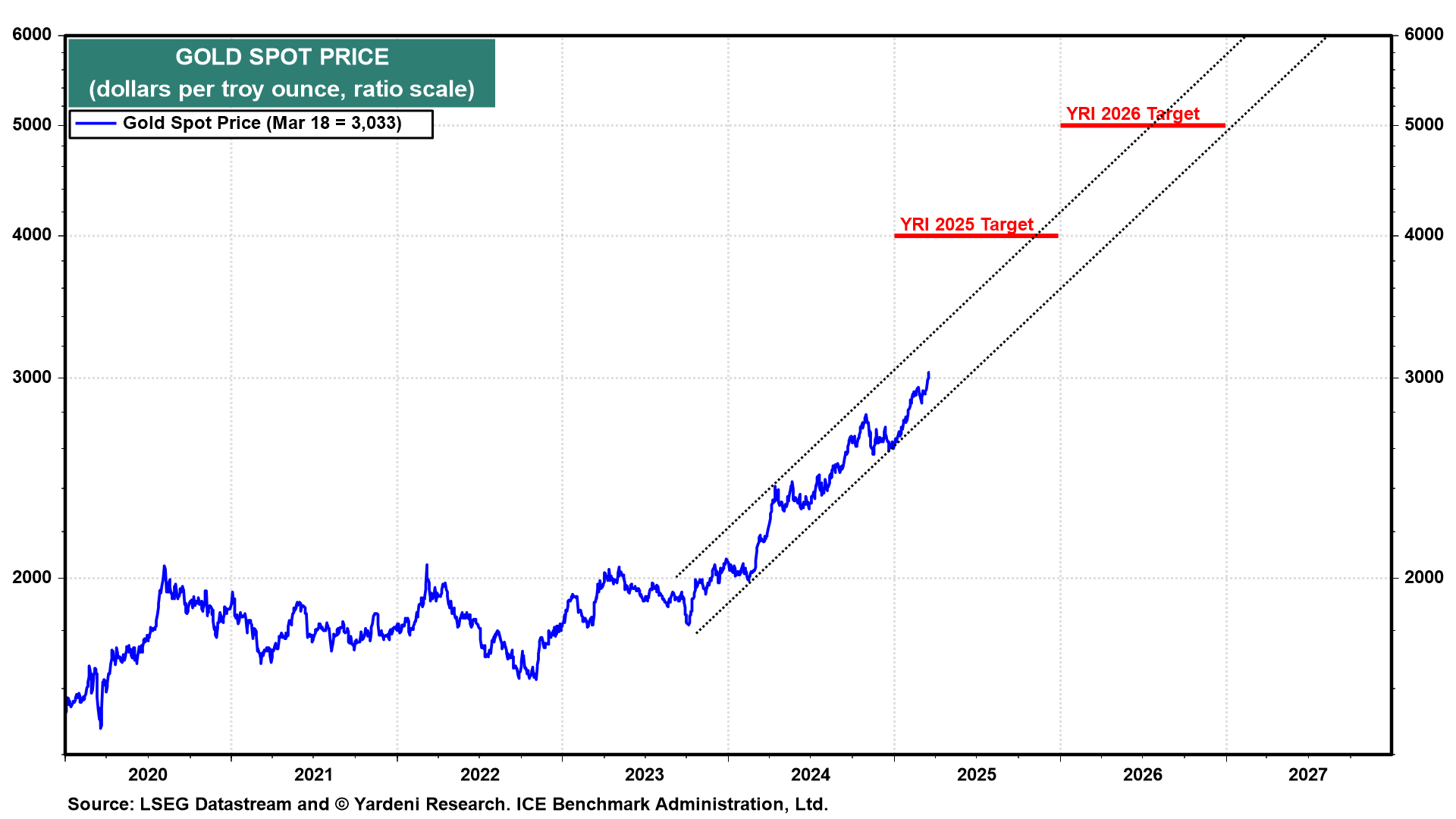

The stock market rally of the past two days faded today. The S&P 500 fell -1.1%, just shy of correction territory. Even Nvidia fell 4.3%, even though the company announced new chips and a strategic collaboration with GM today. The 10-year US Treasury bond yield has been hovering around 4.30% since late February. The price of gold rose to another record high (chart).

We suspect that the stock market hasn't fully discounted what's coming on April 2, when the US will tag America's trading partners with effective tariff rates equal to the average tariff that each country imposes on the goods it imports (or should import) from the United States plus the US Commerce Department's estimate of the implicit tariff imposed by its nontariff barriers to its markets. The US will impose on each country a reciprocal tariff reflecting this effective tariff rate.

Trump has declared that April 2 is "Liberation Day for America." Stock investors aren't buying it. The S&P 500 has declined into correction territory since February 19 on fears of a tariff war, which may very well be exacerbated by the April 2 round of reciprocal tariffs. So far this year, foreign stock markets mostly have outperformed the S&P 500, the Magnificent-7, and the S&P 493 (chart). Among the best performing stock markets have been those in China and Germany.