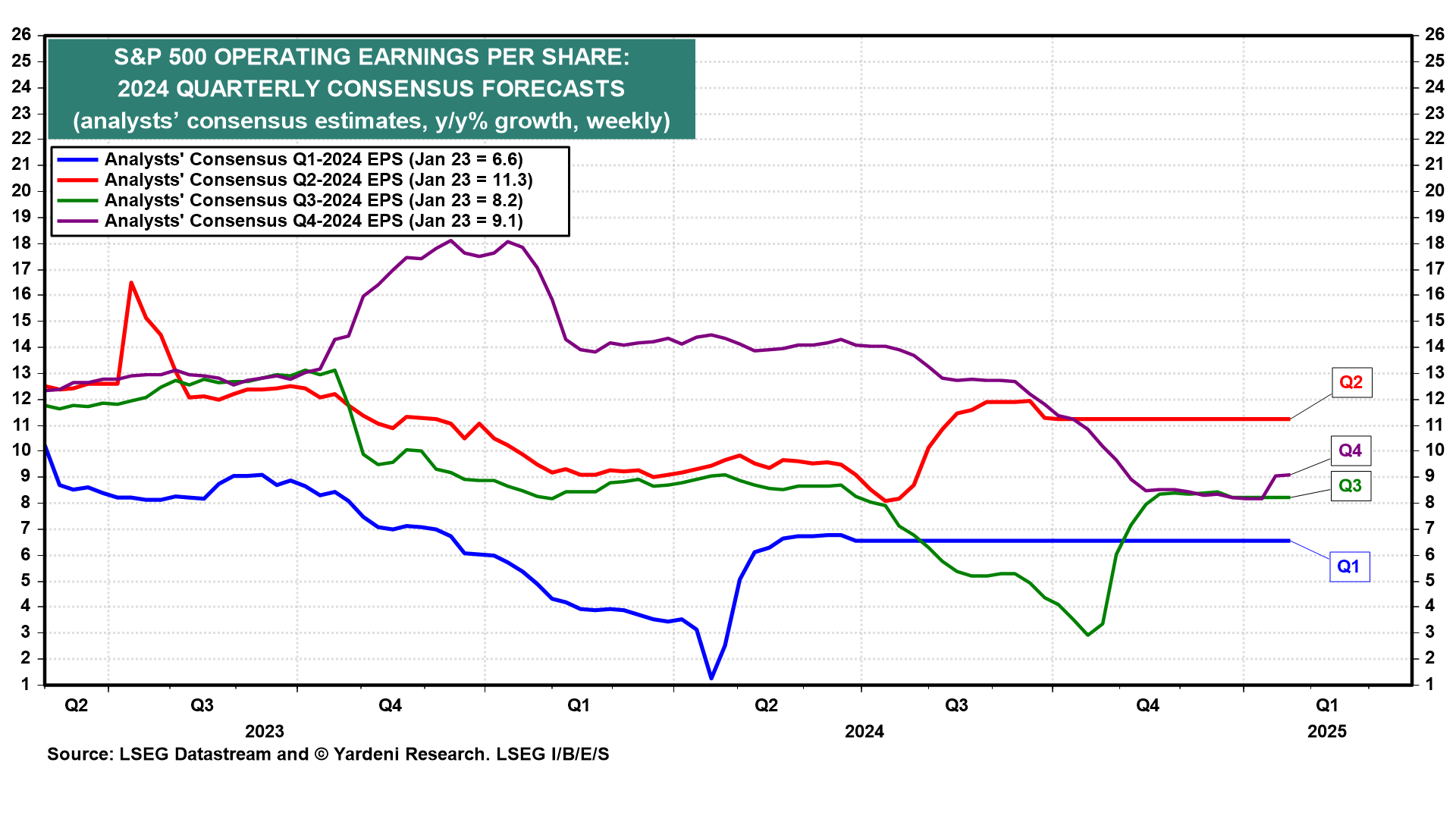

The Q4-2024 earnings reporting season is going well so far. It started out two weeks ago with better-than-expected big bank earnings. As a result, industry analysts increased their consensus expected Q4 earnings growth rate for the S&P 500 companies collectively from 8.2% y/y to 9.1% y/y (chart). We raised our expected earnings growth rate from 10.0% to 12.0%.

