With the exception of the 2.6% (saar) increase in Q3's real GDP, the other more forward-looking economic indicators released today were on the weak side. That might explain why the 2-year and 10-year Treasury yields eased a bit this morning. In the stock market, some of the mega money that is coming out of the MegaCap-8 today is going into the DJIA-30. The former continue to miss earnings expectations, while some of the latter are beating consensus estimates.

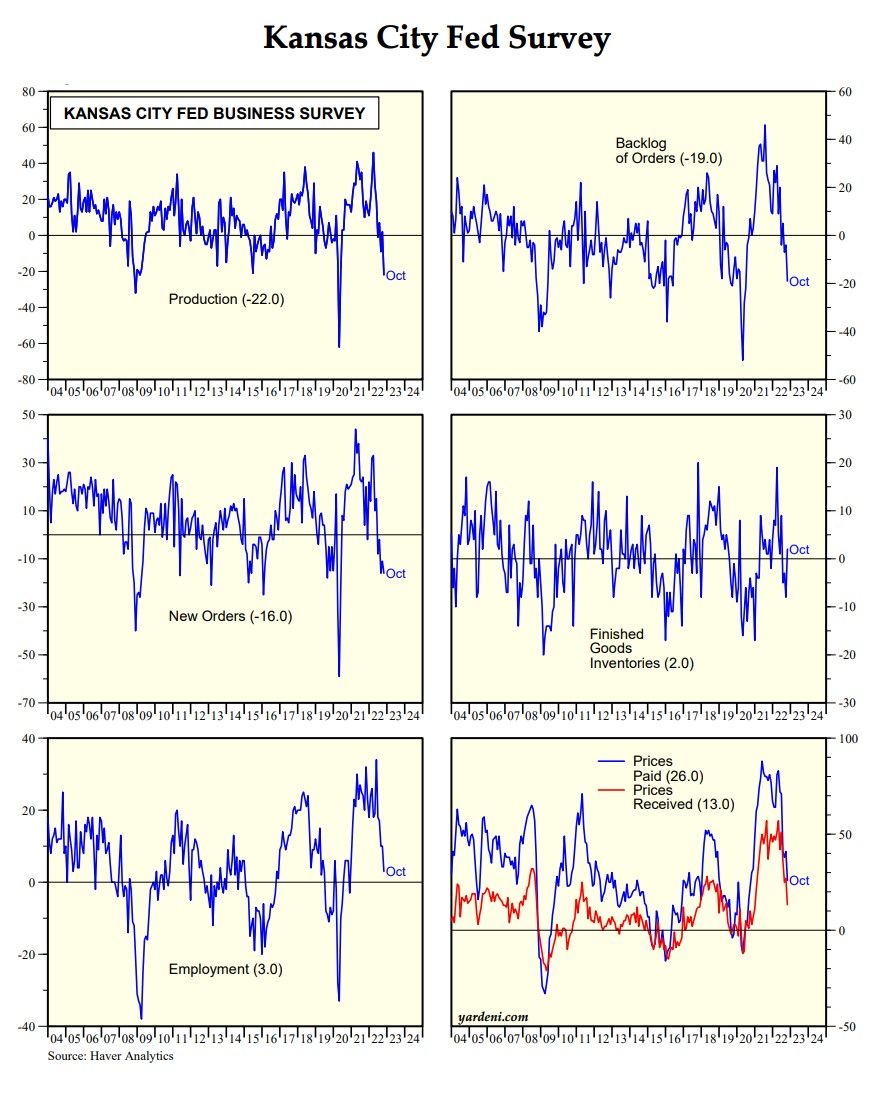

The Kansas City Fed released its October regional business survey this morning (chart). It's the fourth of the monthly surveys conducted by five of the regional Fed banks that are out so far. Dallas will be released on Monday. These surveys tend to be skewed toward manufacturing, which continued to weaken this month.

The four October surveys show a soft landing in economic activity (so far) with some moderation in inflationary pressures, while employment is holding up reasonably well. Here are October's business conditions, orders, and employment index readings for the regional surveys: New York (-9.1, 3.7, 7.7), Philadelphia (-8.7, -15.9, 28.5), Richmond (-10.0, -22.0, 0.0), and Kansas City (-7.0, -16.0, 3.0).

The -8.7 average of the business conditions indexes suggest that October's manufacturing purchasing managers index (out next Tue.) should be just under 50.0.