Fed Chair Jerome Powell is an accomplished danseur. His pirouette's are masterful. He did another such pivot on Friday in prepared remarks for a speech [starts at 19:00] to business leaders in Dallas. He said that, "the economy is not sending any signals that we need to be in a hurry to lower rates." That's what we've been saying since Powell & Co. started the Fed's latest monetary easing dance on September 18, when they cut the federal funds rate (FFR) by 50bps, which we believed was too much too soon.

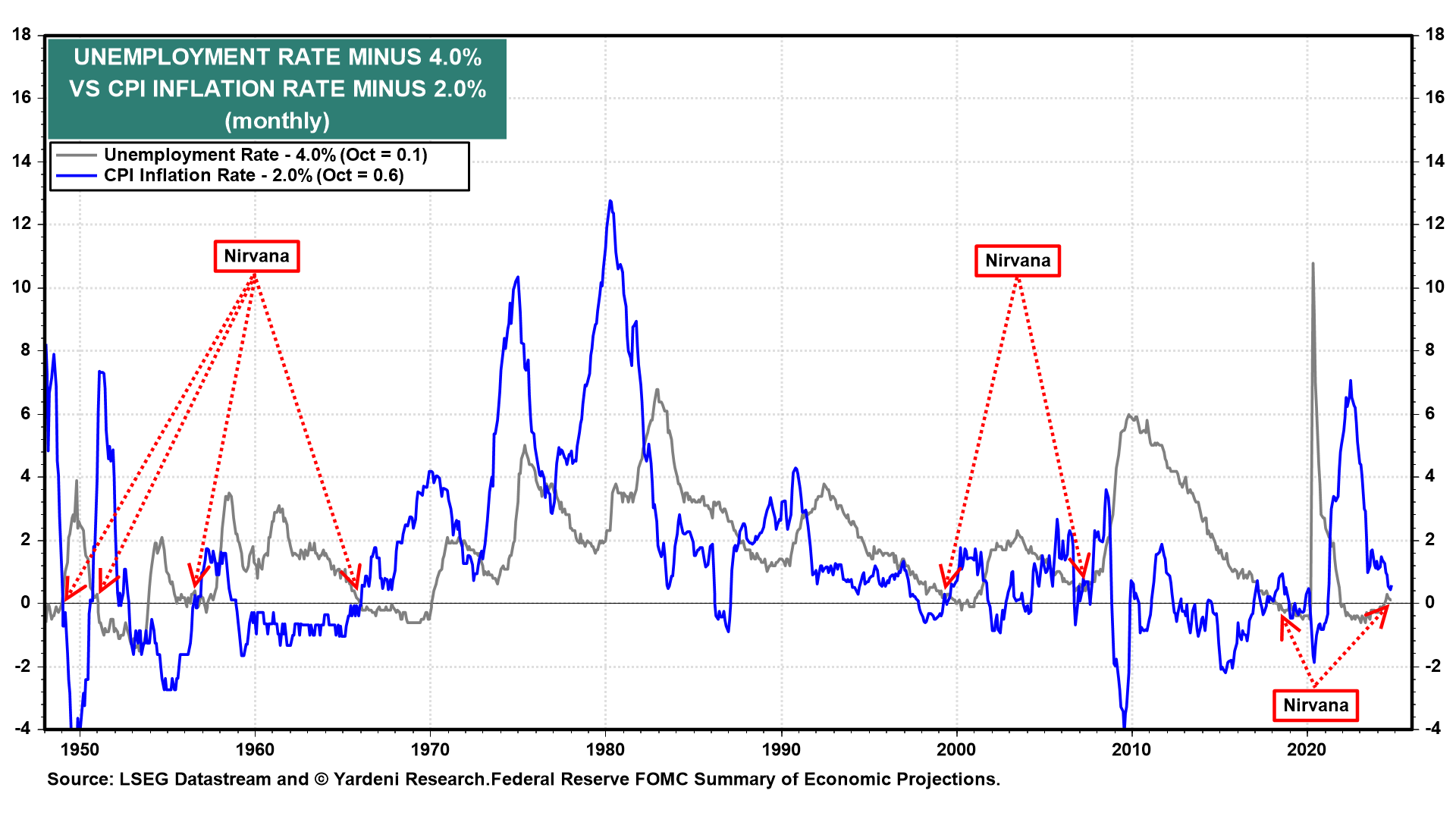

They did it again on November 7, cutting the FFR b y 25bps. But now, Powell is pushing back against market expectations of more rate cuts any time soon. Just last Thursday, at his presser, he claimed that the FFR was still too restrictive and had to be lowered to the neutral FFR. Most Fed officials may still believe that, but they may no longer be in a hurry to do so. So it might be none-and-done at the December 17-18 FOMC meeting. Meanwhile, our new "Nirvana Model" shows that both the unemployment rate and inflation rates suggest that the current FFR is at the neutral rate (chart).

