Just after Donald Trump won the presidential race on November 8, 2016, we observed that the economy and stock market were charged up with "animal spirits," a term coined by John Maynard Keynes meaning spontaneous optimism. Animal spirits are back now that Trump won a second term on November 5 and in a clean sweep if the Republicans win the House, which seems likely.

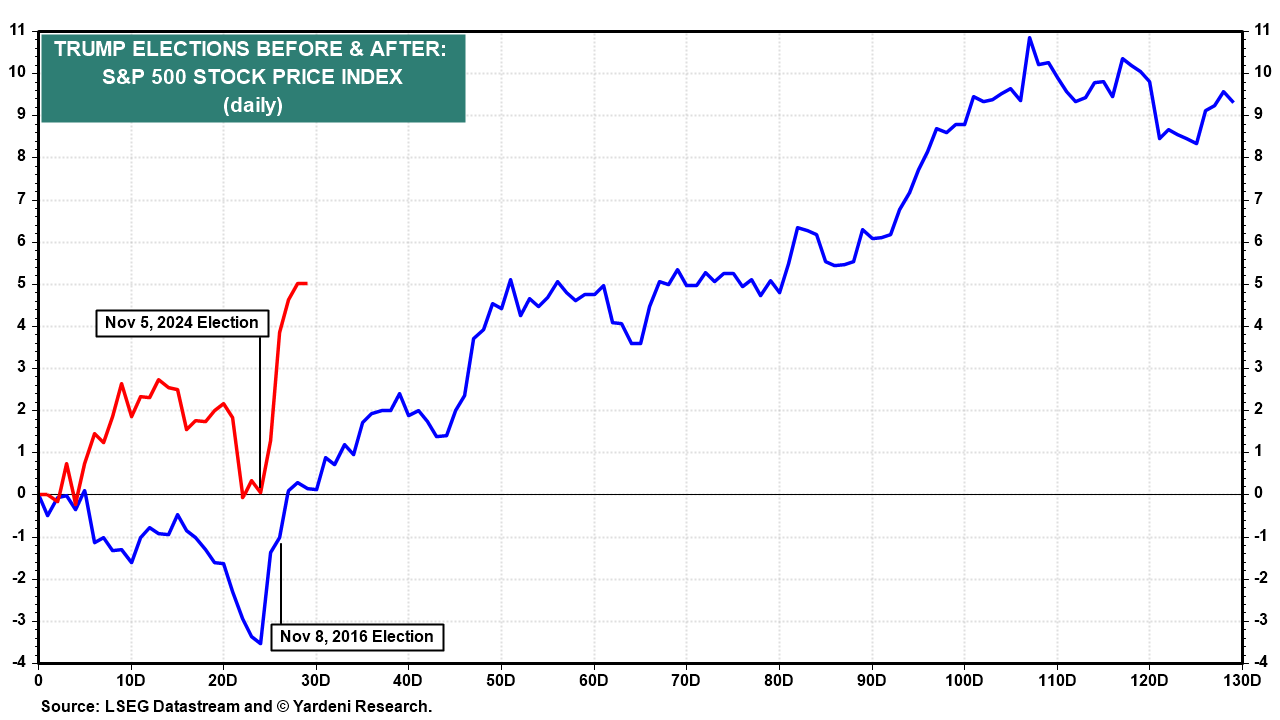

The stock market jumped for joy that the election results were definitive, thus averting a contested election. Stock investors are also thrilled by the regime change to a more pro-business administration promoting tax cuts and deregulation. Concerns about tariffs and bigger federal deficits haven't weighed on the stock market so far, though they seem to be weighing on the bond market. The S&P 500 rose 4.5% from Election Day through Friday last week, exceeding a similar comparison in 2016 (chart).

Industry analysts are likely to up their earnings estimates. We are too. For the S&P 500, we are raising our 2025 and 2026 operating earnings per share from $275 to $290 and from $300 to $320. These estimates assume that Trump will quickly lower the corporate tax rate from 21% to 15%. As of the week of November 7, industry analysts were at $275 and $308 for the next two years (chart). We expect that the S&P 500 profit margin will rise to new record highs of 13.9% and 14.9% over the next two years thanks to Trump's corporate tax cut, deregulation, and faster productivity growth.