Everybody in the stock market (at least everybody with long positions, which includes most investors) has been happy since the S&P 500 bottomed on October 27—until it stumbled a bit today. The market was up in the morning despite a dive by FedEx shares. But stock prices tumbled during a late afternoon selloff. Most pundits concluded that the market was overbought and due for a correction. We agree, which is why we haven't raised our long-standing year-end target of 4600.

Was there a fundamental trigger for the selloff? The only one we can point to is mounting evidence that the Gaza war is turning into a more regional one. We remain concerned about that possibility. On Tuesday, US Secretary of Defense Lloyd Austin, on a visit this week to Bahrain, home of the US Navy's headquarters in the Middle East, said Bahrain, Britain, Canada, France, Italy, the Netherlands, Norway, Seychelles, and Spain were among nations involved in the Red Sea security operation to protect ships transiting the Red Sea that have come under attack by drones and ballistic missiles fired from Houthi-controlled areas of Yemen. The Houthis are backed by Iran.

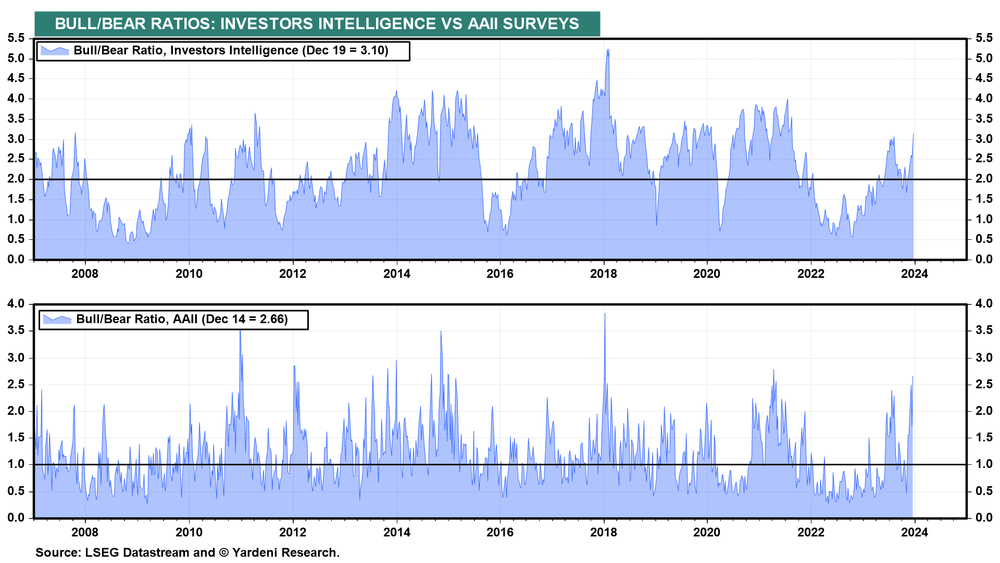

That's a good excuse for some profit-taking, which makes sense to us given the rising risks in the Middle East. In any event, bullishness has gotten a bit excessive of late. Consider the following:

(1) Investors Intelligence Bull/Bear Ratio (BBR) jumped to 3.10 this past week, while the AAII ratio rose to 2.66 (chart). Bears accounted for only 18.1% and 19.3% of the former and the latter, respectively.

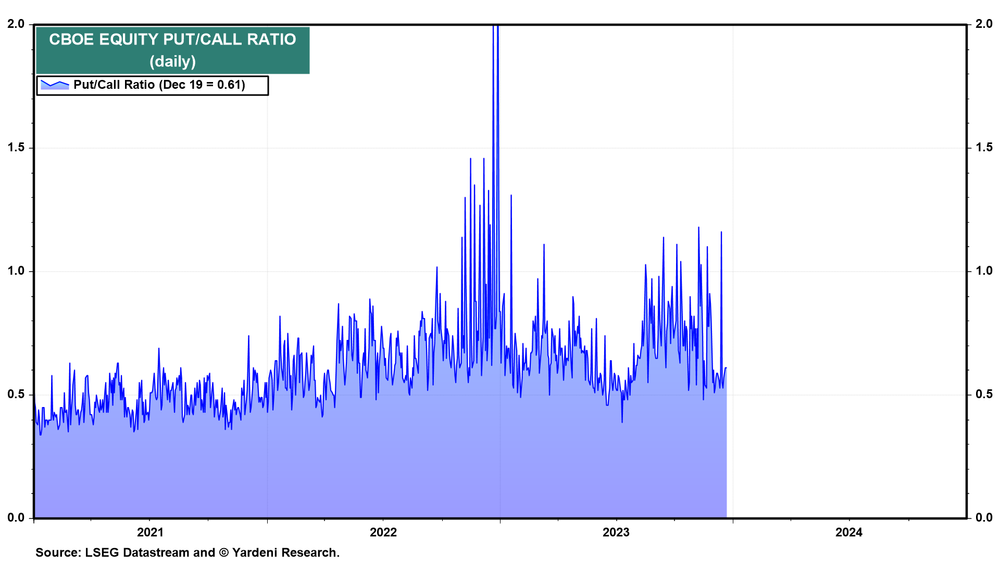

(2) The CBOE Put/Call Ratio was down to 0.61 yesterday (chart).

