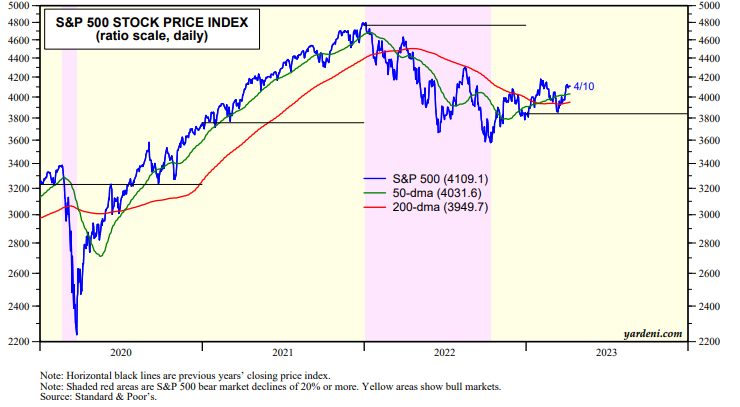

The tug of war between the bulls and the bears has been at a standstill recently with the S&P 500 holding above both its 50-dma and 200-dma (chart). That's quite impressive considering the banking crisis that started on March 10 when SVB imploded. Some observers (including us) think that the Fed Put is back. This time the Fed is shoring up the banking system with a new liquidity facility, which indirectly supports the stock market. In addition, a good case can be made for a none-and-done scenario for Fed rate hiking through the summer.

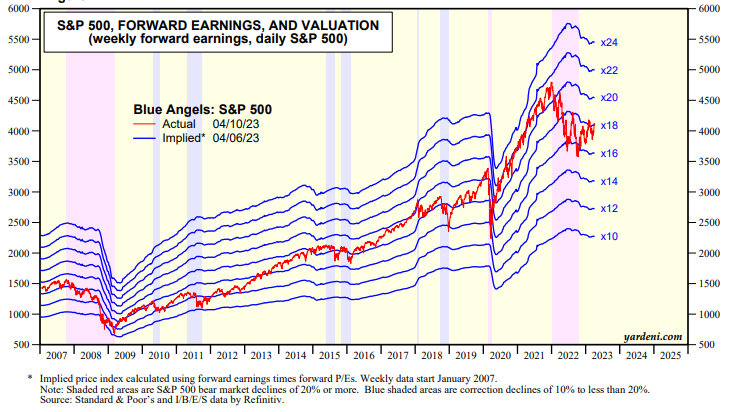

Our Blue Angels framework shows that the S&P 500 has fluctuated mostly between a forward P/E of 16 and 18 since the end of last year's bear market on October 12 (chart). It has done so even though the index's forward earnings has been falling since last summer though it seems to be stabilizing recently.

Here is Joe Feshbach's latest market call for traders:

"The S&P 500 still has a chance to take out its early February high (4179.76) as the Nasdaq has already done. I lean this way. A few weeks ago, I thought that the long bond should make new highs (new lows in yields) for this year so far. That did occur but without any negative impact on the stock market whatsoever. However, I’m not thrilled with the state of the sentiment numbers. So February's high is the max I see for this rally in the S&P 500. We should then fall back into the wide trading range subsequent to any further near term strength."