The stock market is down this morning on worse-than-expected PPI inflation news, heightening fears of more aggressive Fed tightening and a recession. The yield curve spread between the 2-year and 10-year Treasuries is solidly inverted at -24bps.

In addition, JP Morgan Chase reported that Q2 profits slumped as the bank built reserves for bad loans by $428 million and "temporarily" suspended share buybacks. The bank's CEO Jamie Dimon warned in early June that a hurricane is coming. He said, "JPMorgan is bracing ourselves, and we’re going to be very conservative with our balance sheet.”

On June 7, we wrote, "Dimon is the financial system’s Wizard of Oz. He should know better than anyone if a storm is coming since he can have a tremendous impact on the financial weather. After all, he is the CEO of the largest bank in America. By managing his bank’s balance sheet more conservatively, he can tighten credit conditions significantly in the US."

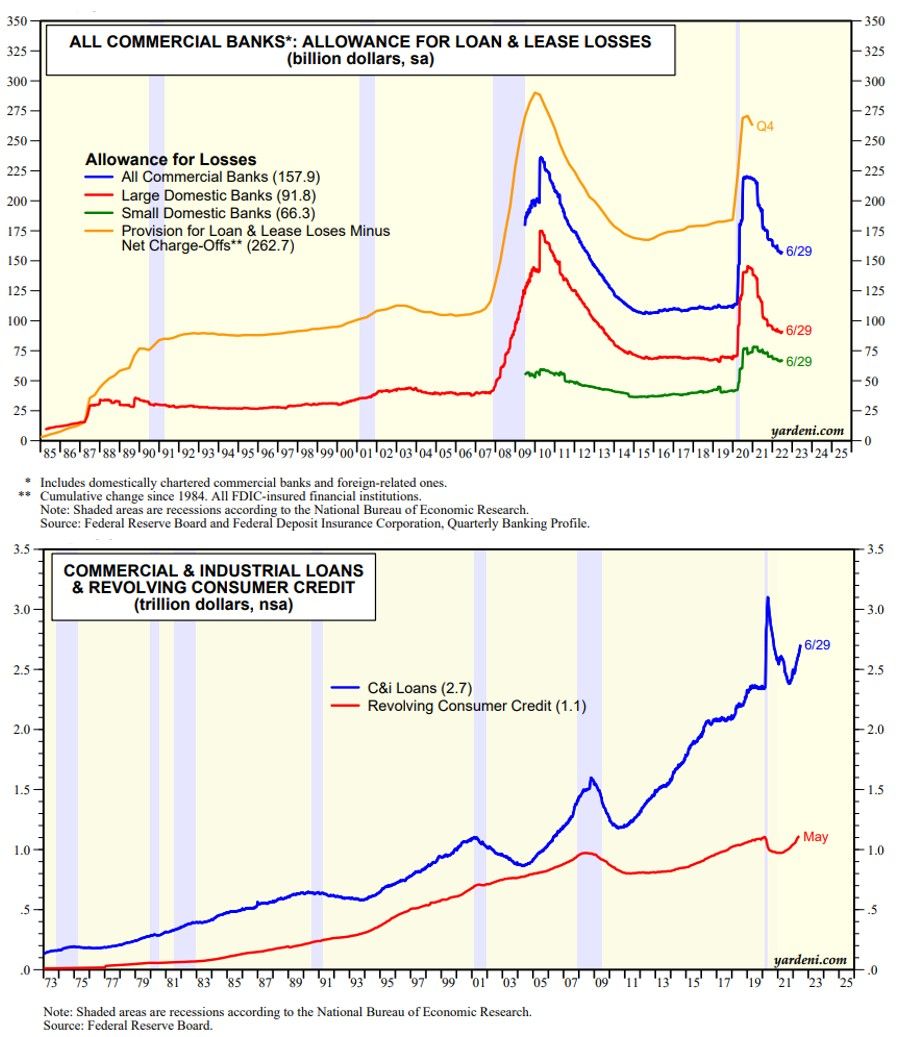

So far, through the end of June, it is hard to see any sign of Jamie's hurricane in the weekly data compiled by the Fed on US commercial banks’ allowances for loan and lease losses, which are still falling, and their loan portfolios, which are still growing (charts below). At the end of June, banks had $157.9 billion in reserves for bad debts.