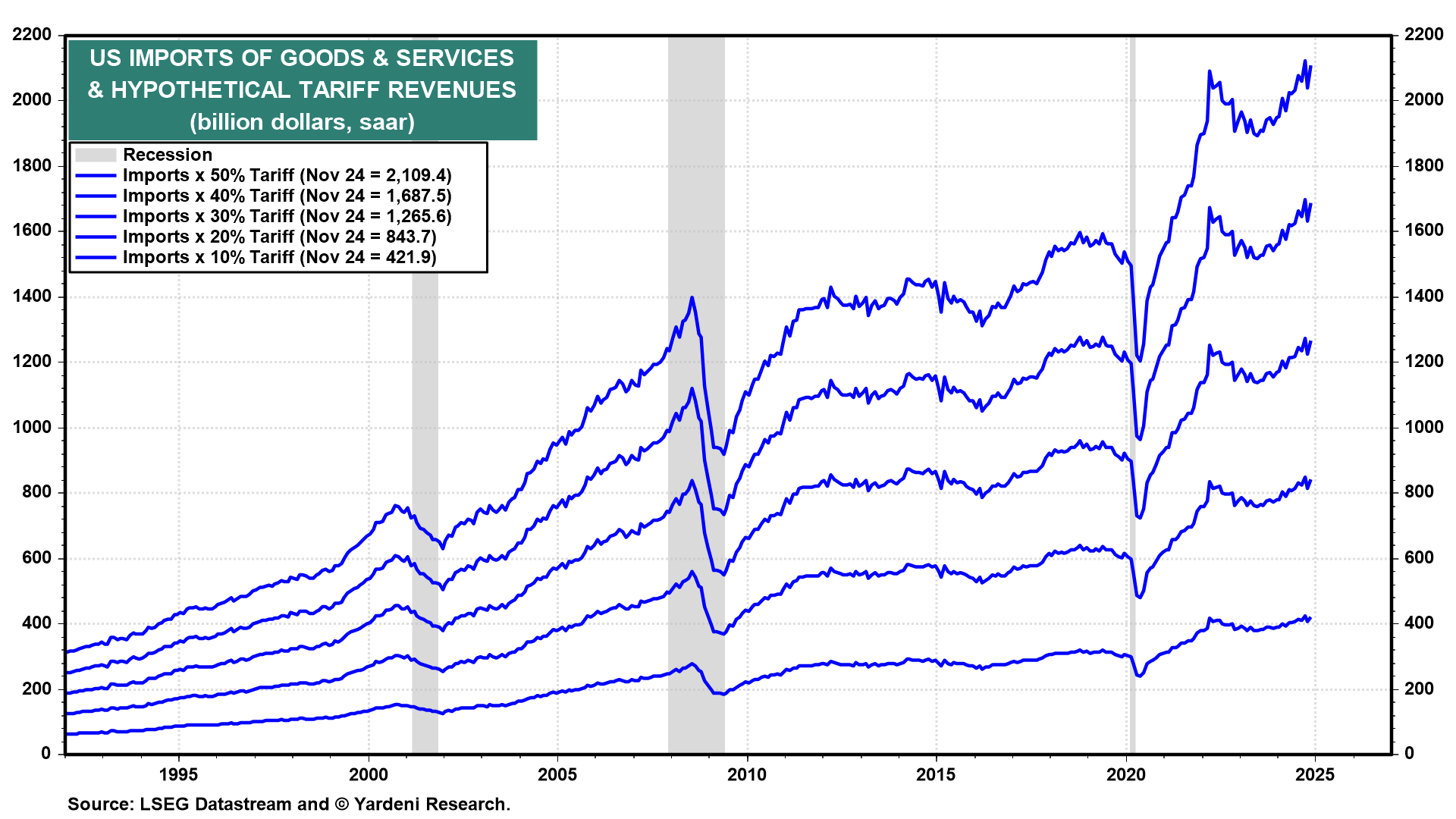

Treasury Secretary Scott Bessent told senators during his confirmation hearing that tariffs will be used to bring manufacturing back to the US, to raise revenues to help pay for extending Trump's 2017 tax cuts, and to use as a lever to negotiate with other countries (as an alternative to sanctions). He estimated that Trump's tax cuts will reduce government revenues by $4.6 trillion over 10 years, while Trump's tariff hikes could raise up to $3.0 trillion over the same period. A uniform 10% tariff on all imports of goods and services would raise about $400 billion per year assuming nothing else changes (chart). But that is undoubtedly a questionable assumption.

