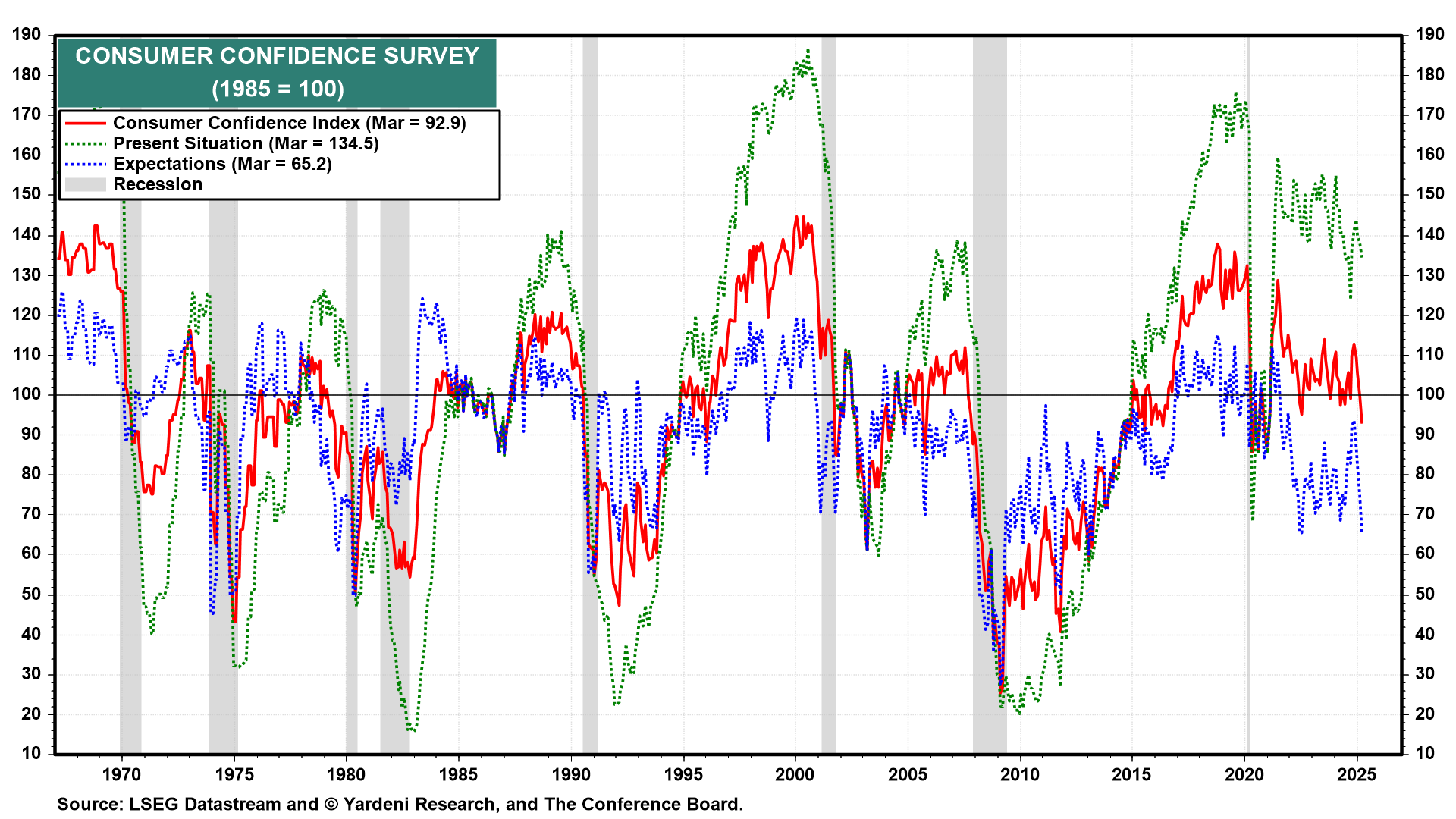

Consumers are feeling okay about the present situation, but they are losing their confidence in the future. The obvious cause of their anxiety is Trump Turmoil 2.0. The Trump administration admits that its trade and DOGE policies might cause some economic pain in the short run but says they should lead to big gains in the long run ("The Golden Age of America").

The problem is that we Americans don't do pain very well. Americans are worrying that a recession is becoming more likely and that means fewer jobs. As a result, yesterday's big rally in the stock market stalled today following the release of the March consumer confidence report this morning. We continue to expect a choppy stock market for the next couple of months.

