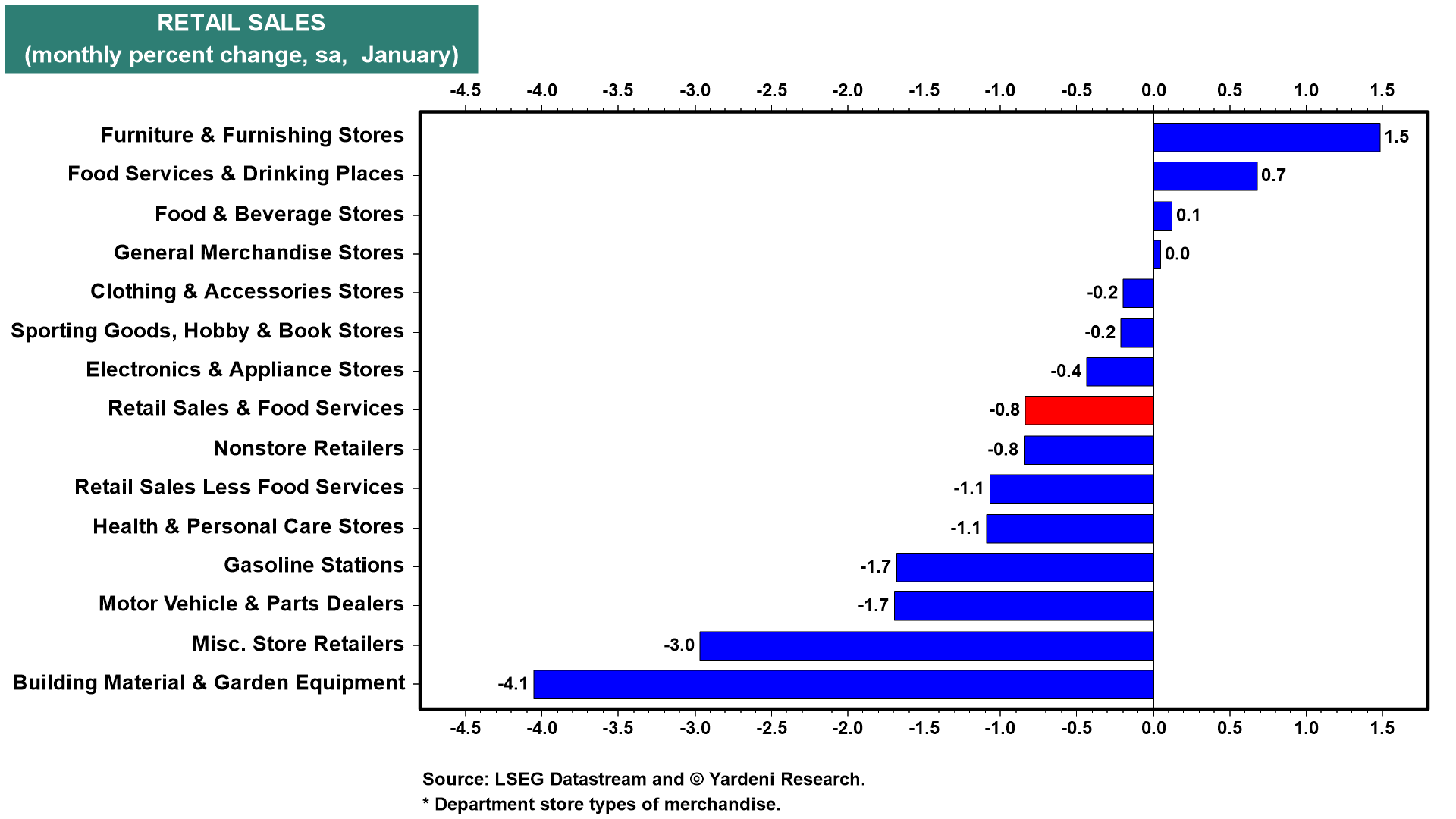

Retail sales fell 0.8% m/m in January, much weaker than expected (chart). Leading the way down was a 4.1% drop in building materials & garden equipment & supplies.

