Salesforce beat Q3 earnings expectations today, but that's not what drove the company's shares 11% higher. CEO Marc Benioff did that by touting the company's AI-powered chatbots on today's quarterly earnings call. He sparked renewed AI optimism that lifted the Nasdaq and S&P 500 to new record highs.

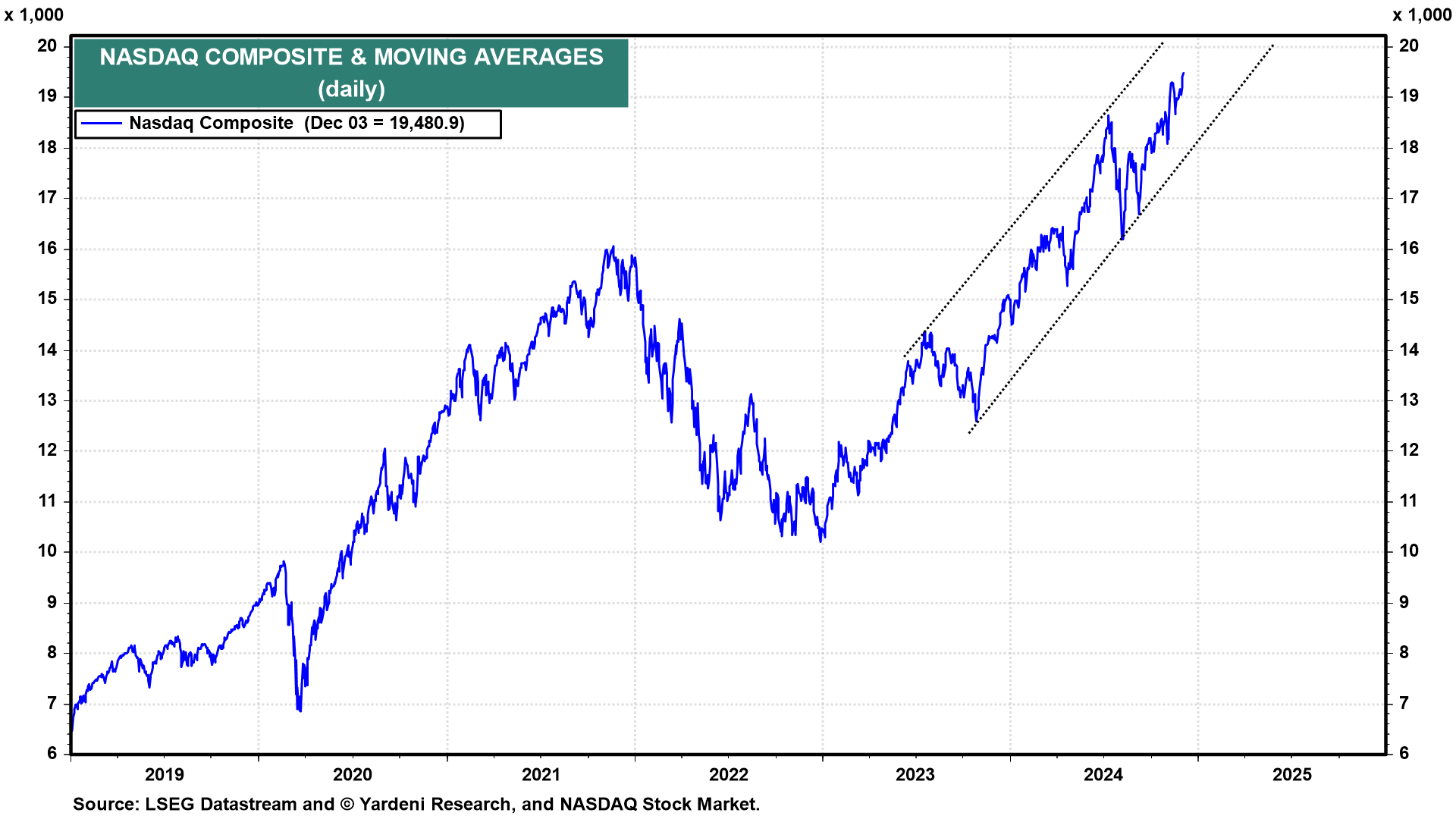

AI differs from the dotcom mania of the late 1990s. It is less hype and more the natural evolution of the Digital Revolution, which is all about processing more and more data faster and faster. This lates innovation in data processing should help to fuel a productivity