The bond and stock markets were closed today for MLK Day. When they reopen tomorrow, we will all be able to assess their initial reactions to Trump 2.0 following today's Inauguration ceremony. The major stock market futures indexes were up all day. Bitcoin soared in the morning, but turned down in the afternoon. Gold and copper prices fell slightly.

The dollar sold off after The Wall Street Journal reported that Trump isn't rushing to implement new tariffs. Instead, he plans to send a memo to federal agencies directing them to evaluate trade policies and economic relationships with China, Mexico, and Canada.

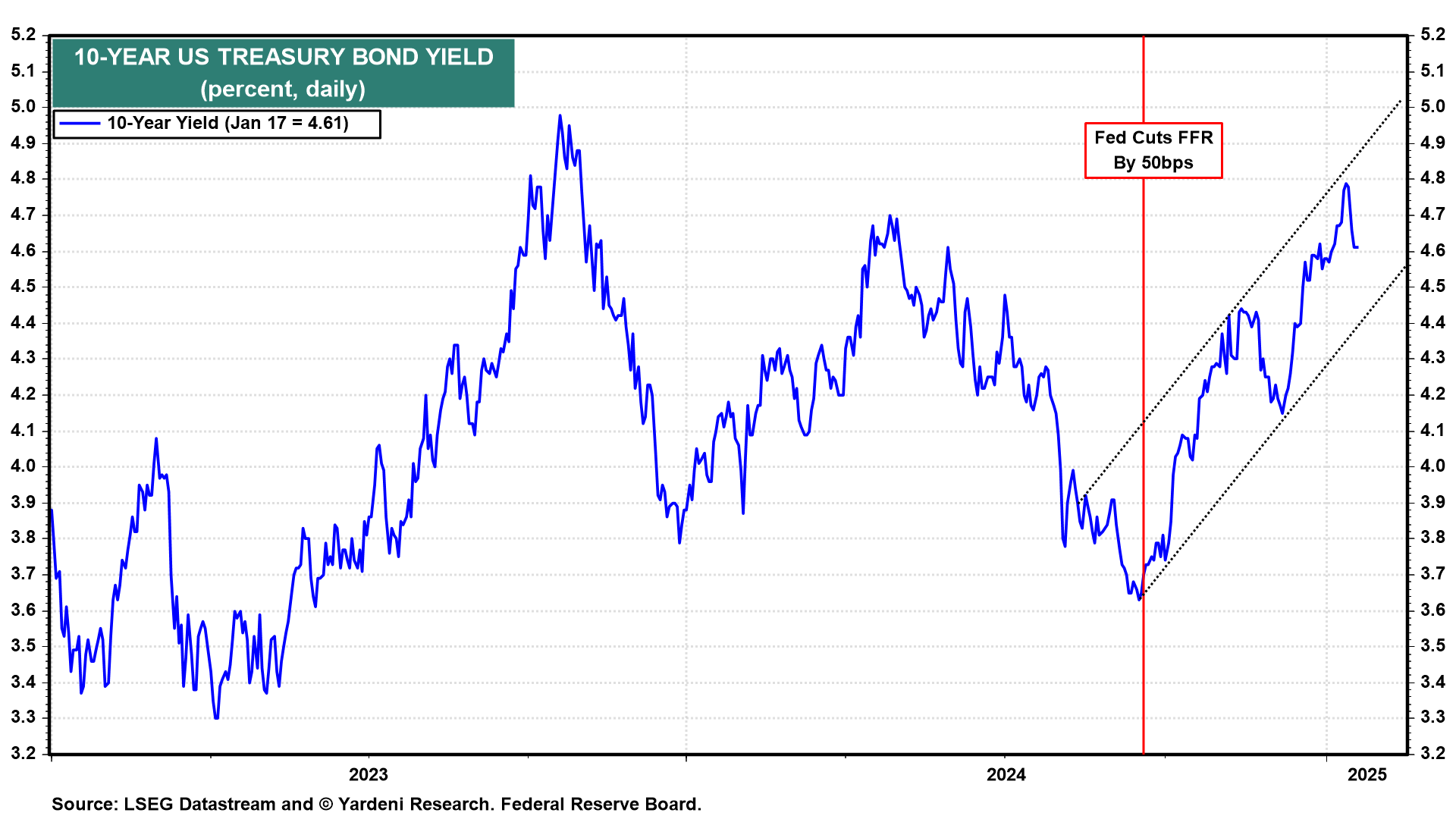

In other words, there might not be much of a shock-and-awe effect on the markets from Trump 2.0 initially since most of it has been discussed by Trump during his campaign speeches. Instead, the markets might continue to focus on Fedspeak and the latest earnings reporting season. Both were bullish last week. Last Thursday, in a CNBC interview, Fed Governor Christopher Waller was dovish. Waller's comments pushed bond yields down, as did the recent batch of lower-than-expected inflation reports (chart).

Also last Thursday, the big banks reported better-than-expected earnings for Q4-2024. Collectively, analysts now expect S&P 500 earnings to rise 9.1% y/y for the quarter, up from their previous estimate of 8.2% (chart). We are raising our Q4 earnings growth estimate from 10.0% to 12.0% y/y. We had thought it would be a strong earnings reporting season. Now we think it will be even stronger.