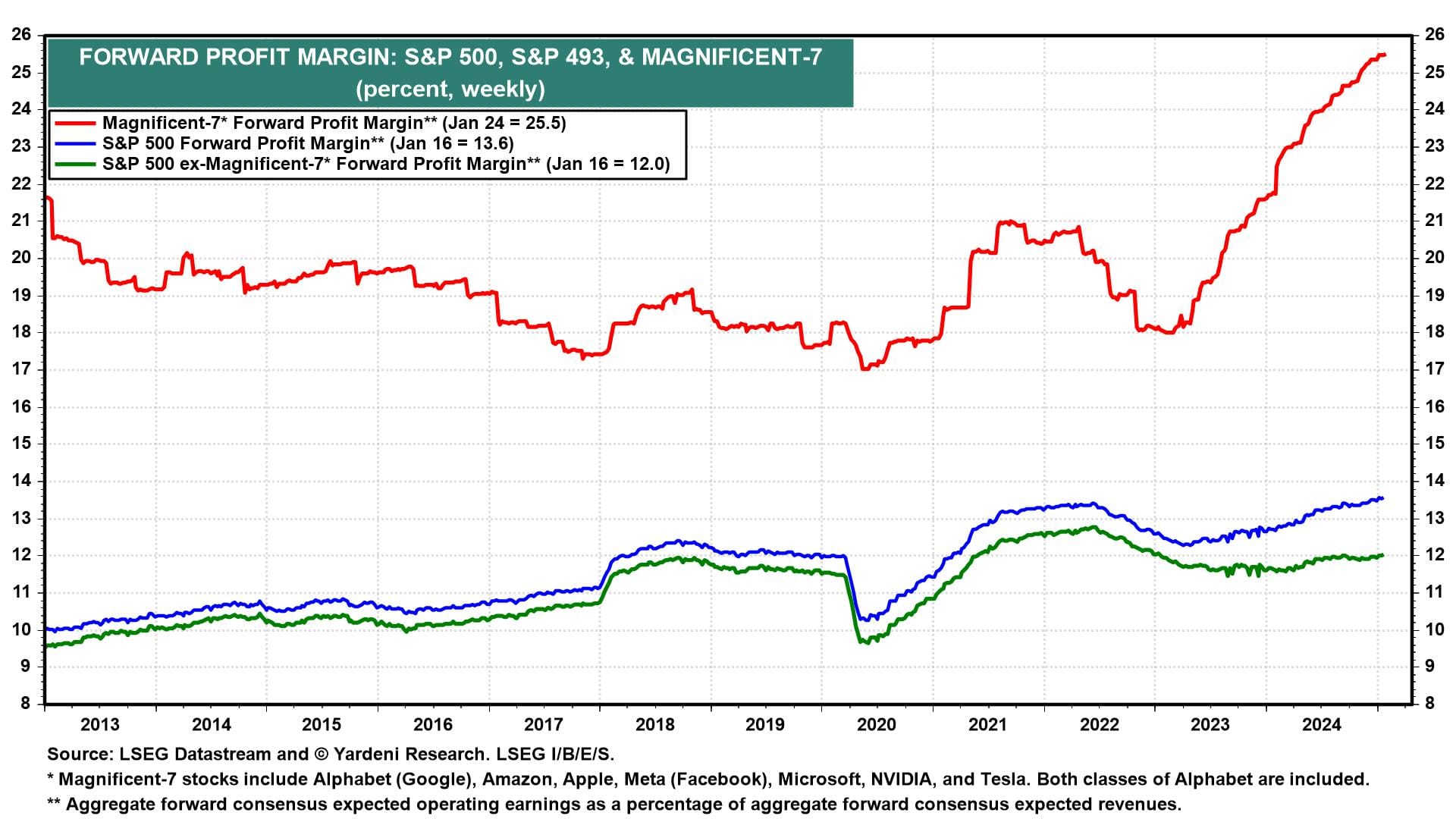

The next round of fun begins this week and next week when the Magnificent-7 report Q4 results: Microsoft, Tesla, and Meta (Wed, Jan 29), Apple and Amazon (Thu, Jan 30), and Alphabet (Tue, Feb 4). Nvidia won't report until Feb 26. The question is whether they will disappoint because their capital spending on AI is soaring faster than are their revenues. That could squeeze their collective profit margin. The forward profit margin of the Mag-7 has soared from 18.0% at the start of 2023 to 25.5% during the January 25 week.

