Last week's economic data confirmed that consumers are still consuming, the labor market is fine, small business owners are more optimistic, and inflation is still moderating. On Friday, at Jackson Hole, Wyoming, Fed Chair Jerome Powell is likely to reiterate that the economy is performing well and that inflation is getting closer to the Fed's 2.0% target. He is likely to support market expectations that the Fed will cut the federal funds rate by 25bps in September. But he is also likely to push back on expectations of cuts in November and December. He will repeat that the Fed's decisions are data dependent.

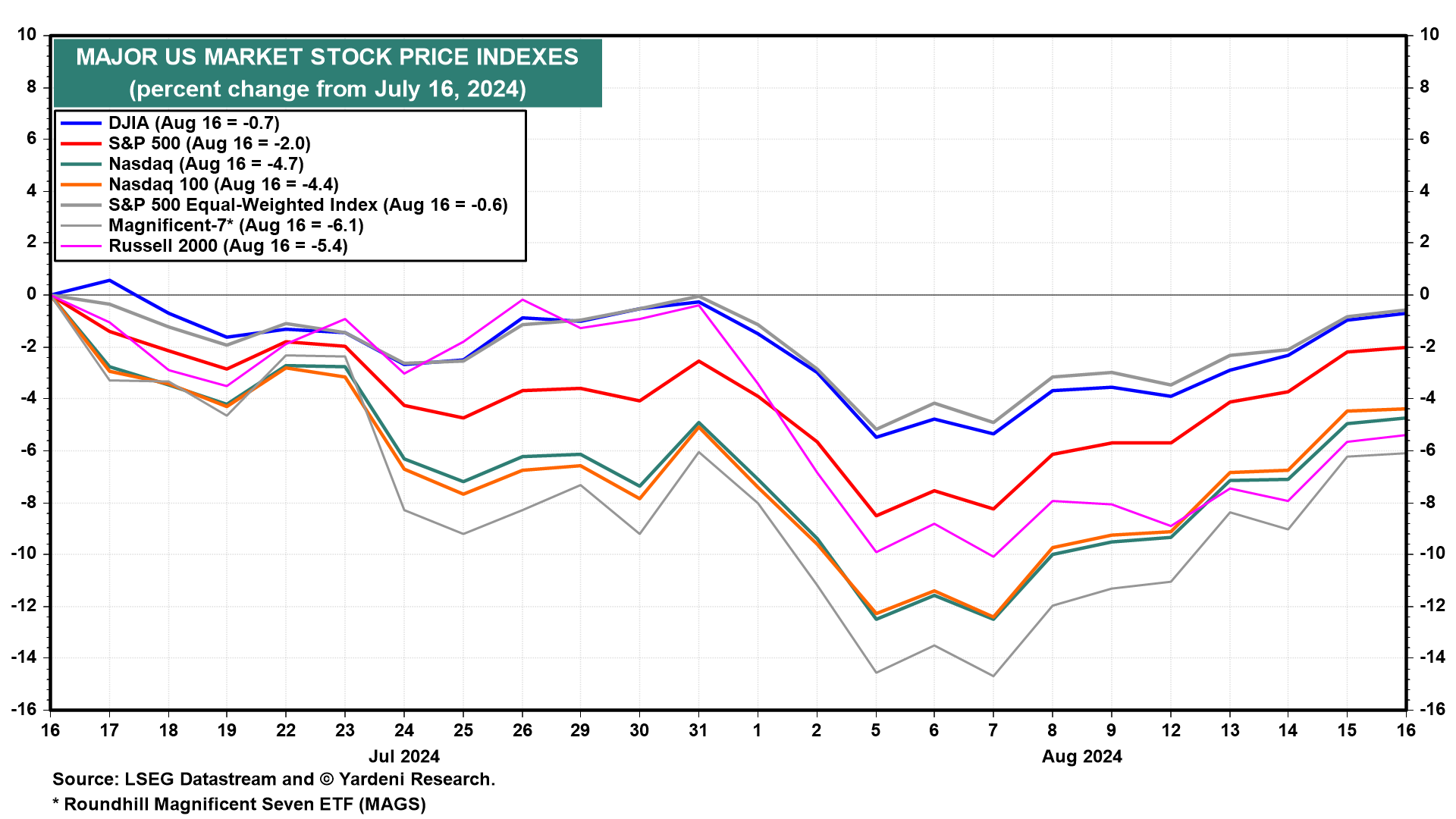

The stock market rebounded sharply last week from the prior week's drop, after July's soft employment report (released on August 2) heightened recession fears, which abated especially after July's strong retail sales report (released on August 15). The stock market's drop at the start of August was exacerbated by the unwinding of carry-trades. But that bearish development also dissipated quickly.

