Real GDP fell 0.9% (saar) during Q2, following a 1.6% decline during Q1. That's a "growth recession" in our opinion. It is widely believed that two consecutive quarters of declining real GDP is an outright recession. However, it won't be an official recession until the Dating Committee of the National Bureau of Economic Research says so. They might not do so since it is so mild so far unless the economy continues to decline during the second half of this year.

While we are waiting for them to decide whether we are in a recession or not, let's just call it a "banana."

“Between 1973 and 1975 we had the deepest banana that we had in 35 years, and yet inflation dipped only very briefly,” the economist Alfred Kahn, who headed the Carter administration’s task force to fight inflation, once said. He substituted “banana” for the word “recession.” The reason, he amiably explained, was that references to recessions seemed to make people nervous and irritable. Of course, one of the people made most irritable was his boss, President Jimmy Carter.

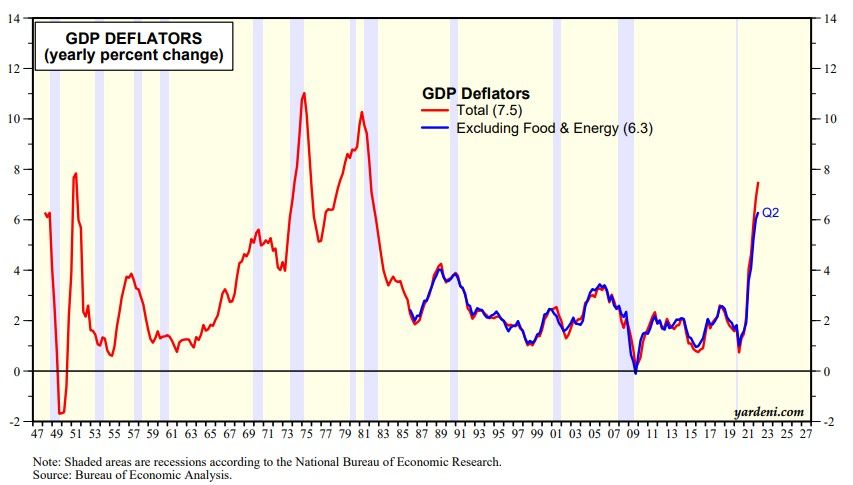

For now, Fed officials remain on course to tighten monetary policy again at their September meeting, even at the risk of an economic squished banana. That's because inflation remains too high. The price index for GDP increased 8.7 % in Q2, compared with an increase of 8.2% in Q1. It is up 7.5% and 6.3% y/y with and without food and energy (chart below). The PCE price index increased 7.1%, the same rate as Q1. Excluding food and energy prices, the PCE price index increased 4.4%, down from 5.2%.