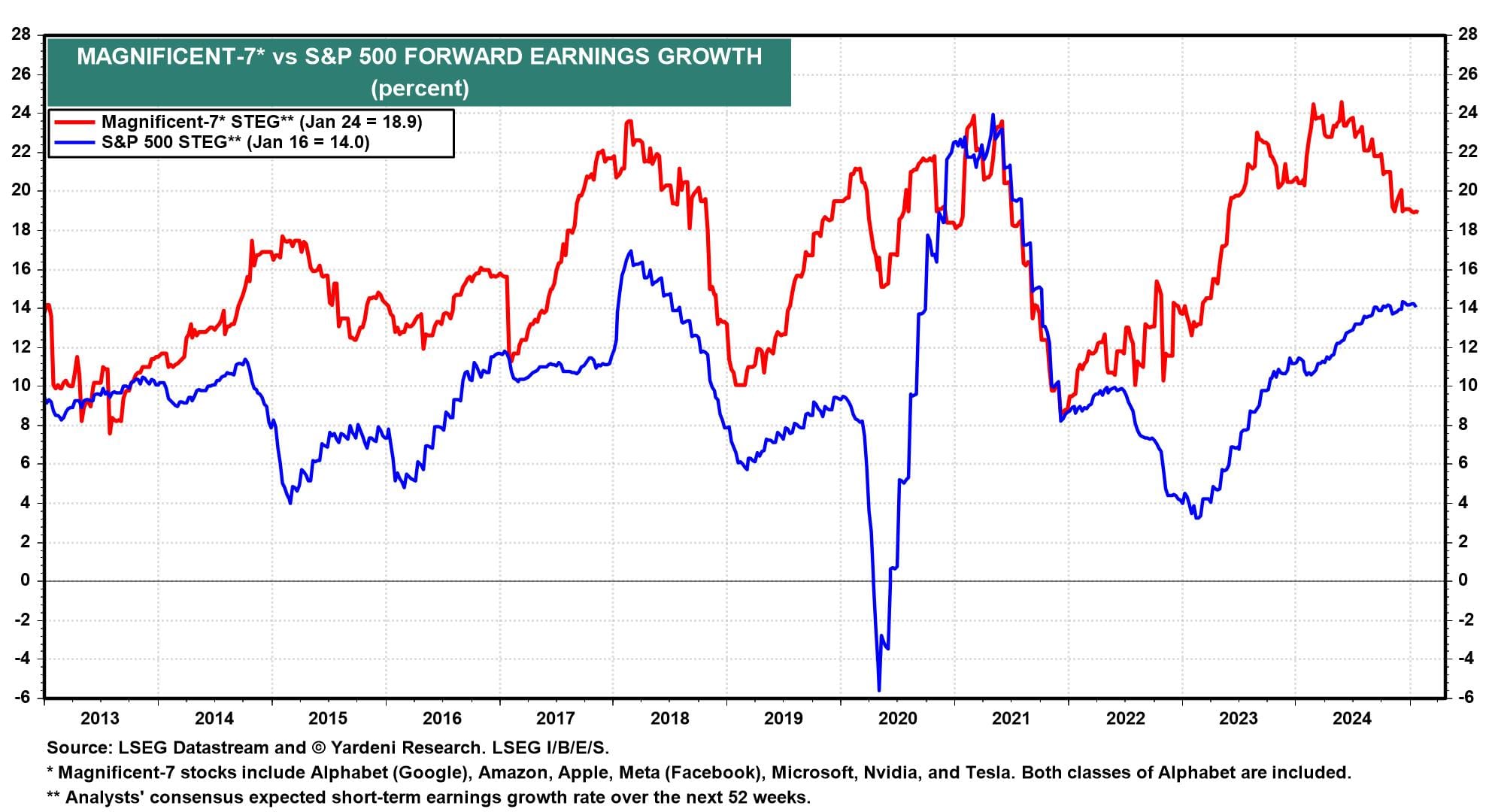

The consensus of industry analysts who follow the Mag-7 is showing that their short-term forward earnings growth rate (STEG) was 18.9% as of the January 24 week, down from almost 25.0% at the start of this year (chart). Interestingly, the STEG of the overall S&P 500 has risen from around 10% to almost 15% over this same period. Analysts must be raising their STEG for the S&P 493.