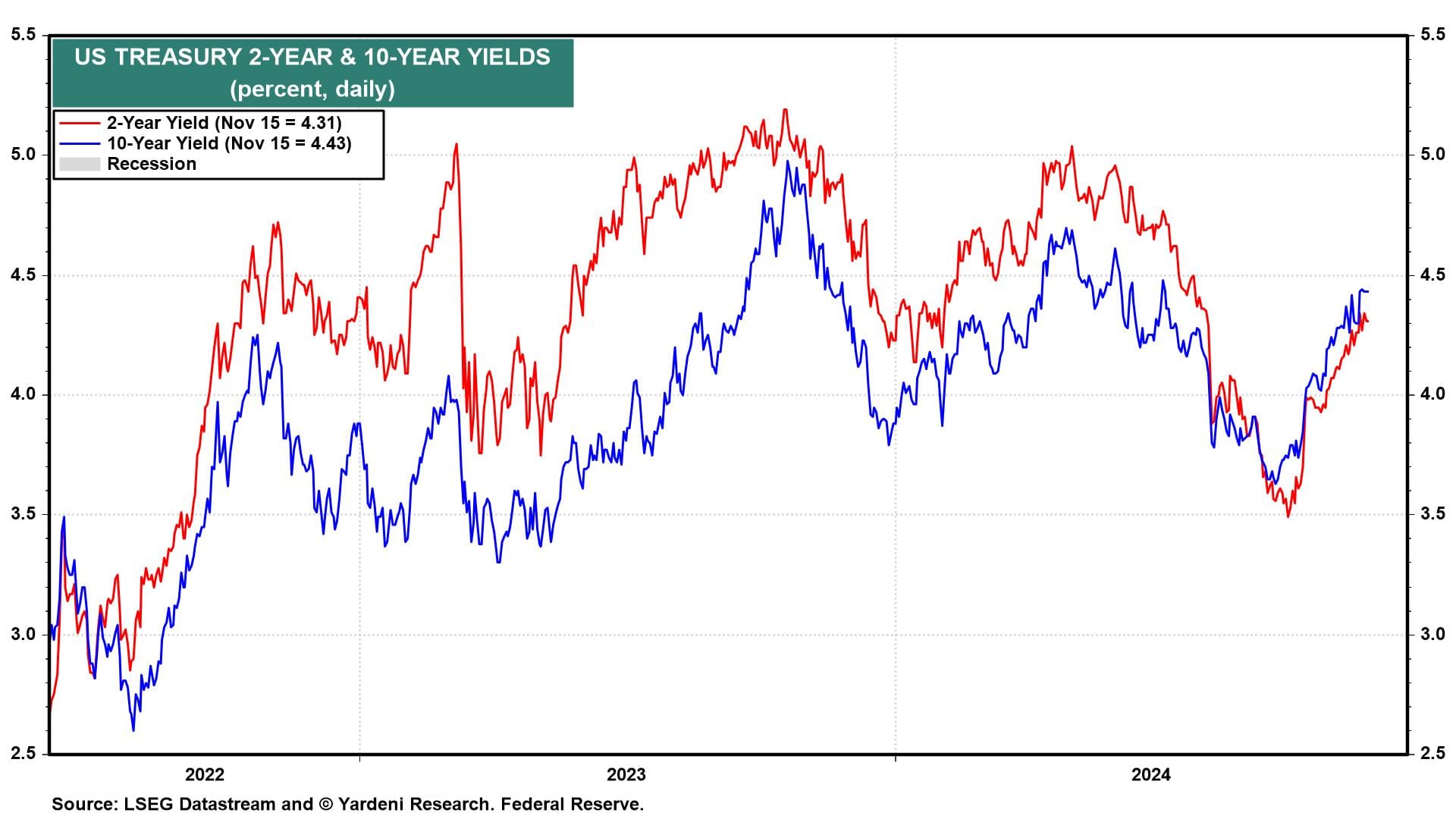

In any case, neither the 2-year nor the 10-year US Treasury yields reacted much to Powell's latest pivot because fixed income investors had already figured out that the Fed's rush to cut rates didn't make sense given the strength of the economy and the recent stickiness of inflation. We expect both yields to be range bound between 4.25% and 4.75% over the rest of this year and possibly into next year (chart).

