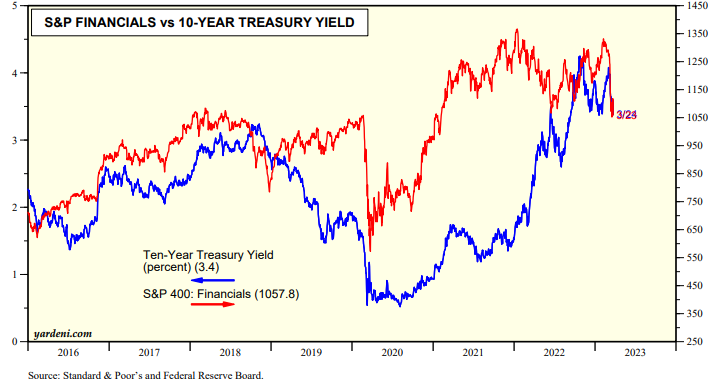

Bond investors are having fun again. The 10-year US Treasury bond yield peaked last year at 4.25% on October 24. It was down to 3.38% on Friday. Most of this decline occurred since the start of the current banking crisis on March 9 (chart). Bond investors have been waiting for something to break in the financial system since last summer when the yield curve inverted. They are betting that something broke when SVB imploded. Overnight, this event raised fears of a widespread banking crisis, credit crunch, recession, and even deflation.

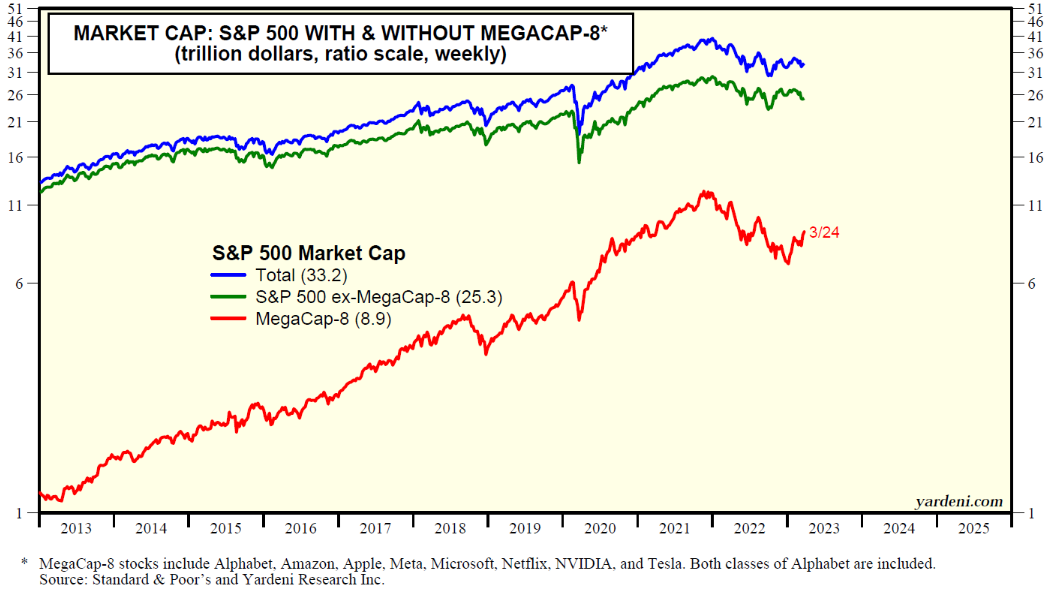

Nevertheless, the S&P 500 is still up for the year to date, by 3.4%, notwithstanding the freefall in the S&P 500 Financials caused by the banking crisis. It’s just above its 200-day moving average and just below its 50-day moving average. Eight of the 11 S&P 500 sectors are down ytd, led by an 11.1% drop in Energy and a 9.4% decline in Financials, while only three are up ytd, namely Communication Services (18.4%), Information Technology (17.5), and Consumer Discretionary (9.6) (Table). The three outperforming sectors are doing well because they include the MegaCap-8 stocks, which as a group are up 26.5% ytd based on their collective market cap (chart).

We asked Joe Feshbach for his latest take on the market from a trader's perspective:

"Toughest short term call I've had to make in 18 months. Midweek the stochastic I love to use on the S&P 500 started to turn up and gave a buy signal. I didn't bother to mention it to Ed because I thought it was probably a false signal. That's because the sentiment indicators along with underperforming breadth were not good enough to suggest a worthwhile short-term rally. The only sentiment indicator that supports a rally here is the AAII investor survey. The most accurate being the put/call ratio does not. Furthermore, the chart on the 30-year Treasury bond may be signaling new 2023 highs in price (new lows in yields) lie ahead suggesting further stock market difficulties.

"As I stare at my reliable stochastic on the S&P 500, I realize I am taking a risk ignoring this signal and missing a tradeable rally, especially since I was surprised how the market shrugged off the financial stocks' weakness on Friday and rallied. Financial stock weakness is usually toxic for the stock market.

"Thus, I have concluded that if the market does continue Friday's rally the sentiment indicators are just not good enough to support a real good rally and I'd rather wait for more improvement before getting too optimistic short term."