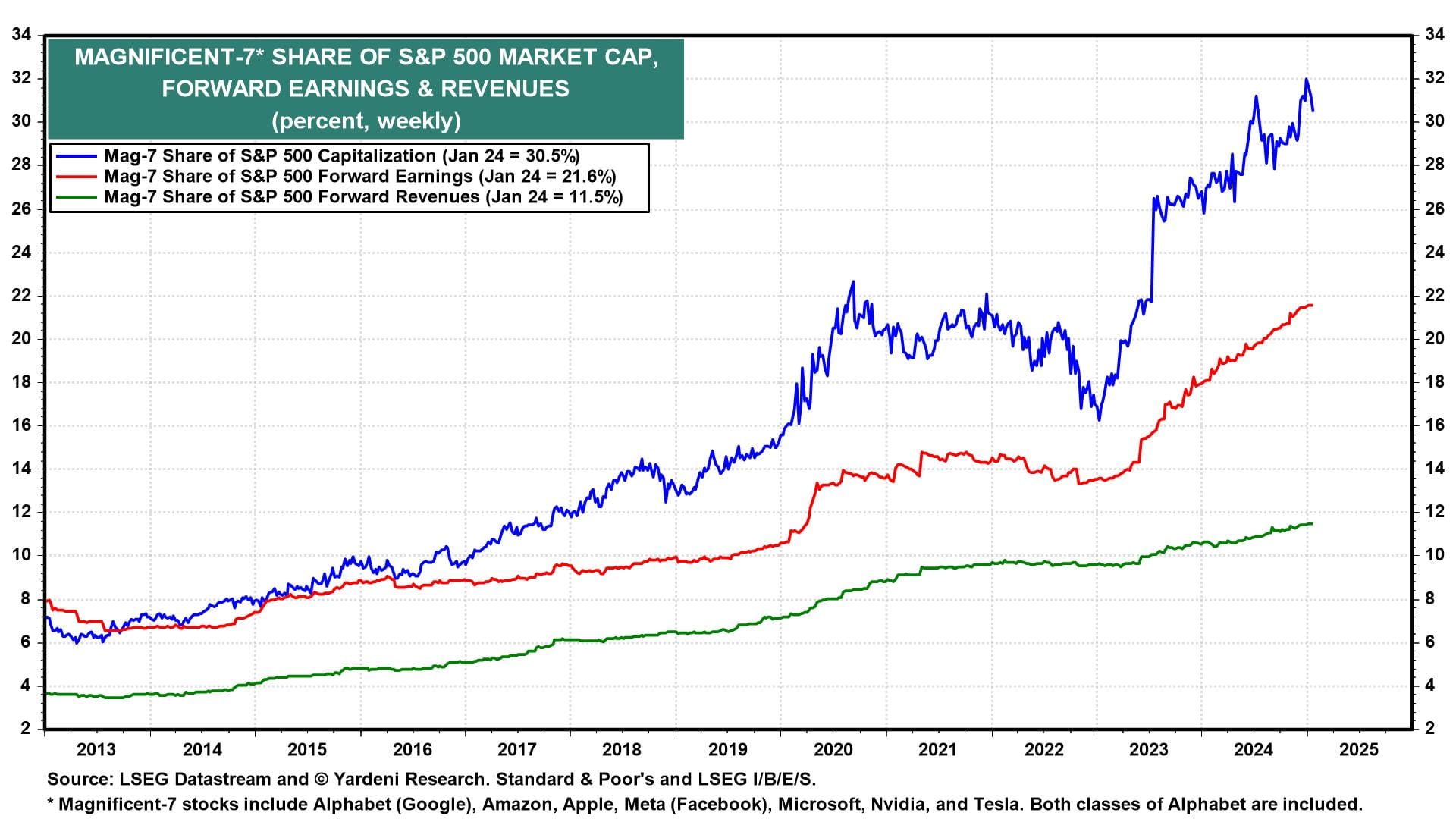

If the Mag-7's Q4 earnings disappoint, these seven stocks could drag the S&P 500 down significantly since they account for a whopping 30.5% of the market cap of the index (chart). They also account for a hefty 21.6% of the forward earnings of the S&P 500 but only 11.5% of forward revenues.