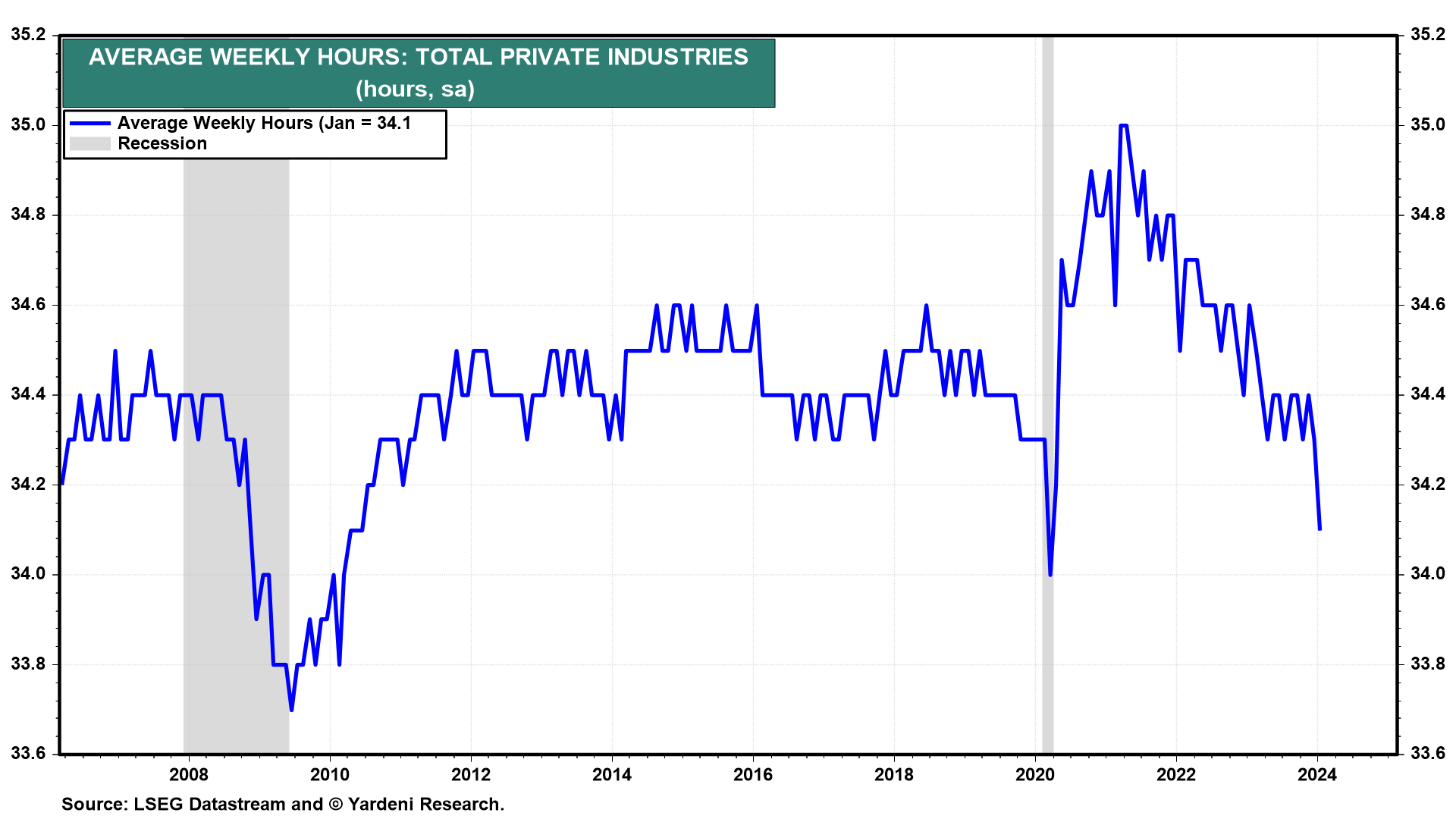

Following the release of January's employment report, we anticipated some weakness in retail sales because the 0.2% increase in payrolls was offset by an odd 0.6% drop in average weekly hours (chart).