It has been quite a bungee jump in the stock market since the S&P 500 peaked at a record high on July 16 (chart). It wouldn't take much to see the S&P 500 at a new record high since it is only down 2.0% from its July 16 record high of 5667.20!

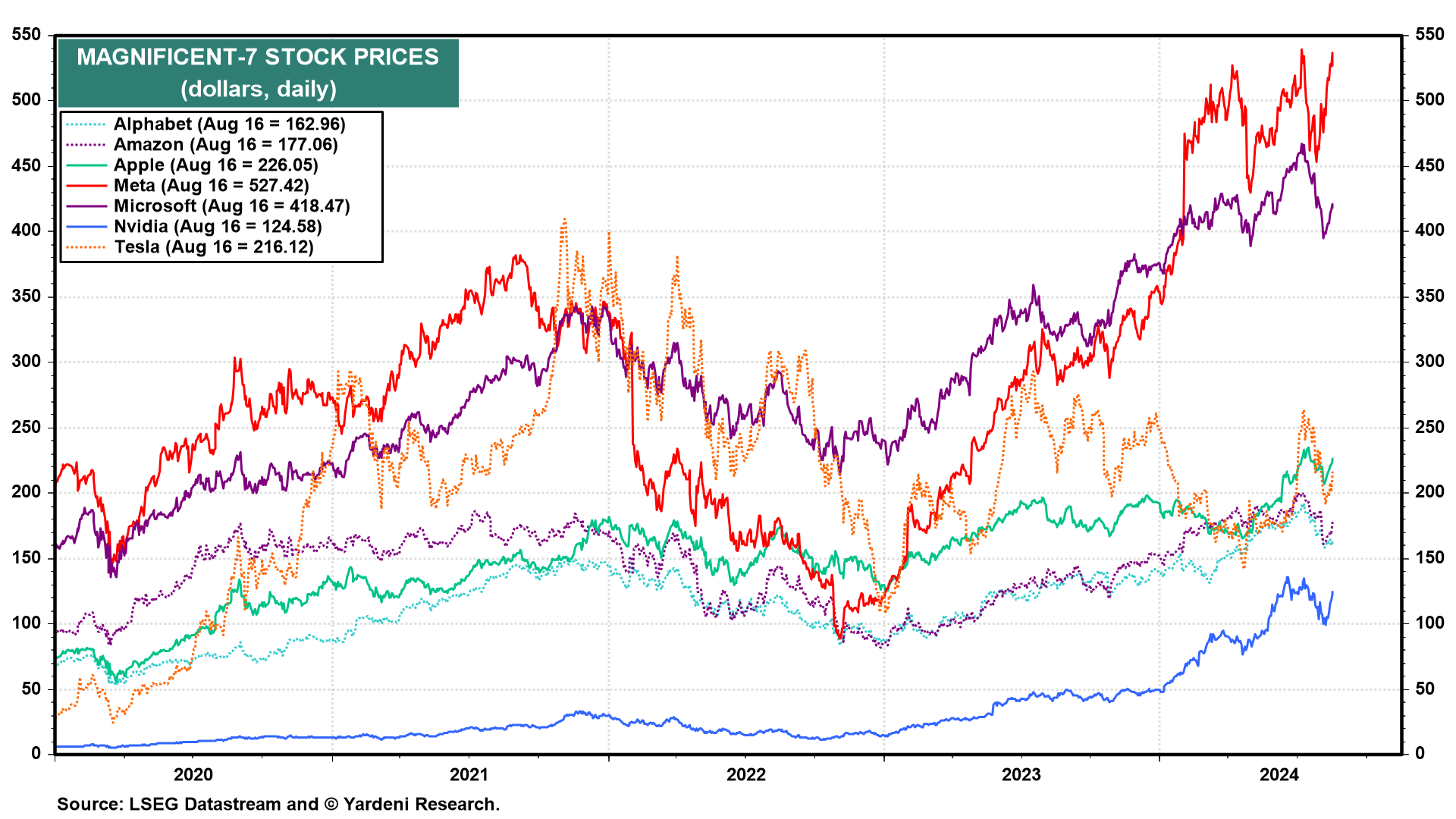

Some of the Magnificent-7 stock prices are also within shouting distances of their record highs (chart).