Consider the following:

(1) Confidence. The Consumer Confidence Index (CCI) dropped sharply to 92.9 during March, to the lowest reading since January 2021 (chart). The drop was led by the CCI expectations component to 65.2, the lowest reading in 12 years. The CCI present situation component dipped but remained relatively high.

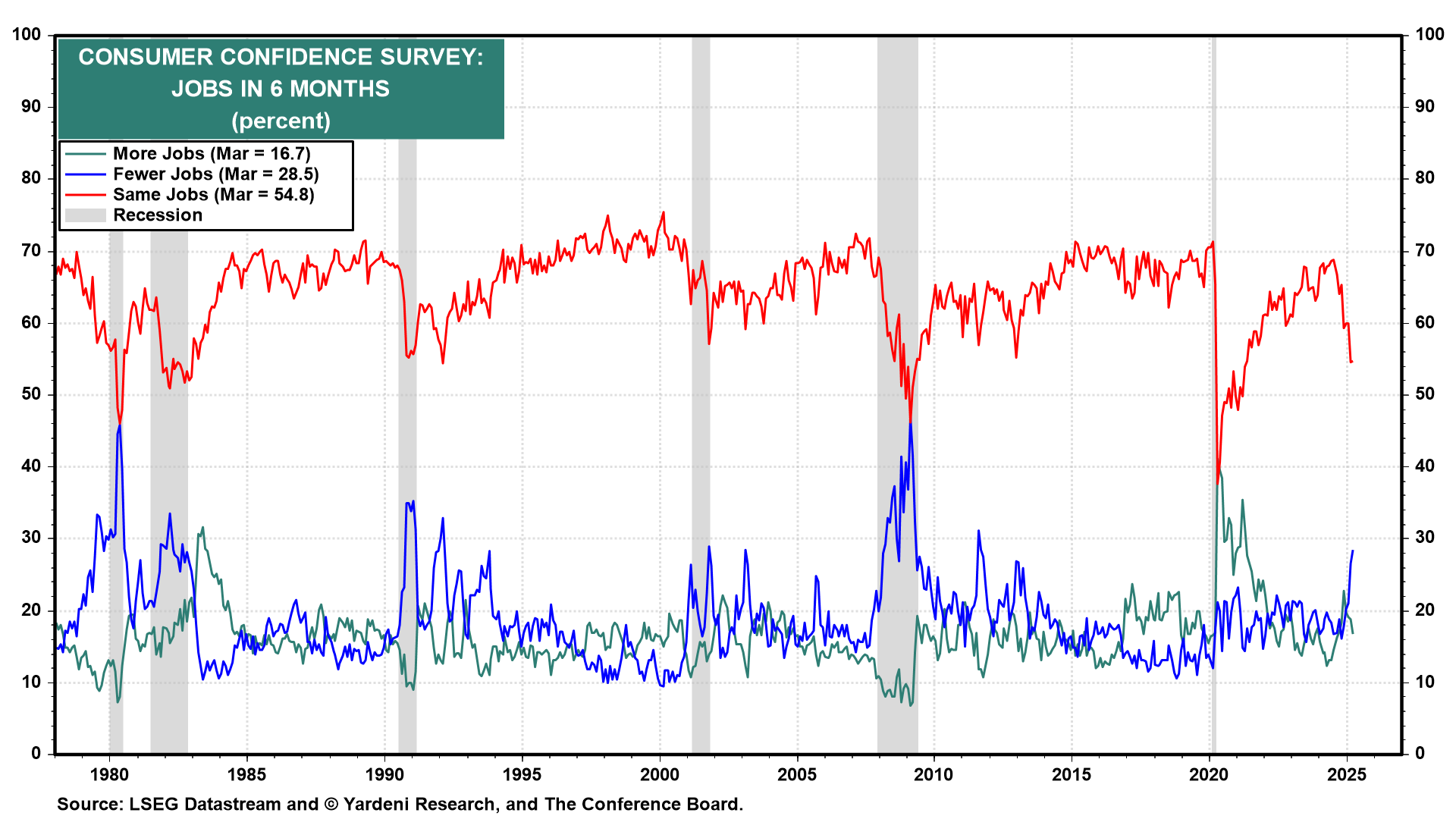

(2) Job expectations. The percentage of respondents in the CCI survey expecting fewer jobs in 12 months rose to 28.5% in March from 16.2% last October (chart). The percentage expecting the same availability of jobs fell from 65.4% to 54.8% over this same period. That magnitude of decline has coincided with the start of previous recessions.

