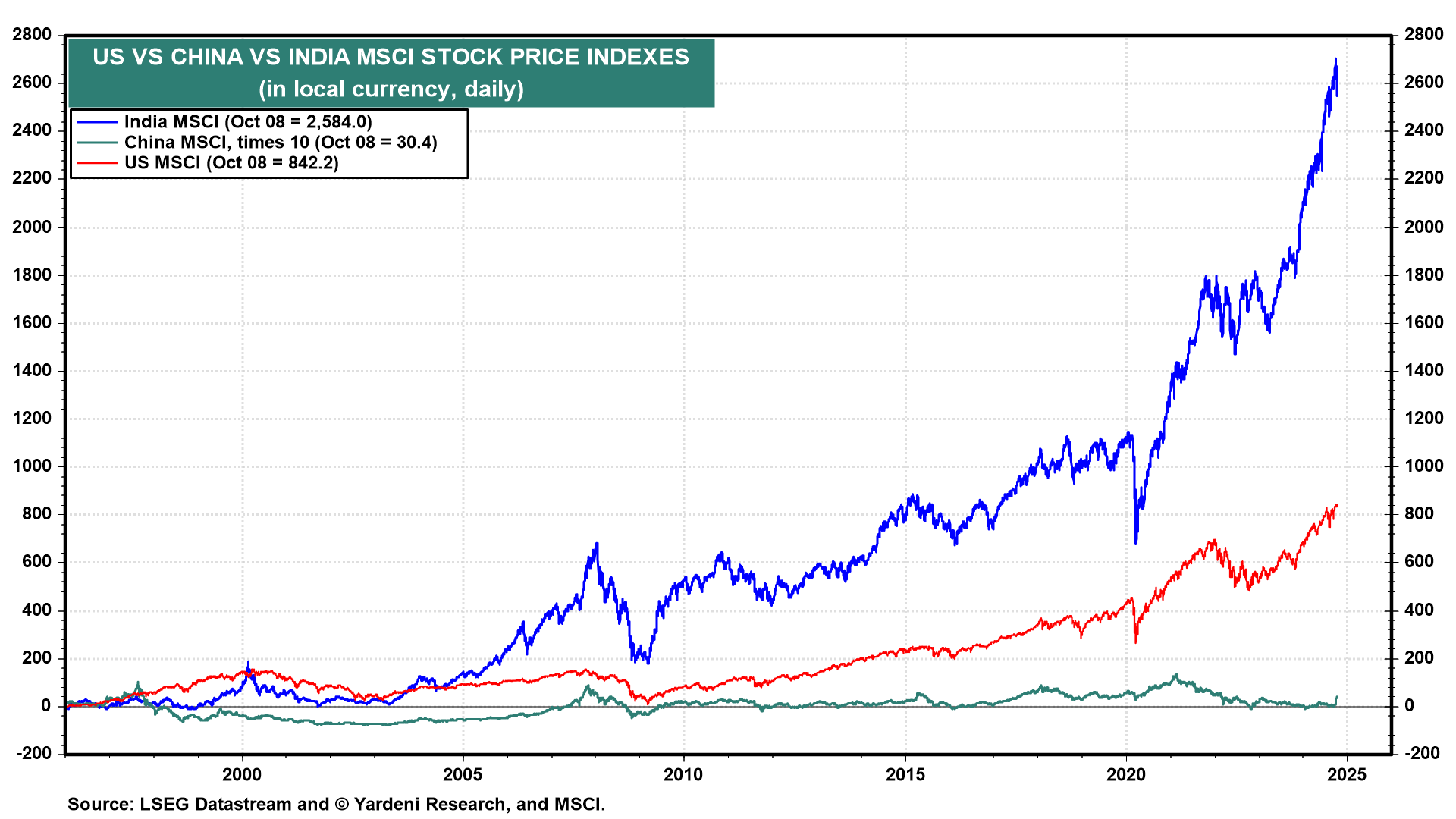

Both Blackrock's Larry Fink and Bridgewater's Ray Dalio have been notable and vocal China bulls for several years. It seems they've both joined our camp in recent days, issuing caution against investing in China as it supports Russia's war against Ukraine and becomes less favorable to capitalism. They should have placed their bets on stock markets in democracies such as the United States and India (chart).