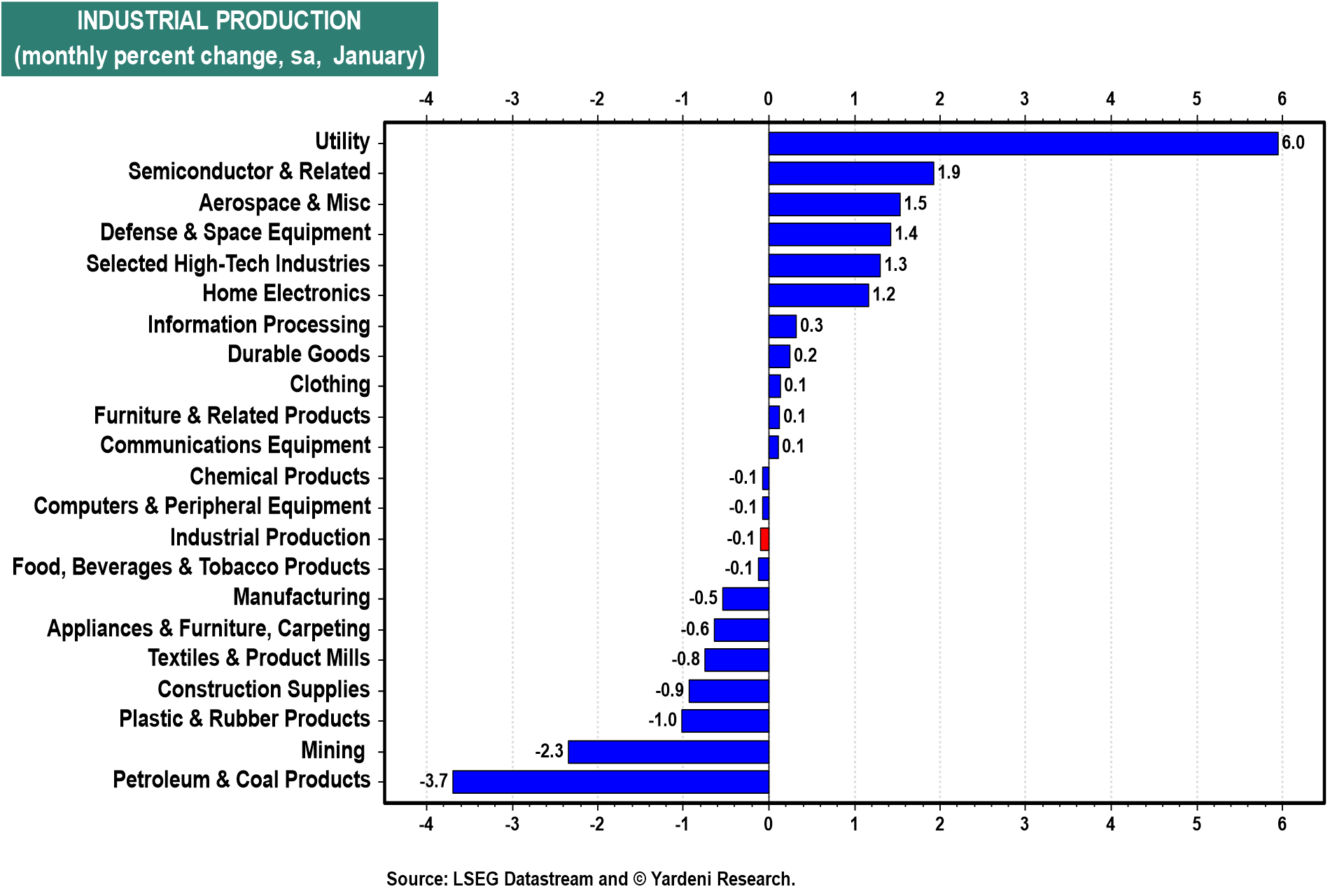

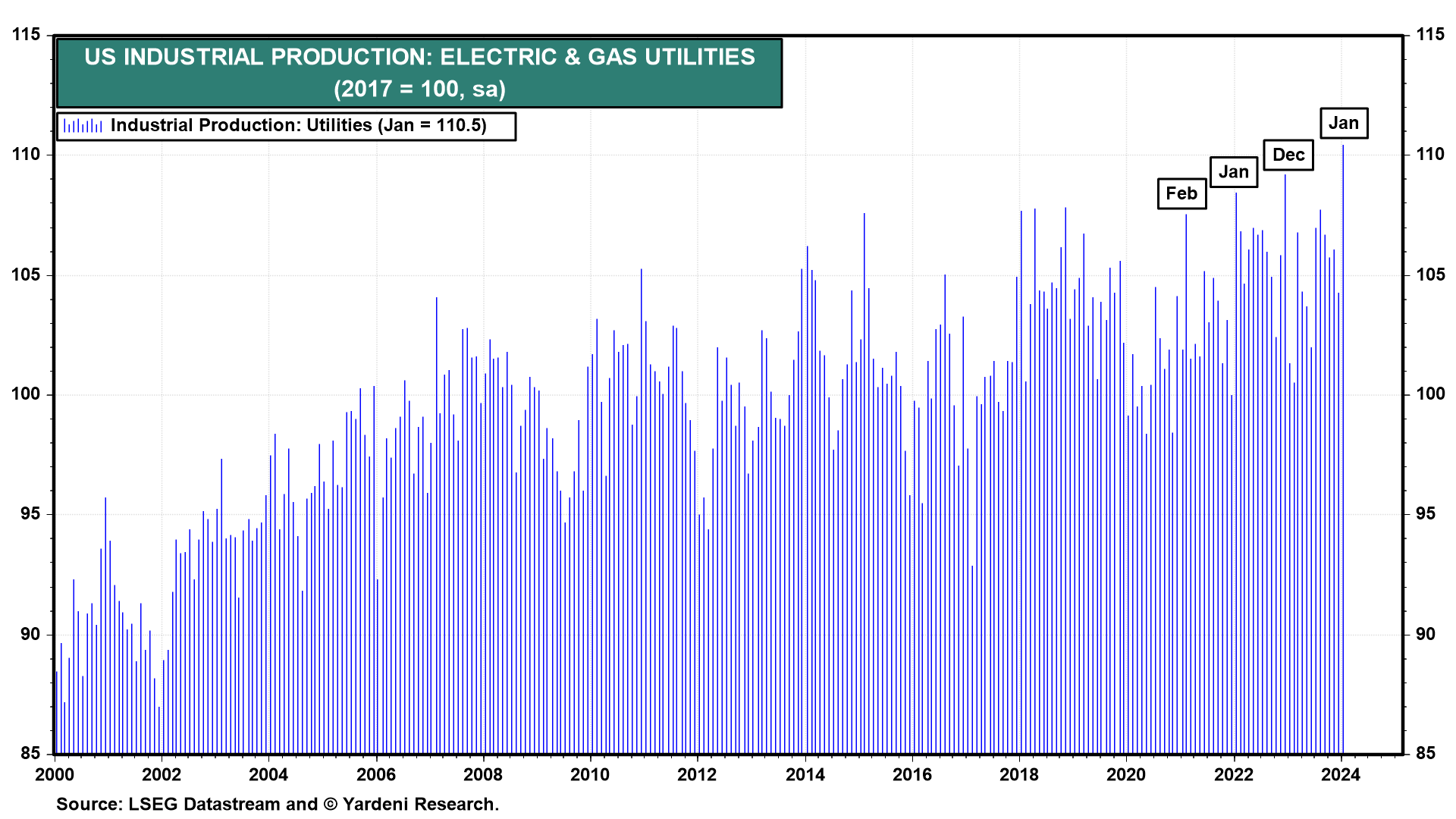

Also weak during January was manufacturing production, down 0.5% (chart). On the other hand, utility output jumped 6.0% m/m last month! Here on Long Island, January was mild. But it must have been very wintery in the rest of the country.

Output of electric and gas utilities is seasonally adjusted, but tends to spike during the winter months when the weather is worse than usual (chart). That's what it did in January of this year. That would explain some of the weakness in January's economic indicators.