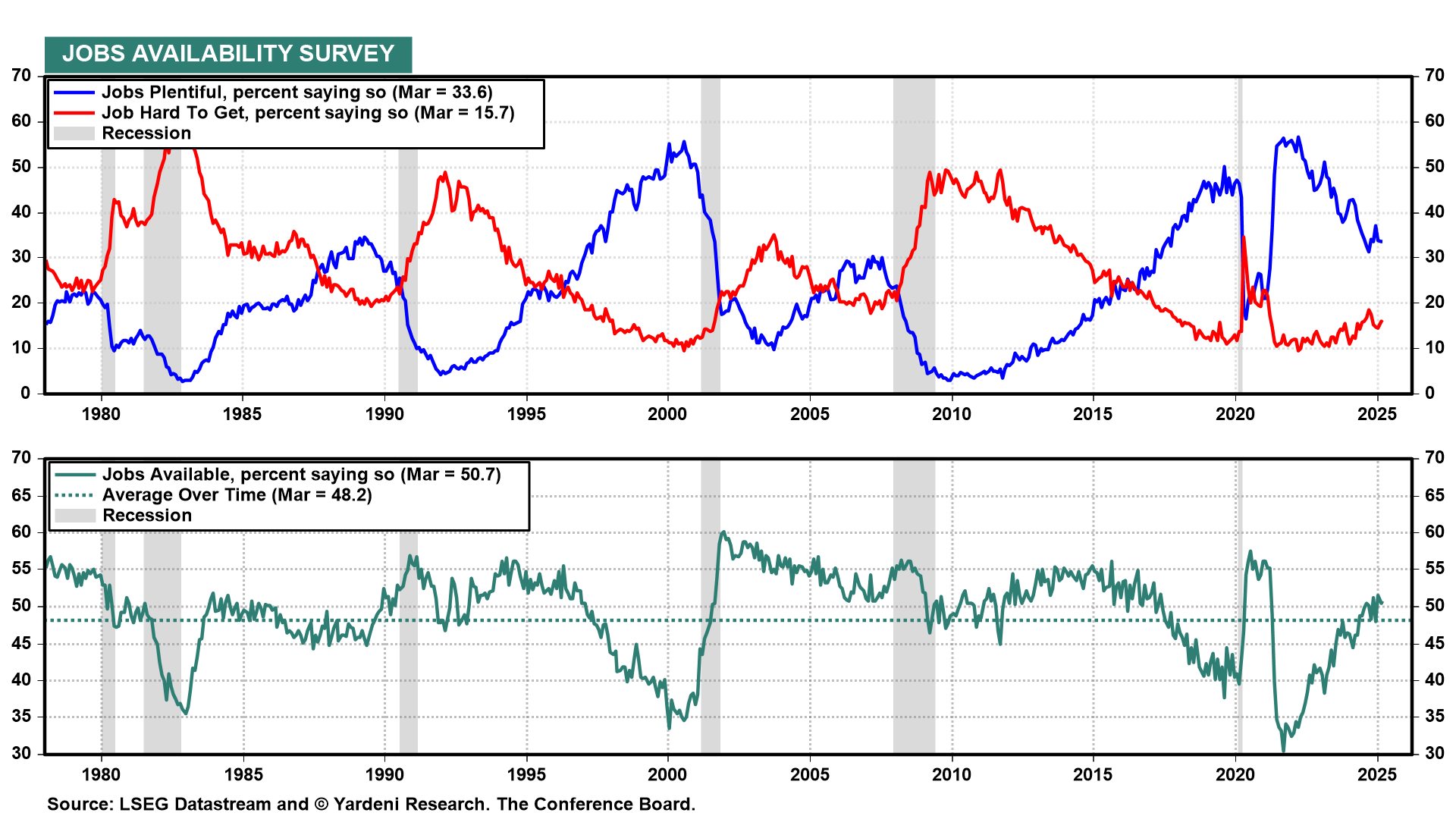

(3) Jobs availability. Now for some happier news. The current situation in the labor market remains quite good according to the CCI survey. That's consistent with our resilient-consumer thesis. The percentage of respondents reporting that jobs are hard to get edged up to 15.7%, which is a relatively low reading. The percentage saying jobs are plentiful edged down to 33.6%, suggesting that the JOLTS job openings series remains relatively high. These are not recession readings.