boom, which is already underway, over the rest of the decade. The Nasdaq has been discounting this development and is on track to reach 20,000 by mid-2025 if not sooner (chart). Let the good times roll!

Today's economic and political developments remain broadly consistent with our upbeat outlook:

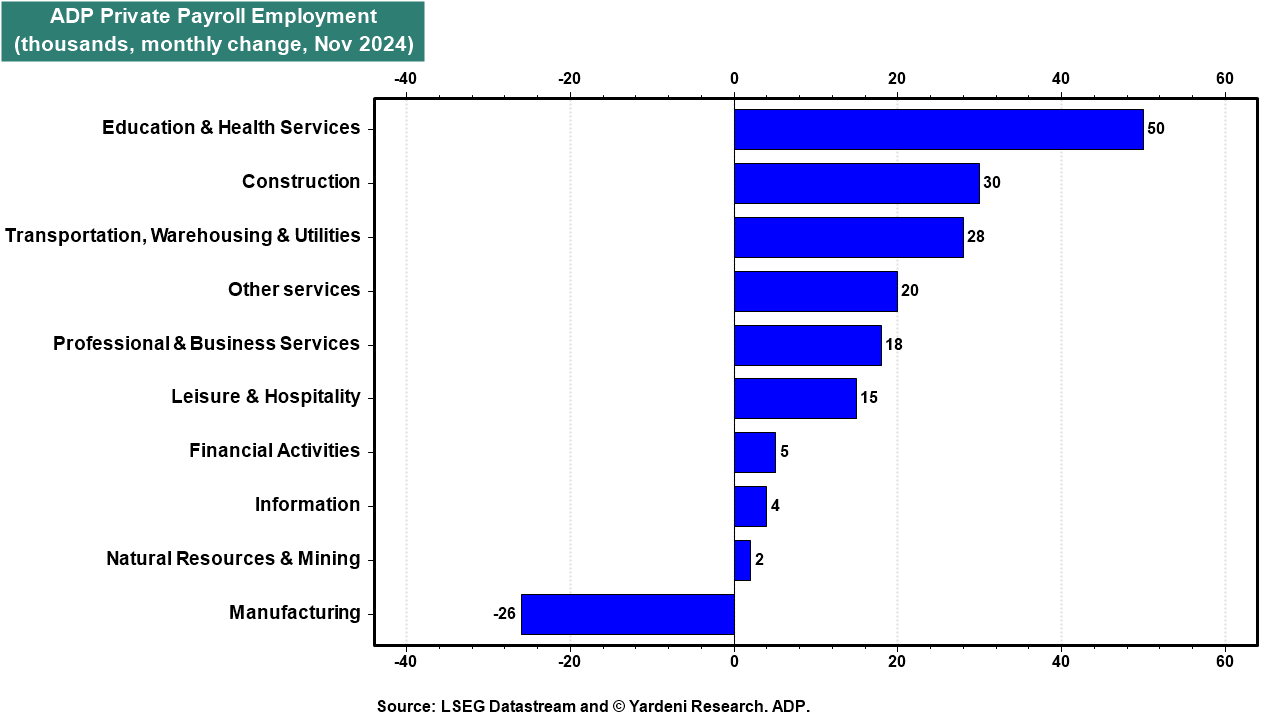

(1) Employment. November ADP private payrolls increased by 149,000, with broad-based gains across industries (chart). Only manufacturing employment was down last month. We expect it will be up in Friday's BLS payrolls data reflecting the end of the Boeing strike.