In his presser last Wednesday, Fed Chair Jerome Powell mentioned "careful" and "carefully" 16 times mostly to describe how the Fed will proceed from here. That sounds like good advice for investors right now. When he was asked about the impact of "external factors" on Fed policy and the economy, he provided a list of five troublesome developments: the UAW strike, a possible government shutdown, resumption of student loan payments, higher long-term interest rates, and the recent oil price shock. No wonder that "uncertain" and "uncertainty" were mentioned 11 times at the presser.

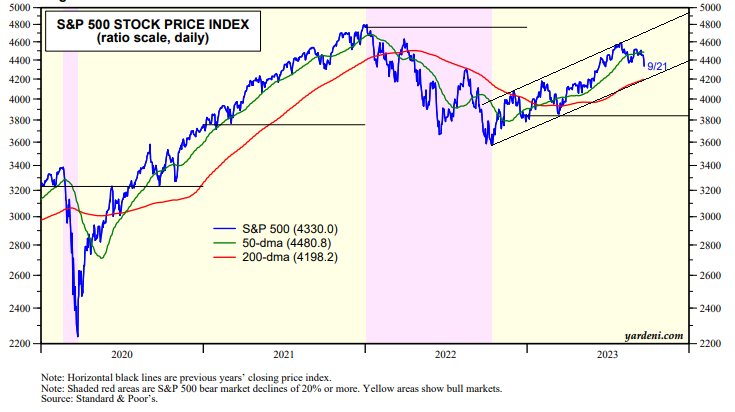

We have to agree with Powell: We live in uncertain times and we need to be careful. We've thought that the bull market might stall over the rest of this year after the S&P 500 came close to our 4600 target at the end of July. It's been a tough slog in the bond and stock markets since Fitch downgraded US debt on August 1. We've been thinking that the S&P 500 might fall to its 200-day moving average, which is currently at the bottom of its bull-market channel around 4200, before proceeding to climb back to 4600 in a yearend rally (chart).

That would require Powell's worry list to turn less worrisome by Thanksgiving. That could happen, in our opinion.

We asked our friend Joe Feshbach for his opinion on the market from a trading perspective: "This past week, the S&P 500 broke below its prior correction low of August 18. The Nasdaq has not breached its August 18 intra-day low but is close. Prior lows or highs are commonly violated when a trend reversal is about to take place. The Put-Call Ratio has moved to a level where I'm not concerned about a complete market annihilation (chart); but I am concerned by overextended tech charts that have developed topping patterns.