Let's review the latest developments in China and the US:

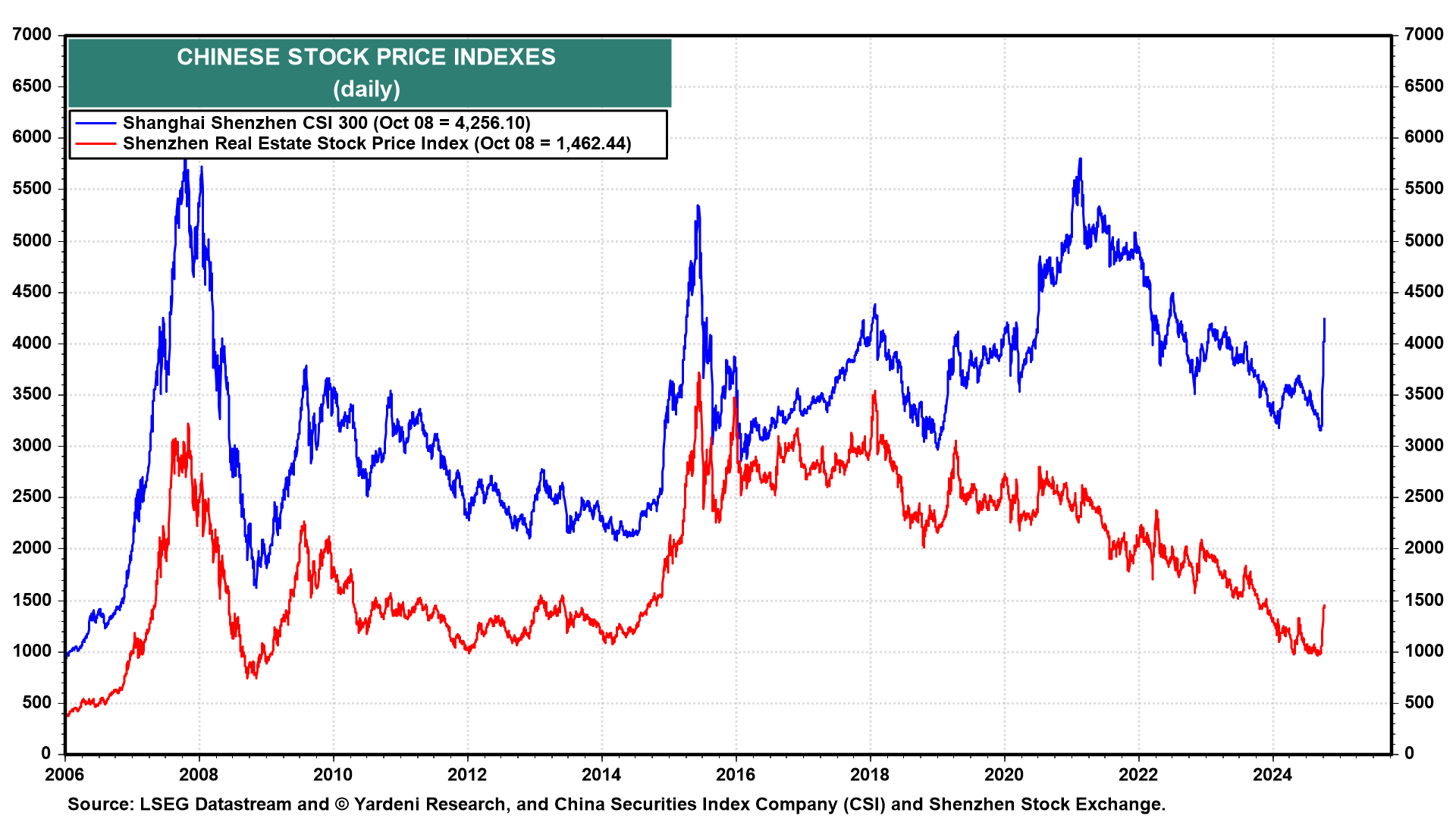

(1) China. Stock prices soared in China after the country's monetary authorities eased credit conditions a couple of days after the Fed lowered the federal funds rate in the US on September 18 (chart).

Today, we learned that China's state planners aren't great at using government resources to revive their economy. Chinese stocks initially jumped 11% after a week-long countrywide holiday. Investors hoped that the government would follow up with a stimulative package of fiscal measures. Commodity prices plummeted alongside Chinese stocks after the government failed to deliver any new measures at a highly anticipated press conference.

By the end of the day, the Hong Kong Hang Seng index fell 9.4%, the biggest one-day drop since 2008. Copper futures, which are closely linked with China's economy, fell 2.2%. Oil prices also fell sharply by more than 4%, though partly on reports that Hezbollah is seeking a ceasefire with Israel.

We've been skeptical about the potential for China to shore up its economic mess with central bank easing and scraped-together fiscal measures. A dramatic shift in China's economic model back toward capitalism would be required to make the country investible over any sustainable time horizon.