The war in the Middle East may be about to widen. Consider the following:

(1) The Israeli intelligence community reportedly believes that Iran has decided to directly target Israel in retaliation for the assassination of Hamas Political Bureau Chief Ismail Haniyeh. That decision was made after an internal debate between the Iranian Revolutionary Guards (IRG) and the new Iranian president and his advisors. The IRG has been pushing for a more severe and widespread response than the April 13 attack on Israel. The president and his advisors advocated for a more limited attack.

(2) In a call on Sunday night, the defense minister of Israel reportedly informed US Defense Secretary Lloyd Austin that Iran is preparing a significant attack against Israel. Austin ordered that the USS Abraham Lincoln Carrier Strike Group, along with F-35C fighters, accelerate its transit to the Central Command area, bolstering the military presence already provided by the USS Theodore Roosevelt Carrier Strike Group. Additionally, the USS Georgia, a guided missile submarine, has been deployed to the region.

(3) If the attack happens and causes significant casualties and damage in Israel, the result might be an outright war between Israel and Iran with Israel targeting Iran’s oil and nuclear facilities. They would also target key officials of the Iranian regime.

(4) Oil prices jumped by more than 3% today suggesting an imminent widening of the war in the Middle East (chart).

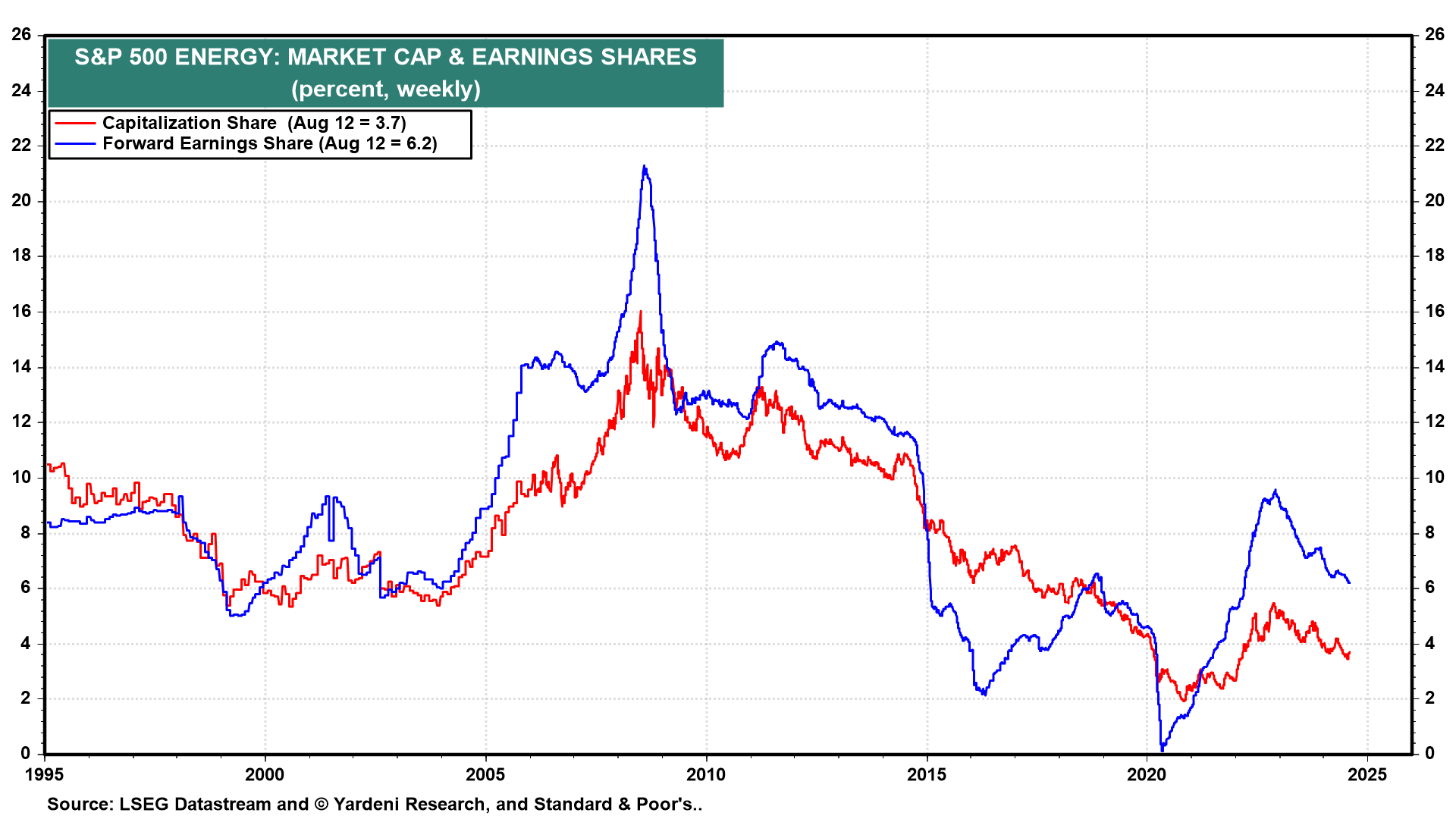

(5) Our Energy sector overweight hasn’t played out as well as our overweights in S&P 500 Tech (Information Technology & Communication Services), Industrials, and Financials. Fortunately, at just 3.7% of the S&P 500 market capitalization, Energy is an easy sector to overweight in a portfolio these days (chart).

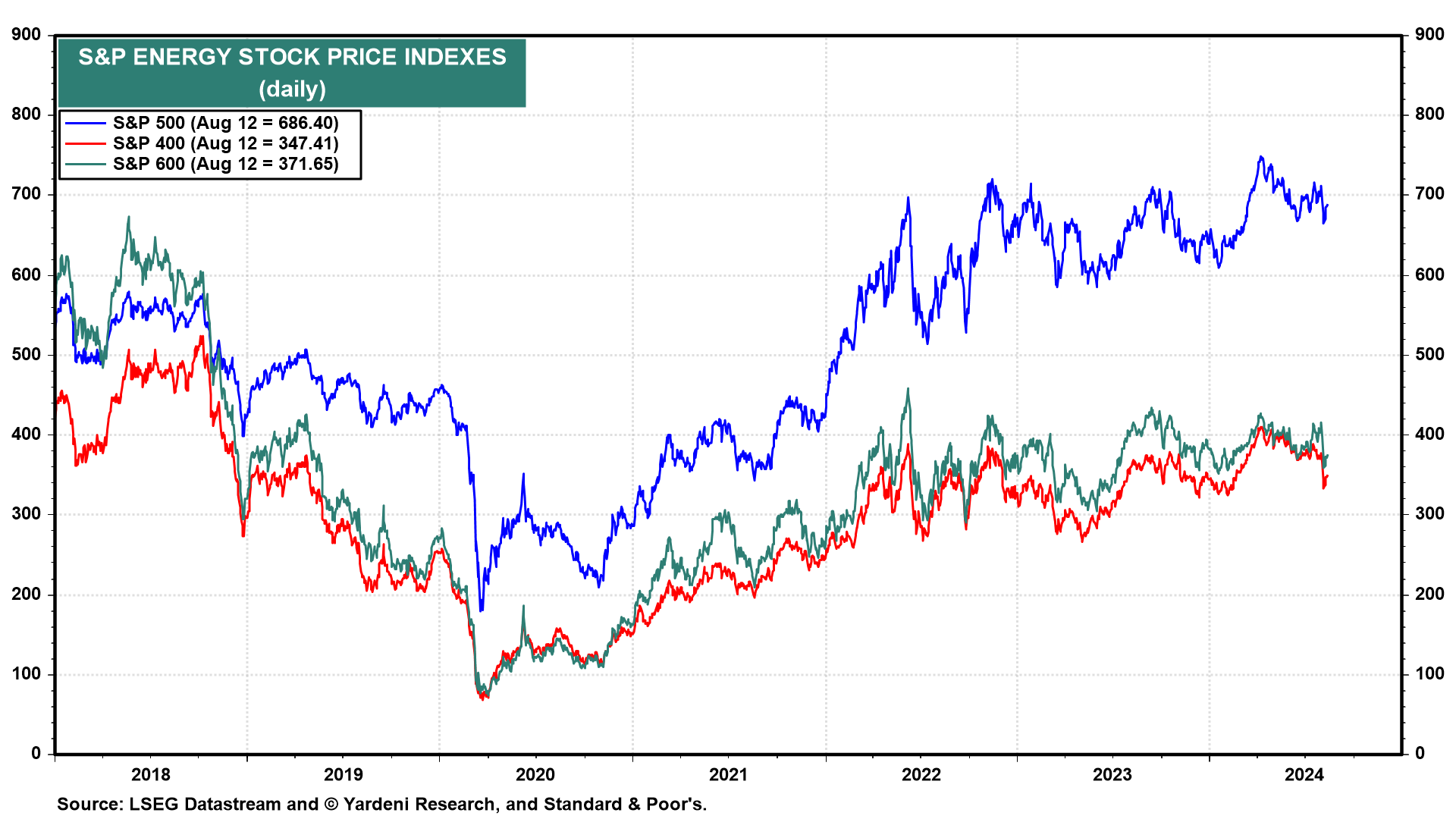

The S&P 500/400/600 Energy stock price indexes have rallied along with oil prices in recent days (chart).