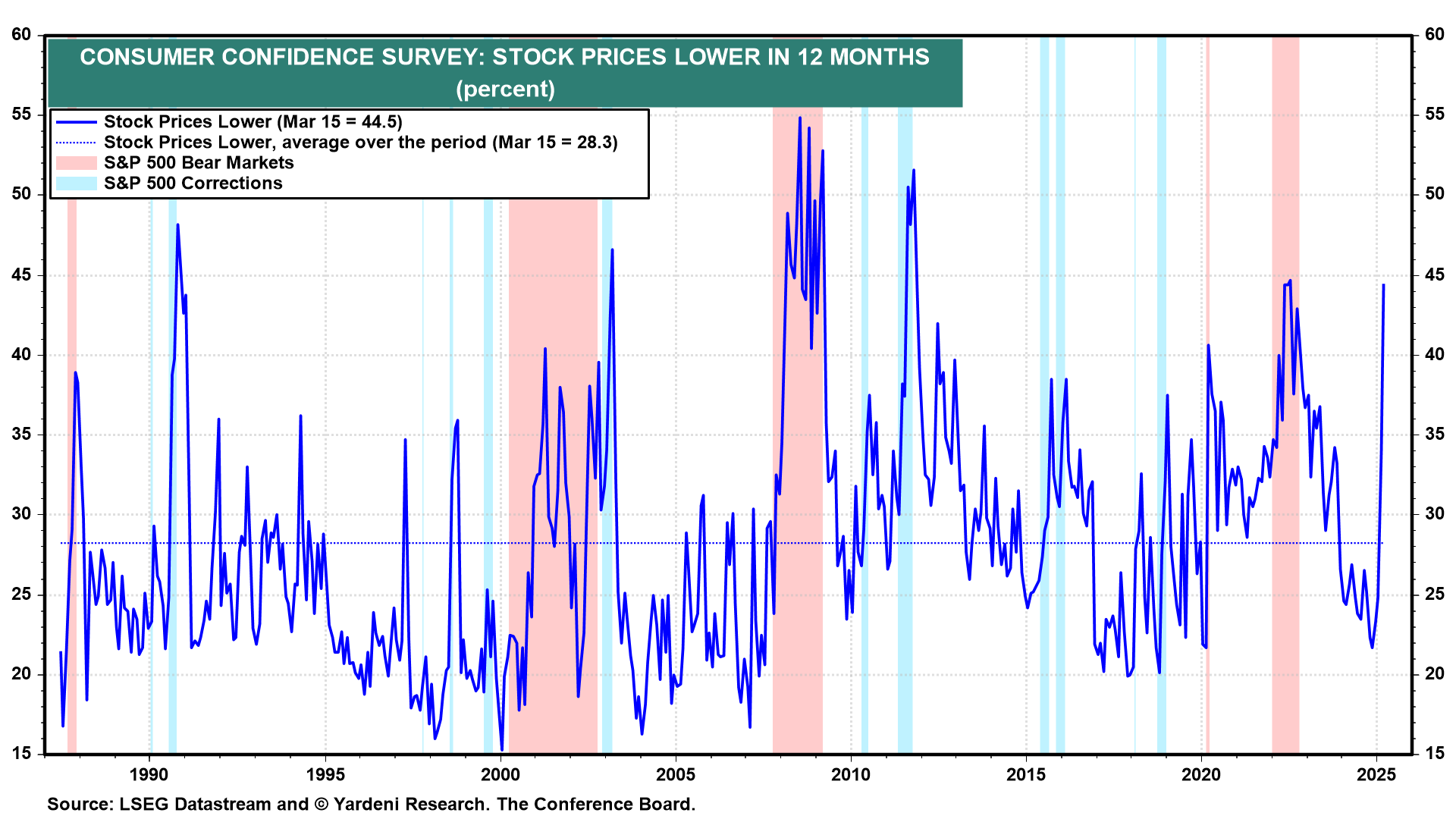

(4) Stock market. Some of the decline in consumer confidence is undoubtedly attributable to the rapid drop in stock prices since the second half of February. Indeed, the percentage of respondents expecting lower stock prices in 12 months jumped from 21.7% in November of last year to 44.5% in March (chart). That's the sort of jump that has occurred in the past at the start of bear markets and recessions.

On the other hand, from a contrarian perspective, high levels of bearish sentiment have often signaled stock market bottoms. But those bottoms have also coincided with the implementation of the Fed Put, which isn't likely to happen anytime soon since Fed officials have stated that they are in no rush to lower interest rates given the current resilience of the economy and the potential inflationary impact of tariffs.

