After the stock market crashed on Thursday and Friday of last week, we have to conclude that any day during which the Dow Jones Industrial Average isn't down more than 1000 points is a good day. Today was an okay day. The DJIA plunged 1652.81 through 9:42 a.m. It then soared 2518.86 by 10.16 a.m. on a bogus report that President Trump was willing to postpone tariffs by 90 days. By the end of the day, the DJIA was down 349.26. Is the market starting to bottom? It's literally debatable. Consider the following:

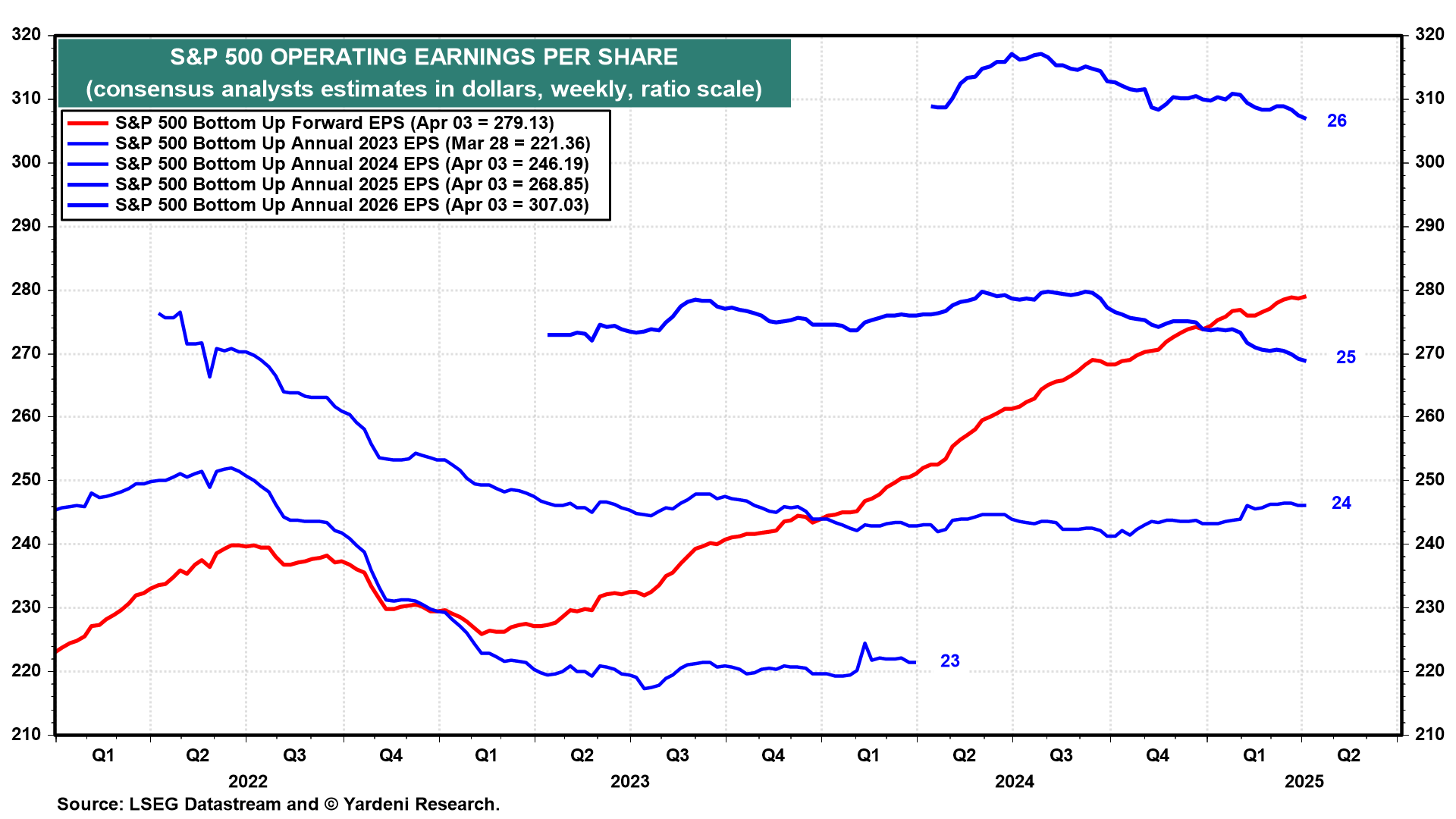

(1) Annual earnings estimates. Industry analysts have been lowering their S&P 500 earnings per share estimates, but they remain high at $268.85 and $307.03 for 2025 and 2026, up 9.2% and 14.2% y/y (chart). Those estimates are likely to fall over time, as estimates typically do since analysts tend to be too optimistic initially. They will fall a lot if Trump Tariff Turmoil causes a recession.

S&P 500 forward earnings per share has been flattening out at a current record high of $279.13. That puts the forward P/E at 18.1 based on today's close of 5062.25 on the S&P 500. That's relatively high given the downside risk to earnings.

(2) Earnings season. The analysts' consensus expected growth rate for Q1-2025 S&P 500 earnings per share has dropped sharply since the start of the year (chart). We reckon that the actual results will be better. However, the forward guidance that company managements give analysts is likely to weigh on estimates for the remaining three quarters of the year given the tariff situation.