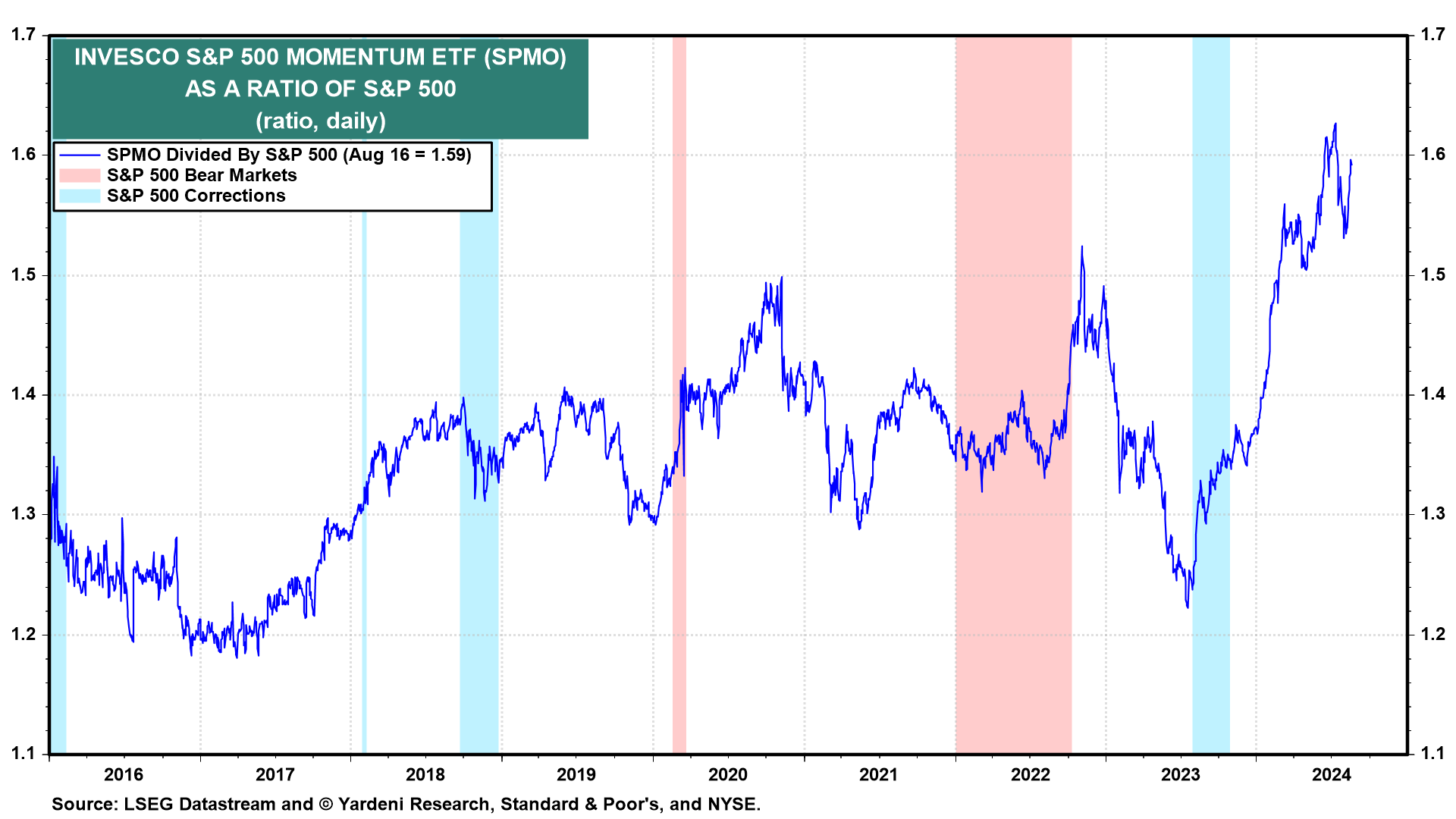

We are still targeting 5800 for the S&P 500 by the end of this year, but it could get there sooner since momentum investing has made such a remarkable and powerful comeback in recent days (chart).

We asked Michael Brush for an update on what insiders are doing: "Insiders continued to step up their buying as stocks recovered from the early August pullback last week. Large and actionable buys (meaning buys with especially bullish characteristics like size, clusters, and positive insider track records) predominated in the cyclical areas like technology, energy, media and retail."

