Wednesday was a bad day for stocks after the release of the FOMC's Summary of Economic Projections (SEP), which showed two cuts in the federal funds rate in 2025 rather than the four cuts shown in September's SEP. Friday was a better day for stocks after two Fed officials suggested that November's PCED inflation report provided justification for rate cutting in 2025.

- Goolsbee. "Over the next 12 to 18 months, rates can still go down a fair amount, and whether that happens three months earlier or three months later, I don't think is the most material thing," said Chicago Fed President Austan Goolsbee in a televised interview with CNBC on Friday. "The thing that's material is we've gotten inflation down."

- Williams. Also in a Friday CNBC interview, New York Fed President John Williams said he expects the central bank to deliver more interest rate cuts. Even with this week's rate cut, Williams thinks "we're pretty restrictive."

Also helping the stock market rebound on Friday from Wednesday's rout was news that the House approved a budget bill and that the Senate would work late into the night towards votes to pass the bill, which is what occurred.

Did November's PCED inflation rate justify the "never mind" reversal of the market's sentiment about the outlook for rate cuts in 2025? It might have:

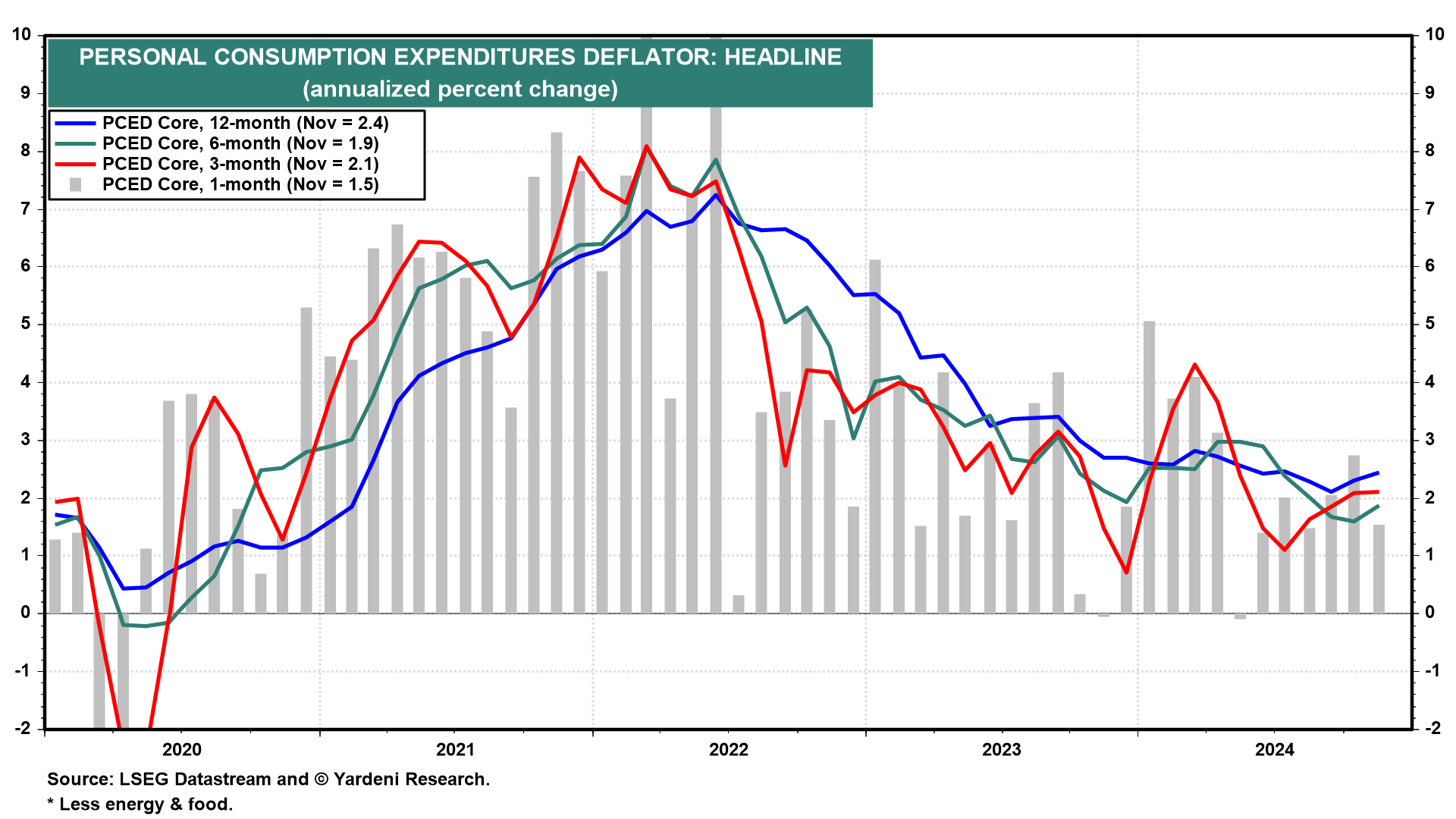

(1) Headline and core PCED. The annualized percent change in the headline PCED was down to just 1.5% m/m compared to 2.4% y/y (chart). The comparable core PCED inflation rates were 1.4% and 2.8%. Commenting on October's PCED readings at his post-FOMC presser on Thursday, Fed Chair Jerome Powell said, "We still have some work to do though is how we're looking at it. We need policy to remain restrictive to get that work done we think."

(2) Supercore PCED. The work that still needs to be done is to bring the PCED supercore inflation rate closer to 2.0%. It is currently 3.5% y/y (chart). However, its m/m inflation rate was only 1.9% on an annualized basis.