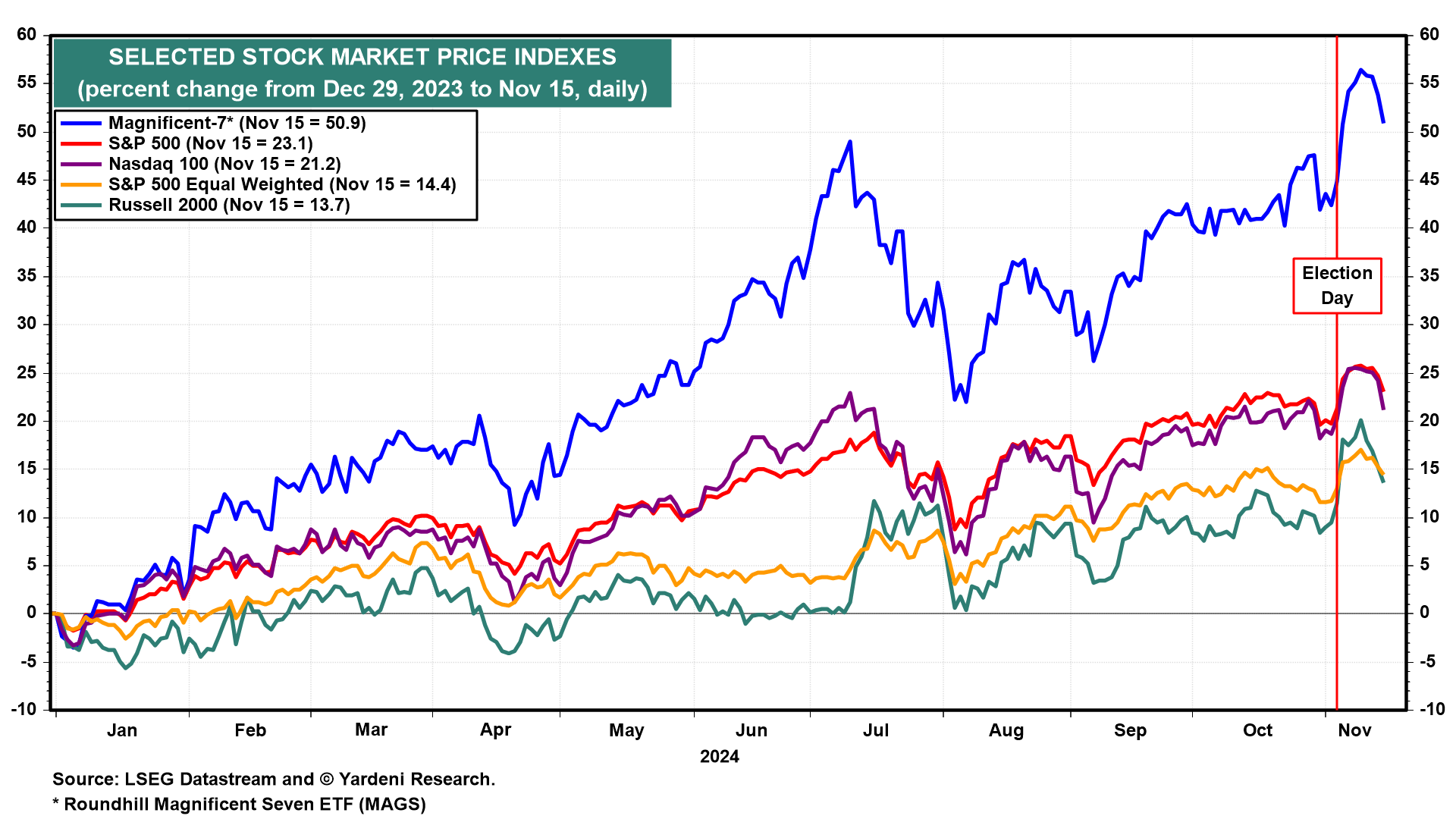

On the other hand, stock prices gave back some of their post-election gains last week, especially on Friday after Powell's pirouette (chart).

