Chevron CEO Michael Wirth warned yesterday in a CNBC interview that the Red Sea crisis could disrupt oil supplies and quickly push oil prices higher: "So much of the world's oil flows through that region that were it to be cut off, I think you could see things change very rapidly," he said. So what did the price of oil do today? It edged down (chart).

US National Security Advisor Jake Sullivan said nations with influence in Iran need to take a stronger stand to demonstrate the "entire world rejects wholesale the idea that a group like the Houthis can basically hijack the world as they are doing." It's not clear why the US isn't tightening sanctions on Iran.

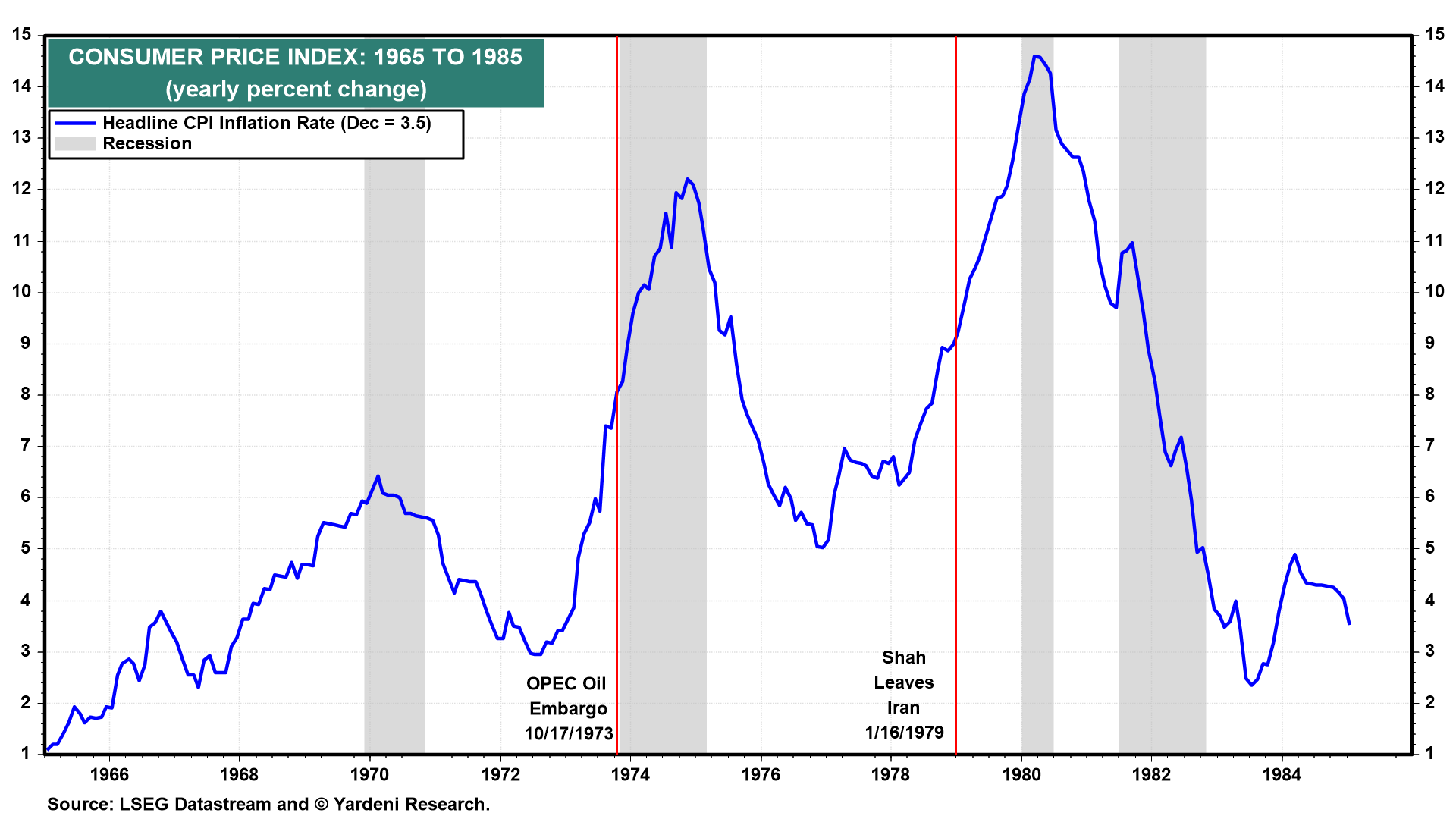

Fed Chair Jerome Powell is undoubtedly monitoring the situation closely since a second oil shock, following the one in 2022, could boost inflation just the way it did in 1979, following the 1973 oil crisis (chart). All the more reason not to rush rate cutting.

