In recent weeks, many news headlines have suggested that the US economy is tanking and that so is the Old World Order. So investors are jittery, and a risk-off investment style is back in favor relative to a risk-on posture. They are questioning whether Trump 2.0 might depress the economy before stimulating it because higher tariffs, deportations, and federal job cuts are occurring before tax cuts, deregulation, and lower oil prices. They are wondering whether President Donald Trump's New World Order will be more or less stable than the old one. They were shaken by Friday's shouting match in the Oval Office.

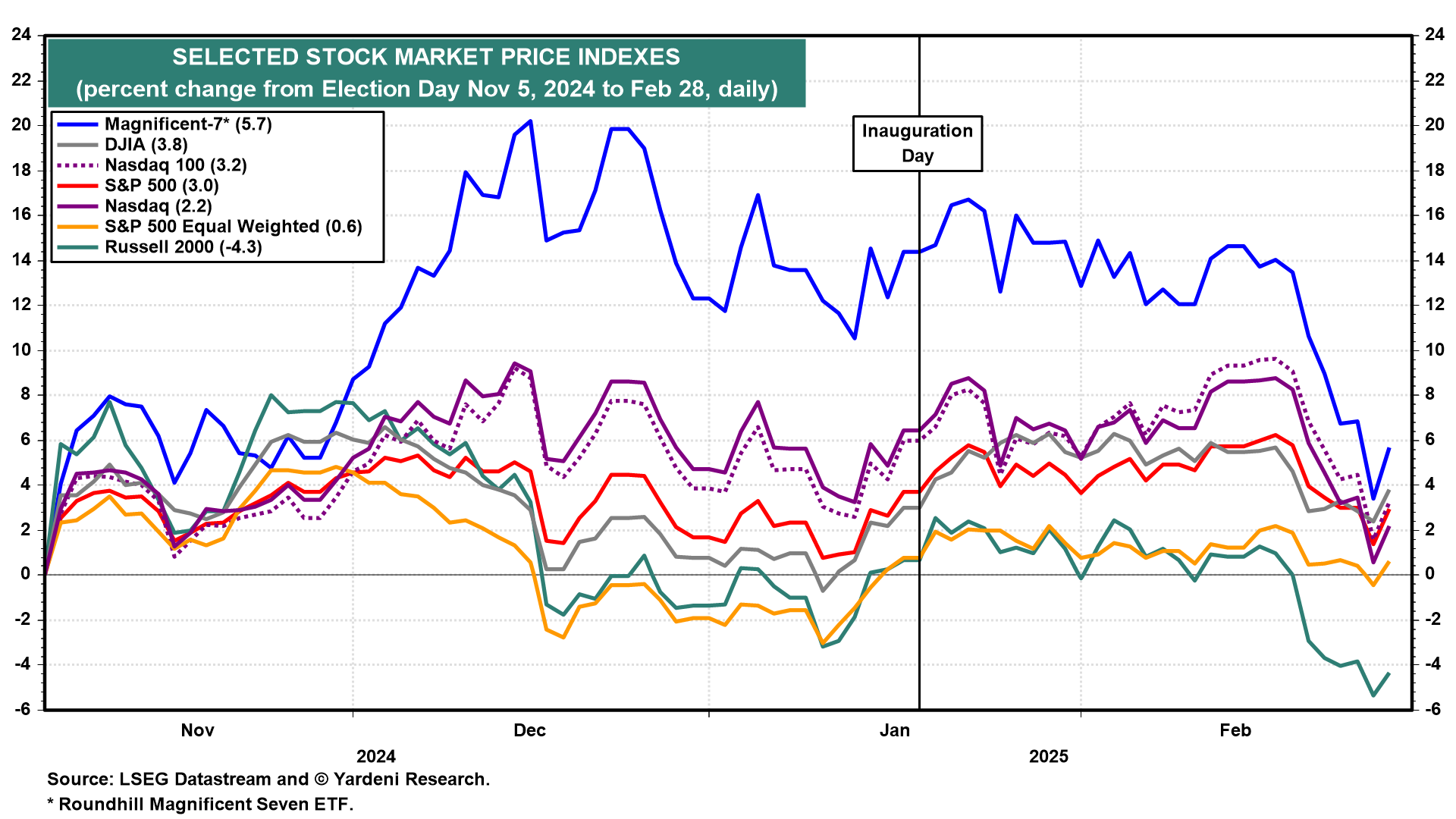

It all adds up to lots of uncertainty that is offsetting some of the animal spirits that were unleashed when Trump was elected for a second term. Most of the stock market gains following Election Day have been pared so far this year, especially those of the Magnificent-7 and the Russell 2000 (chart). Interestingly, the S&P 500 managed to rise 6.2% since Election Day to a new record high on February 19, but it is now down 3.1% since then and up just 3.0% since Election Day.