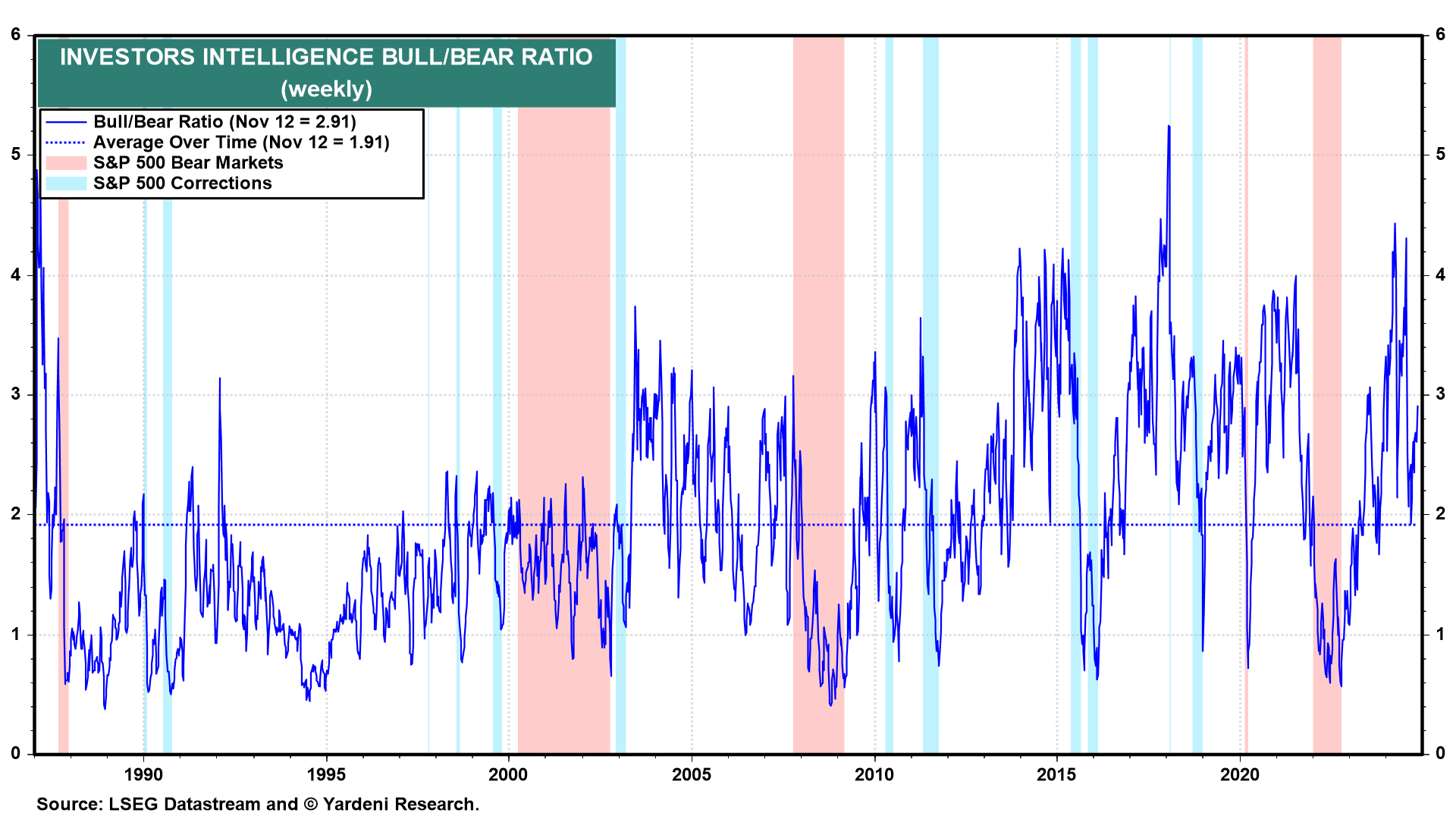

We were surprised that the Bull/Bear Ratio (BBR) rose to just 2.91 during the November 12 week, which included the big post-election rally (chart). We thought the BBR might jump above 3.00 and closer to 4.00. The percentage of bulls did surge to 60.3%, which is near previous record highs, but the percentage of bears remained relatively high at 20.7%. The percentage in the correction camp dropped to a low reading of 19.0%. From a contrarian perspective, this might be a signal that the stock market could experience a correction now that the Fed might pause rate cutting. Nevertheless, we expect a Santa Claus rally in the S&P 500 to 6100 by the end of this year.