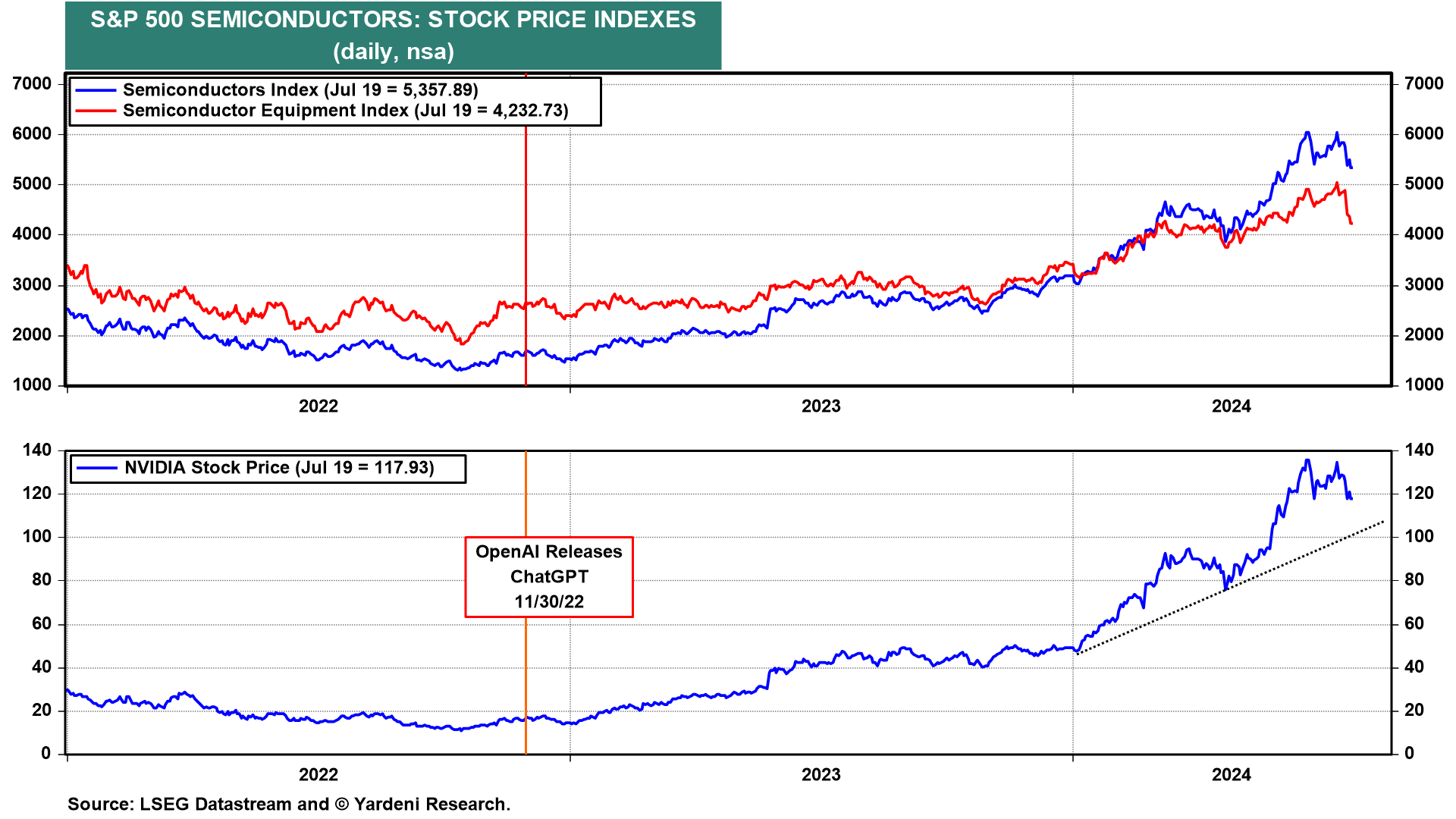

The S&P 500 is down 2.9% from its record high of 5667.20 on Tuesday, July 16. The following day semiconductor stocks got whacked on news that the Biden administration is considering draconian measures to clamp down on foreign companies which manufacture chipmaking machinery from selling their products in China (chart). Of course, the pain spread quickly to the Magnificent-7 including Nvidia, which should find support north of $100 per share.

So is the Tech-led bull market over? Is the AI bubble bursting? Or are investors rotating out of Tech into all the laggards? Or is the bull market simply broadening?