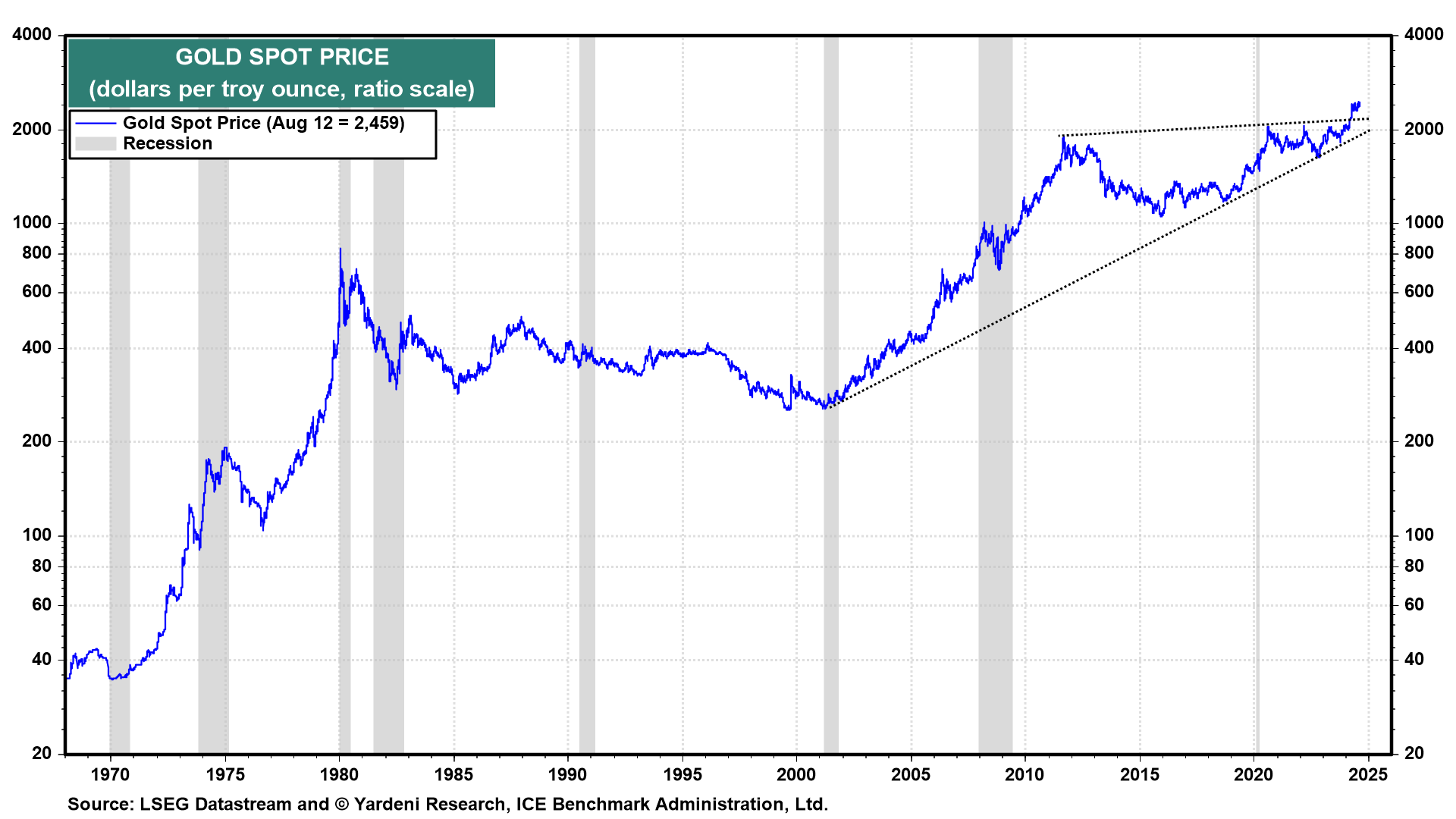

(6) We've been recommending overweighting gold along with oil as shock absorbers against geopolitical shocks. The price of gold also rose today nearing a new record high (chart).