It is widely believed that political gridlock is bullish for stocks in the US. The market is happiest when our constitutional system of checks and balances is working. Therefore, a divided government is preferable to a unified government when one party controls the White House and both houses of Congress. So a widely expected "red wave" tomorrow should be bullish for stocks.

We have previously observed that the stock market has a strong tendency to perform well following midterm elections irrespective of the actual election outcome. However, there are too many factors that influence the stock market to show conclusively that the market performs better under divided than unified governments.

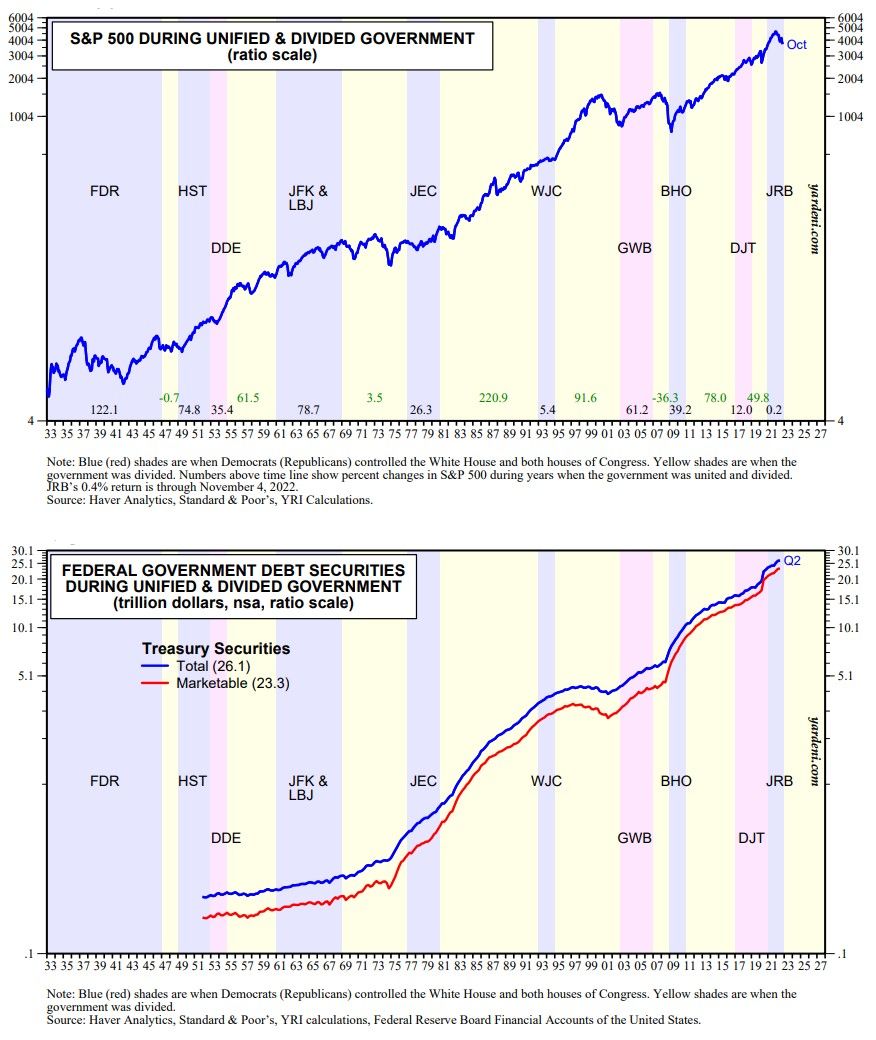

By our count, during periods of a unified government, the S&P 500 rose on average 9.5% per year under Democrats and 13.0% under Republicans since 1933 (chart). During periods of a divided government, the S&P 500 rose 7.5% per year. Since 1933, there have been three instances when the Republicans ruled the unified government and seven instances when the Democrats did. Altogether, the government was unified under Republicans for 8 years, unified under Democrats for 36 years, and divided for 46 years.

Nevertheless, we can clearly observe that the amount of federal debt outstanding has risen during periods of both unified and divided government (chart). The two parties may fight over federal spending and taxation issues, but they can always agree on paying for budget deficits by issuing more debt. Enabling their fiscal excesses in recent years has been the ultra-easy monetary policies of the Federal Reserve. However, the excessively stimulative mix of fiscal and monetary policies in response to the pandemic caused inflation to soar, forcing the Fed to raise interest rates significantly.

Gridlock may not be bullish this time if the government can't function as a result of extreme partisanship. Don't forget to vote tomorrow!