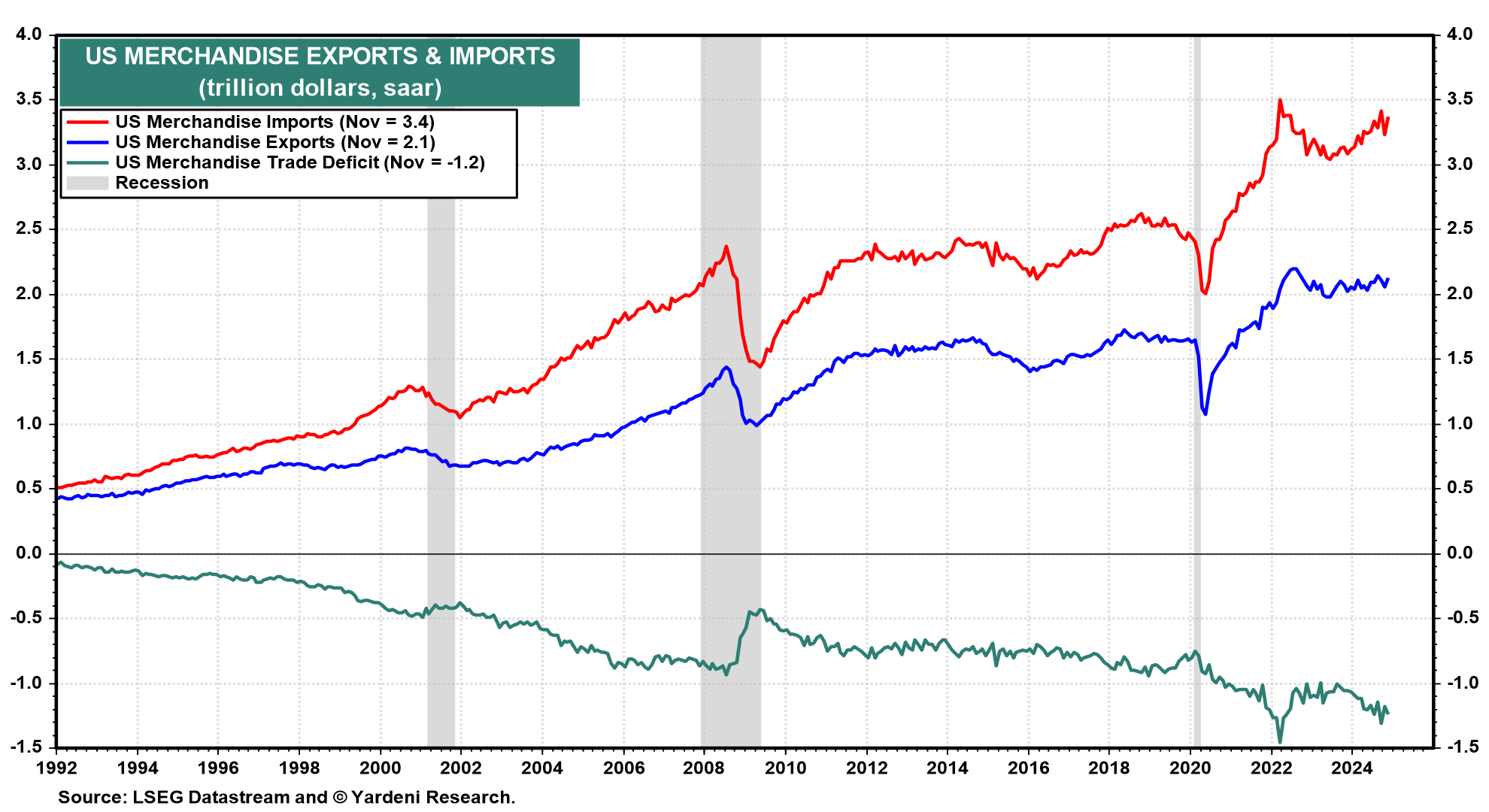

We note that during Trump 1.0, tariff hikes by the US seem to have depressed merchandise imports in 2018 and 2019. But they also depressed US exports because global economic growth was weakened by trade tensions (chart).

