The economy continues to teeter on the edge of a recession. The Atlanta Fed's GDPNow tracking model shows Q2's real GDP growth at -1.0% (saar). It was revised down from 0.3% following this morning's release of May's personal income and consumption data. The model shows real consumer spending up 1.7%, a downward revision from 2.7%. In addition, real gross private domestic investment growth was revised down from -8.1% to -13.2%, led by a 10.1% drop in residential investment. Let’s have a closer look at the recession issue:

(1) Inflation has eroded consumers' purchasing power. Nominal disposable personal income (DPI) is up 2.8% y/y through May, but the PCED inflation rate was 6.3% over this same period. As a result, real DPI has been falling. Many consumers were able to offset the weakness in their real DPI by reducing their personal saving rate over the past year through April to maintain their spending. But that may be harder to do going forward.

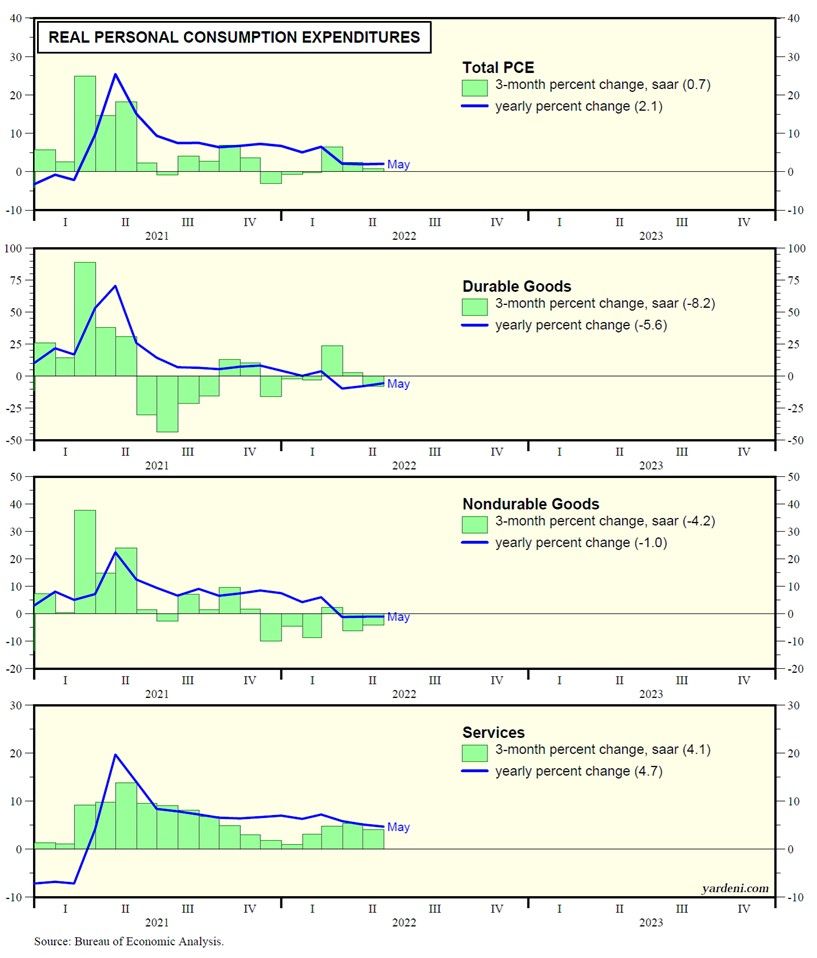

(2) Following the lockdown recession in early 2020, consumers have satisfied a lot of their pent up demand for durable goods, which has led the recent weakness in spending (charts below). However, consumers are now even reducing their real outlays of nondurable goods as their prices have soared, especially gasoline and groceries. Rent is another essential outlay with a rising inflation rate.

(3) So is it a recession given that Q2's estimated 1.0% decline follows Q1's 1.6% actual drop? Not yet, and certainly not officially. Q2's estimate is a work in progress, though it is more likely to be even weaker once all of June's data are released. It is widely believed that a recession is defined as two consecutive down quarters for real GDP. It is actually up to the Dating Committee of the National Bureau of Economic Research to make that determination.

(4) In any event, the markets currently seem to be discounting a growth recession, not a hard landing. That's brought the yields on the 2-year and 10-year Treasury notes back down below 3.00% today. Stock investors are torn between the deteriorating outlook for corporate earnings and a less hawkish outlook for Fed policy. Our view is that the 10-year yield is fairly valued under the circumstances around 3.00% and that June 16’s closing low on the S&P 500(at 3666) might have been the bottom.