After languishing for the past couple years, manufacturing gauges in both the US and China improved in November. Could this be the start of a rolling recovery for both countries' goods producers? We think so, though a tariff war would spoil the party quickly.

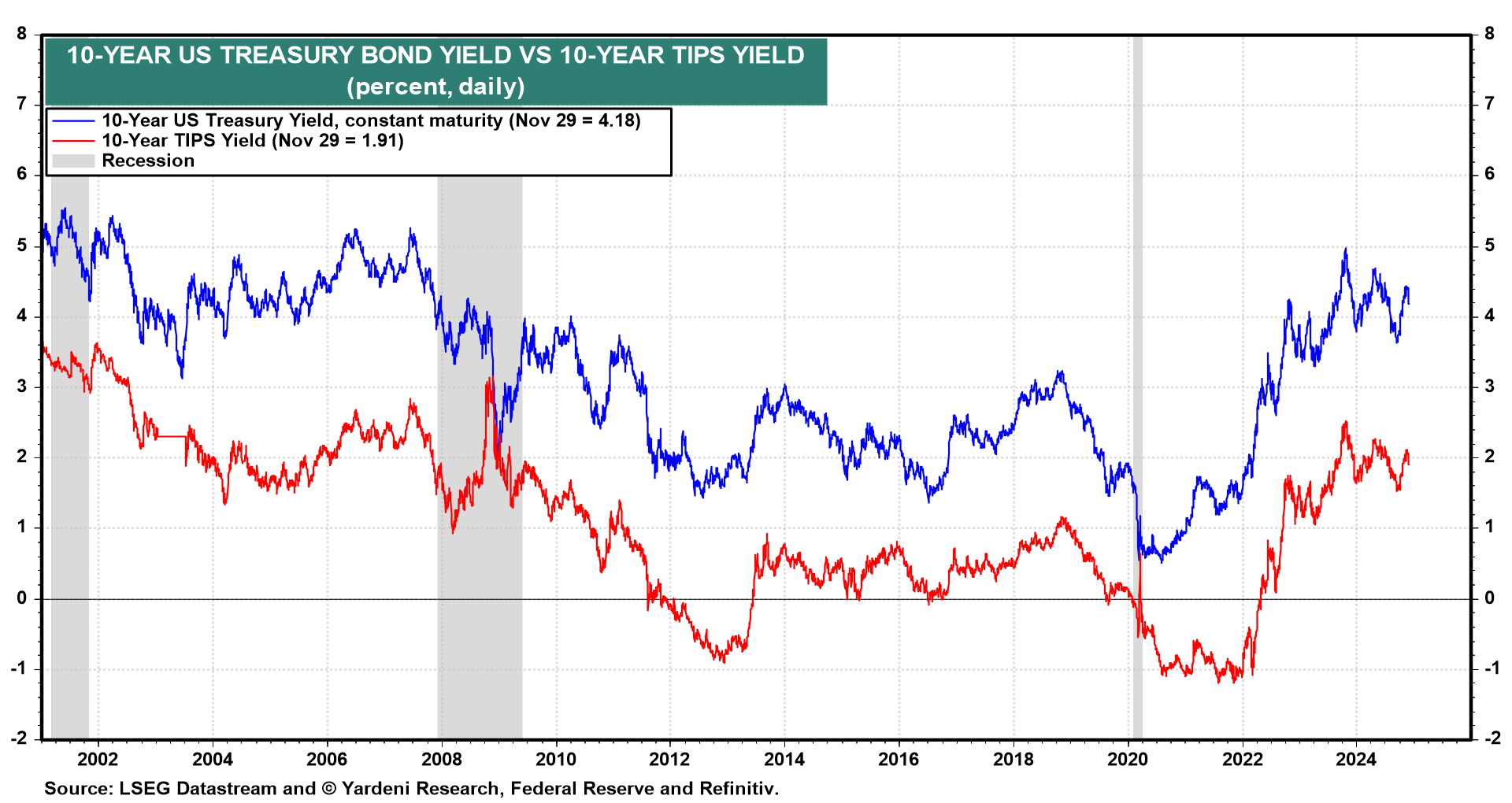

A revival in US goods production would likely boost bond yields as growth expectations increase. The 10-year Treasury yield could breach 4.5% by year-end in that scenario while the inflation-adjusted TIPS yield climbs above 2.0%, similar to where they traded before the Great Financial Crisis (chart).

Meanwhile, Chinese bond investors aren't ready to bet on a sustained improvement in their economic data. China's 10-year yield fell below 2% for the first time on record today (chart).