Markets were abuzz with headlines from Washington today. The S&P 500 opened 1.7% lower on the weekend's news that President Donald Trump announced that he would slap 25% tariffs on Mexico and Canada on Tuesday. But losses were pared significantly after Trump's call with Mexican President Claudia Sheinbaum resulted in a one-month delay of tariffs as well as bilateral cooperation on fentanyl, immigration, and countering China.

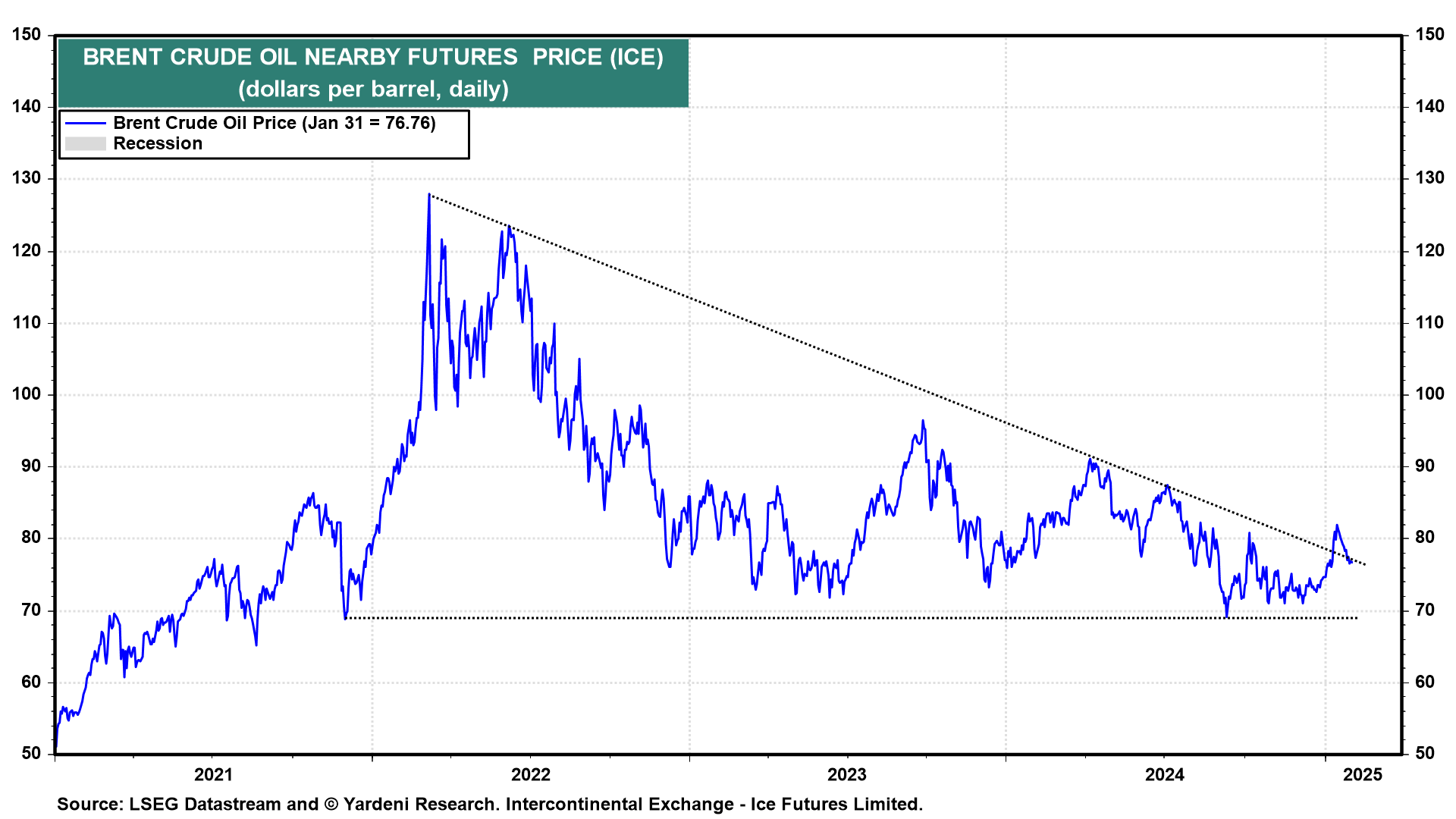

Ultimately, the S&P 500 fell less than 0.8% today. A quick spike in the price of crude oil also fully reversed, and that was before a similar deal was reached between Trump and Canadian Prime Minister Justin Trudeau after the market closed. With energy security of the utmost priority to this administration, crude oil prices could retest their 2021 lows in the coming quarters (chart).

For all the chatter about tariffs upending global trade, US manufacturing—the sector that’s the most sensitive to such headlines—appears to be staging a comeback. Today's economic updates supported our view that the economy's strength and resilience can minimize any negative externalities from Trump 2.0's agenda. Here's more on today's data: