The 10-year US Treasury bond yield has recently stabilized around 3.00%. That calm reflects a remarkable increase in the comparable TIPS yield that has been offset by a drop in the expected-inflation component of the nominal yield. What's going on? Consider the following:

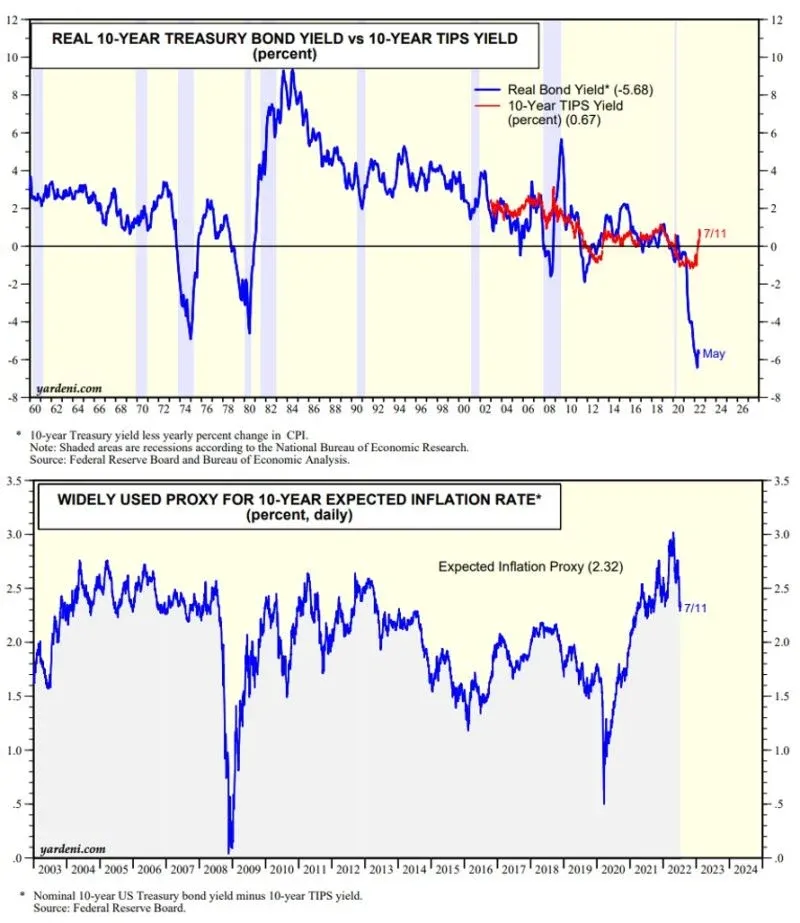

(1) Until the past few weeks, the daily TIPS yield has been highly correlated with the monthly real bond yield, defined as the spread between the nominal yield and the CPI inflation rate on a y/y basis (chart).

(2) The TIPS yield fell to a record low of -1.19% on November 9, 2021. It then moved higher, especially this year, closing at 0.67% today. This suggests that investors expect that real interest rates will rise as the increase in nominal rates over the past year will in the short run (i.e., soon) depress inflation.

(3) The spread between the nominal yield and the TIPS yield is widely considered to be a market proxy for the average annual inflation rate over the next 10 years (chart). It too is signaling a drop in the expected inflation rate over the next 10 years. (Then again, this spread tracks the daily moves in the price of copper quite closely. Go figure!)

(4) The bond market seems to be signaling that inflation is peaking. Let's see how that assessment is impacted by June's CPI, which will be reported on Wednesday. It is widely expected to be up 1.1% m/m and 8.8% y/y.