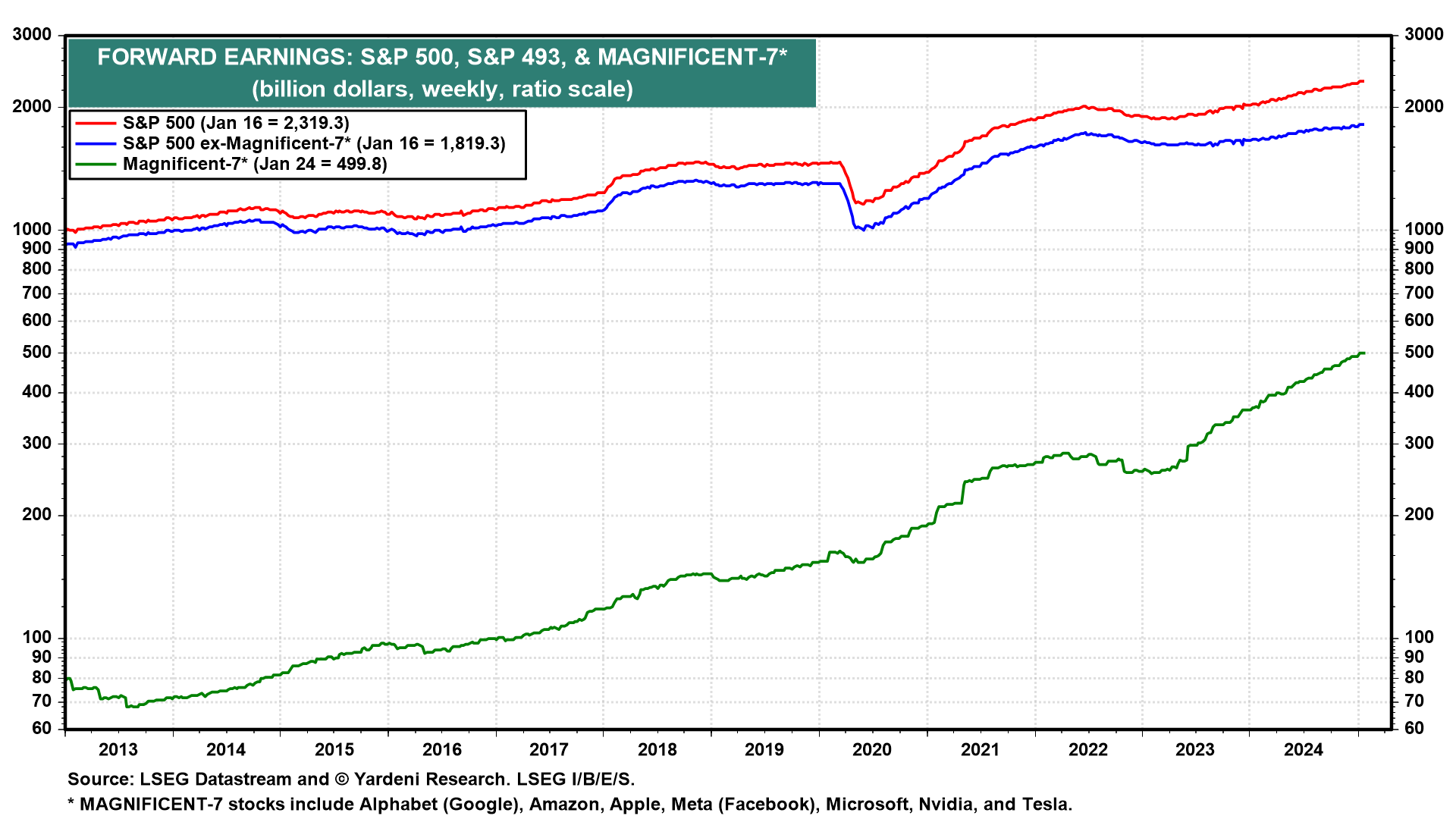

On balance, we expect that the Mag-7 will deliver solid earnings, as suggested by the record high in their combined aggregate forward earnings of $500.1 billion during the week of January 24 (chart). The forward earnings of the S&P 493 was $1,819.3 billion that same week.

The new issue for the Magnificent-7 is whether DeepSeek will deep-six their AI aspirations.