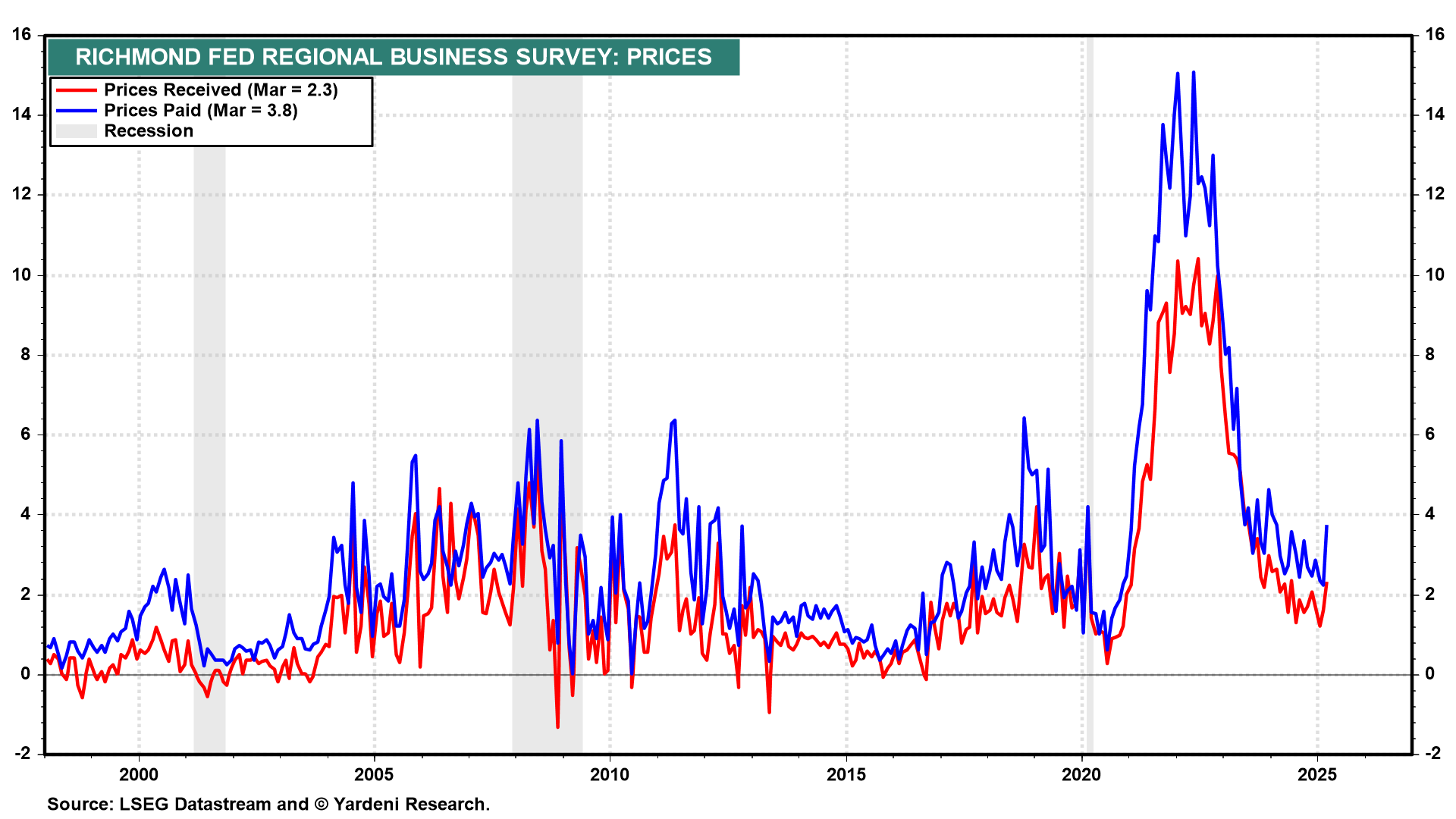

(5) Business surveys. So far, March regional business surveys have been released by the Federal Reserve Banks of New York, Philadelphia, and Richmond. They suggest that the March reading for the national ISM M-PMI fell back below 50.0. The first two surveys showed disturbing rebounds in their prices-paid and prices-received indexes. The comparable Richmond Fed series were slightly less concerning. Admittedly, there is a whiff of stagflation in these numbers.