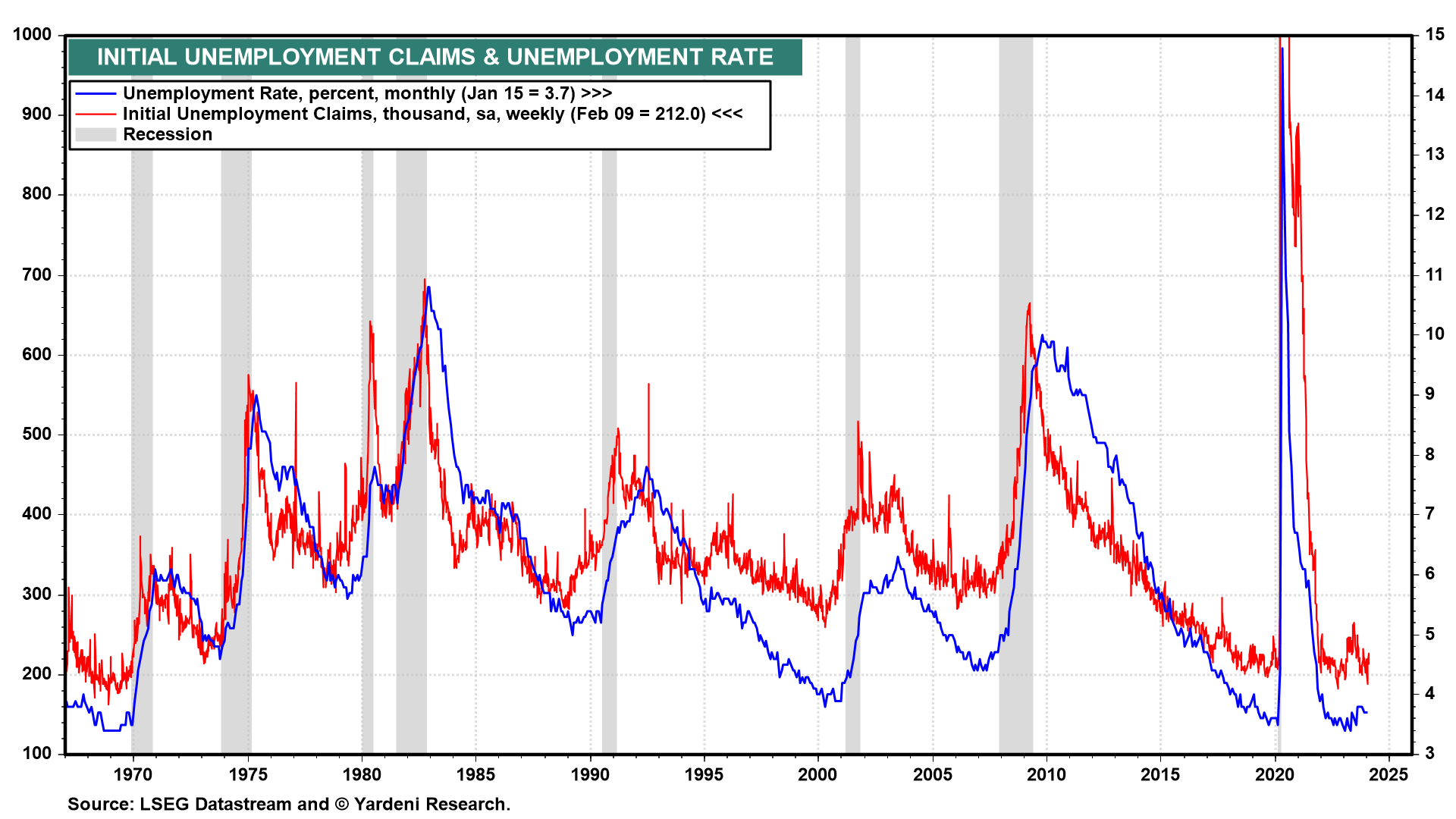

Now for some good news: Initial unemployment claims edged down to 212,000 during the February 9 week (chart). This suggests that the unemployment rate remained below 4.0% for the past 25 months! Inflation has turned out to be transitory, while the jobless rate has remained persistently below 4.0%.