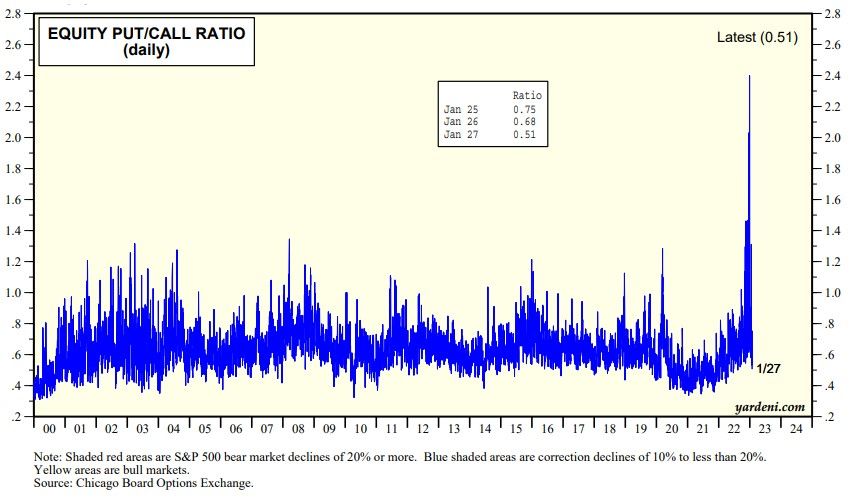

Here is Joe Feshbach's latest take on the S&P 500: "The index is getting closer to its two previous highs of 4100,and thus a possible break above that level." That's been his target at the beginning of this rally and he sees "no reason to alter it." He adds, "The sentiment numbers just do not support a big breakout above these levels and while a break above 4100 could lead to another 2% or so, I believe the right strategy now is to start pairing back positions bought earlier in preparation for the market's next setback."

We asked Joe about the downside. He said, "Hard for me to tell now. I just want to start paring back, as this breakout is going to fool most people."

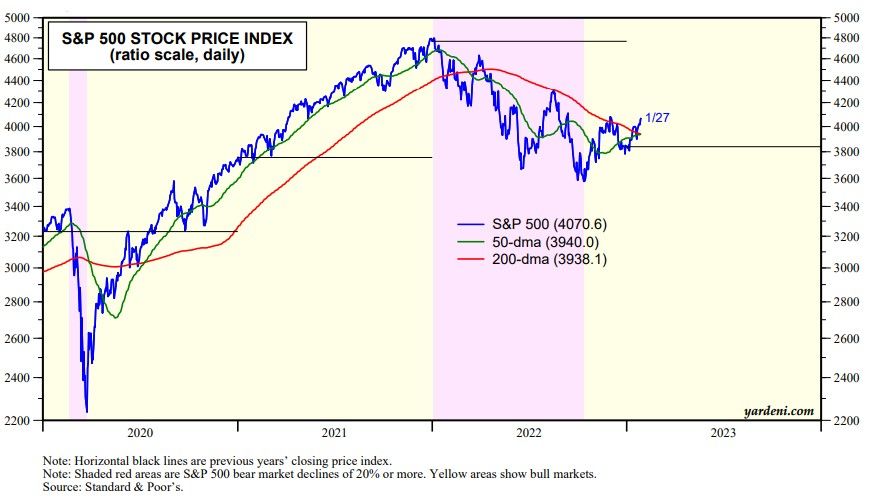

The S&P 500 has risen above its 200-day moving average in recent days. This is the fifth attempt by the index to rise above this average since early 2022 (chart). It might fail like the previous four attempts if Fed Chair Powell's presser on Wednesday is much more hawkish (again) than widely expected.

Sentiment may be too bullish as Feshbach suggests. The put/call ratio fell to 0.51 on Friday (chart).

Nevertheless, we still think that the bear market ended on October 12 of last year and that the S&P 500 will rise above last year's close this year.