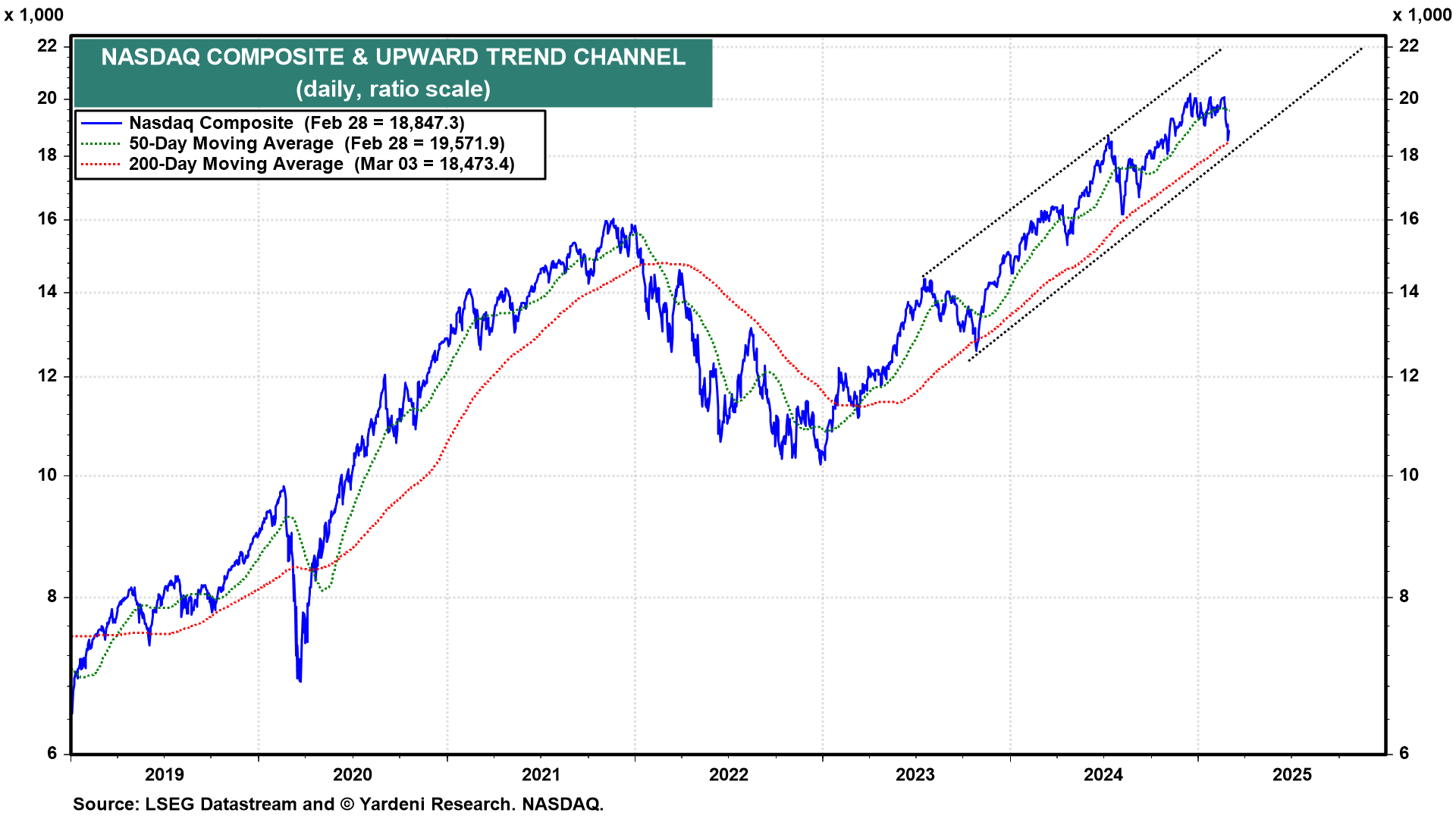

The Nasdaq Composite has been struggling to climb above 20,000 to a new record high since late last year (chart). In recent days, it gave up the effort and dropped back down to 18,847, just slightly above its 200-day moving average.