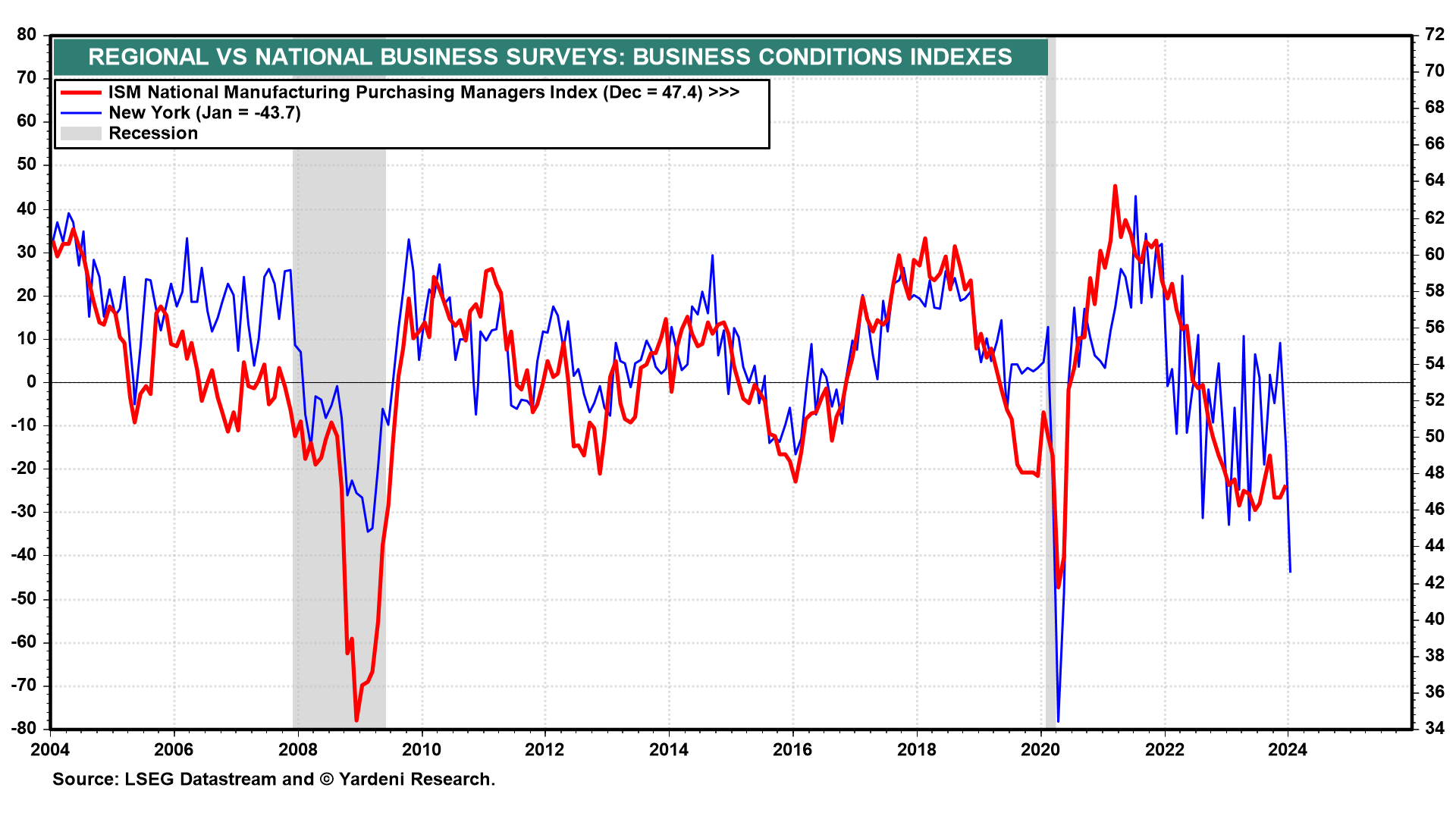

On the home front, the only significant economic news today was a sharp drop in the business activity index in the NY Fed's district according to the bank's January survey (chart). It is highly correlated with the national M-PMI. However, it has been extremely volatile over the past couple of years.

So the markets didn't flinch on the news. We could be singing "Home on the Range" for awhile.