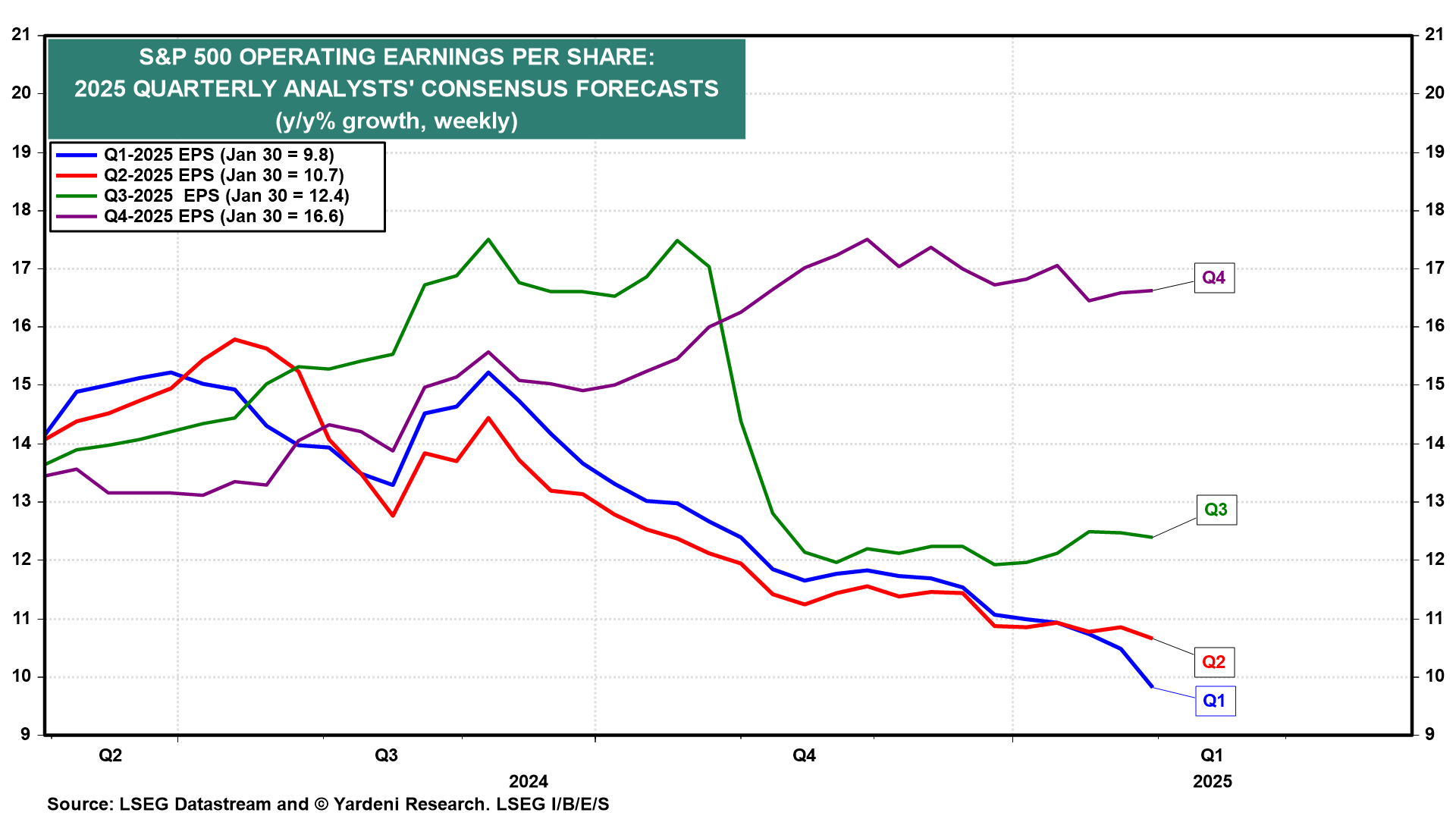

The Q4-2024 earnings reporting season has been a solid one, with industry analysts currently projecting a 9.2% y/y increase in S&P 500 earnings per share. However, the focus now will be on the next couple of quarters. Analysts already had been lowering their expectations for Q1- and Q2-2025, which are down to 9.8% and 10.7% (chart). Trump 2.0 tariffs, and upward pressure on the dollar resulting from them, will probably lead to more downward earnings estimate revisions. Uncertainty about the impacts of Chinese AI competitor DeepSeek may also weigh on the AI stocks.

Meanwhile, our good friend Jim Lucier of Capital Alpha Partners reminded us this weekend that the federal budget reconciliation process starts a week from now. His prediction: “I expect it is going to be a trainwreck. No ‘big, beautiful bill’ done by May 1. Expect a jalopy held together with scotch tape and chewing gum to wheeze across the finish in time for August recess—maybe.”

We started the year expecting that it would be more volatile for the stock market during the first half than the second half. That's still our call. Our S&P 500 price targets remain unchanged, however. We continue to bet on the resilience of the US economy and our Roaring 2020s scenario.