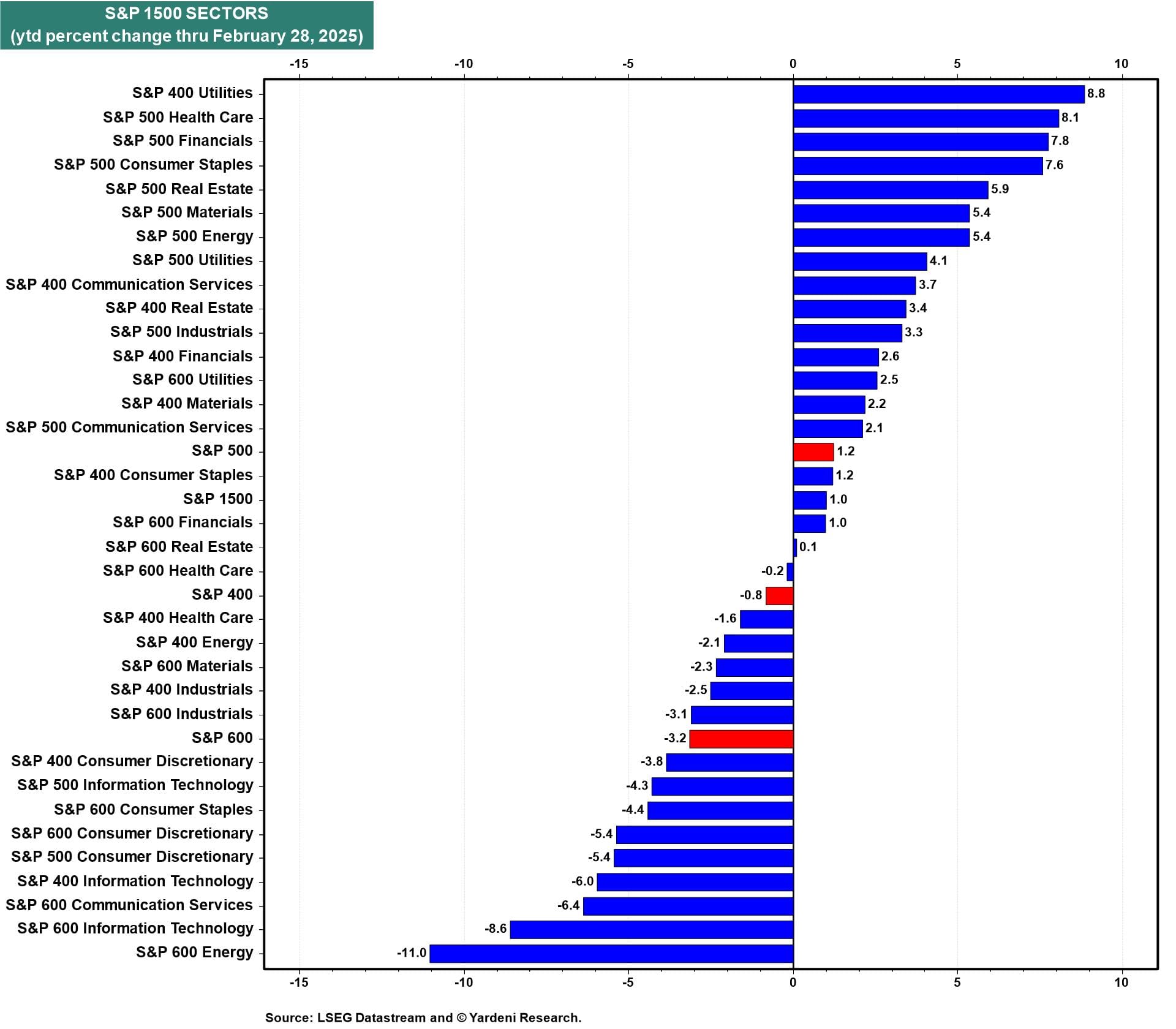

The defensive sectors of the S&P 1500 have mostly outperformed the cyclical sectors so far this year (chart). LargeCaps have outperformed SmallCaps and MidCaps so far this year.

So where do we go from here?