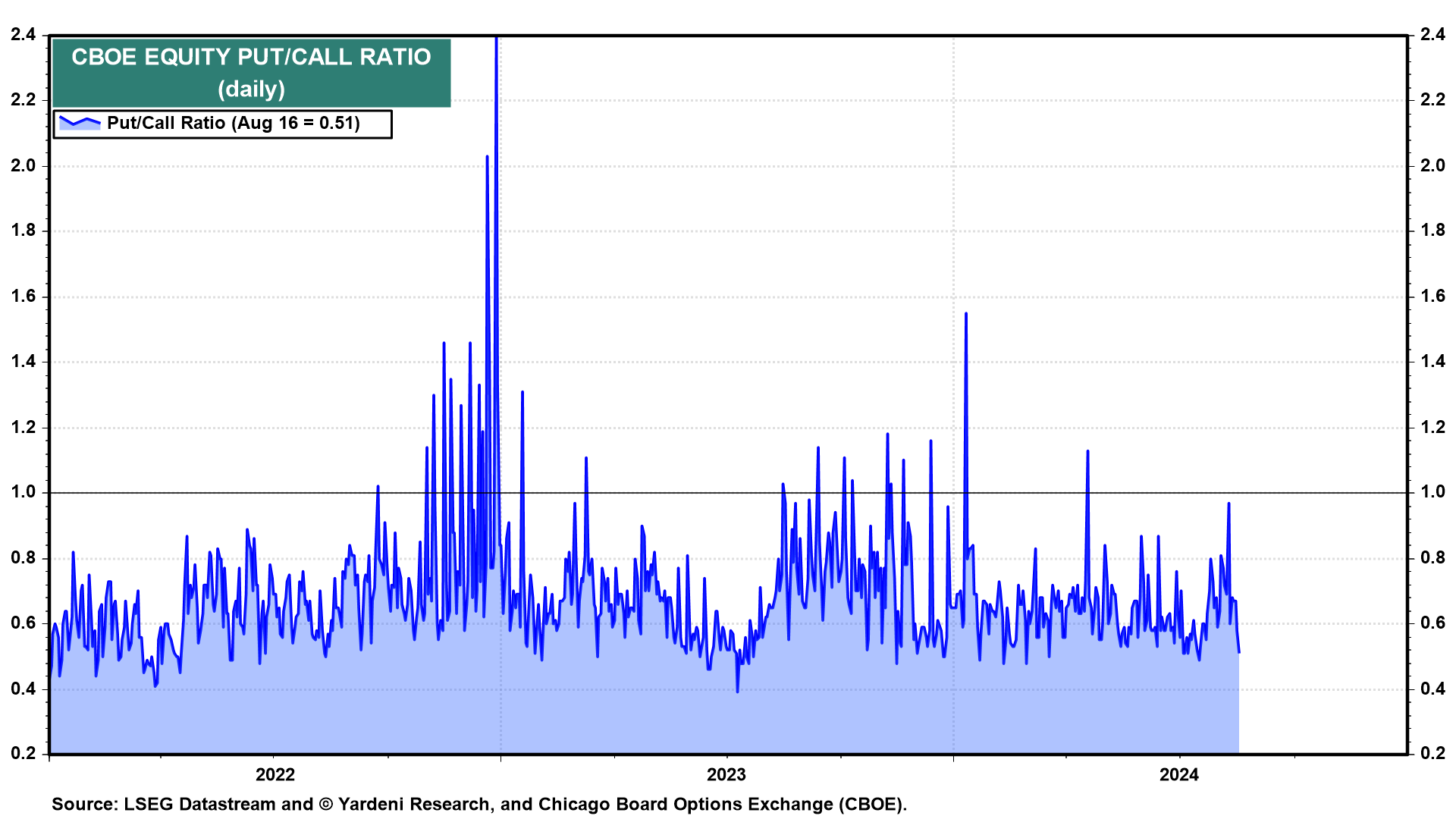

Here is Joe Feshbach's current perspective on the market from a trading perspective: "While there may be some more short-term upside due to momentum, I continue to believe using strength to lighten up is the correct strategy. Sentiment definitely improved on the recent selloff, but the put/call ratio has fallen back to optimistic levels (chart). This coupled with rallies in many broken charts should lead to an expanding topping process in stocks." Thanks Joe and Michael!