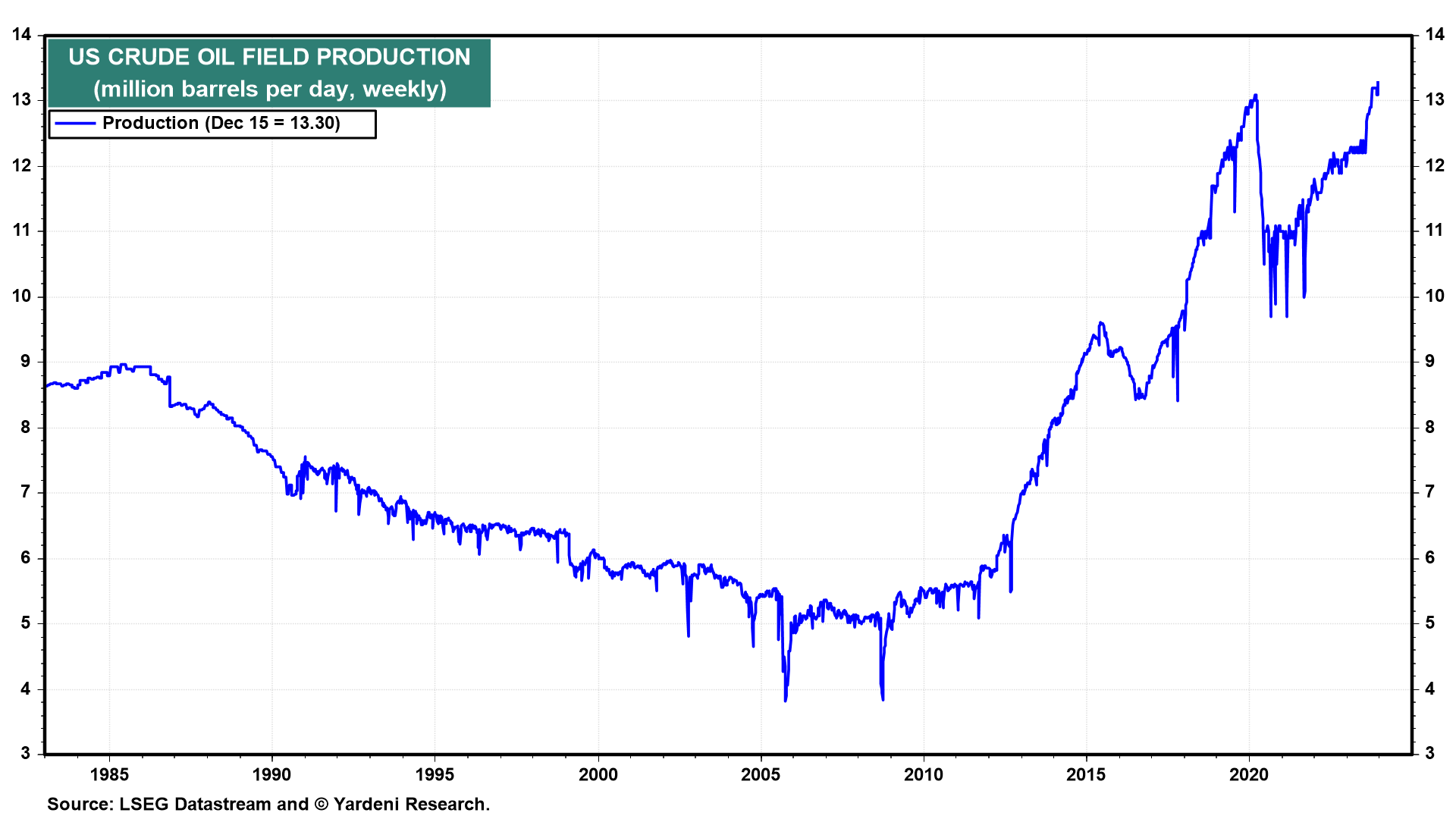

(3) So why isn't the price of crude shooting up as a result of the mounting tensions in the Middle East? One reason is that the global economy is weak because of recessions in China and Europe. Another is that US crude oil field production rose to a new record high of 13.3mbd during the December 15 week (chart).

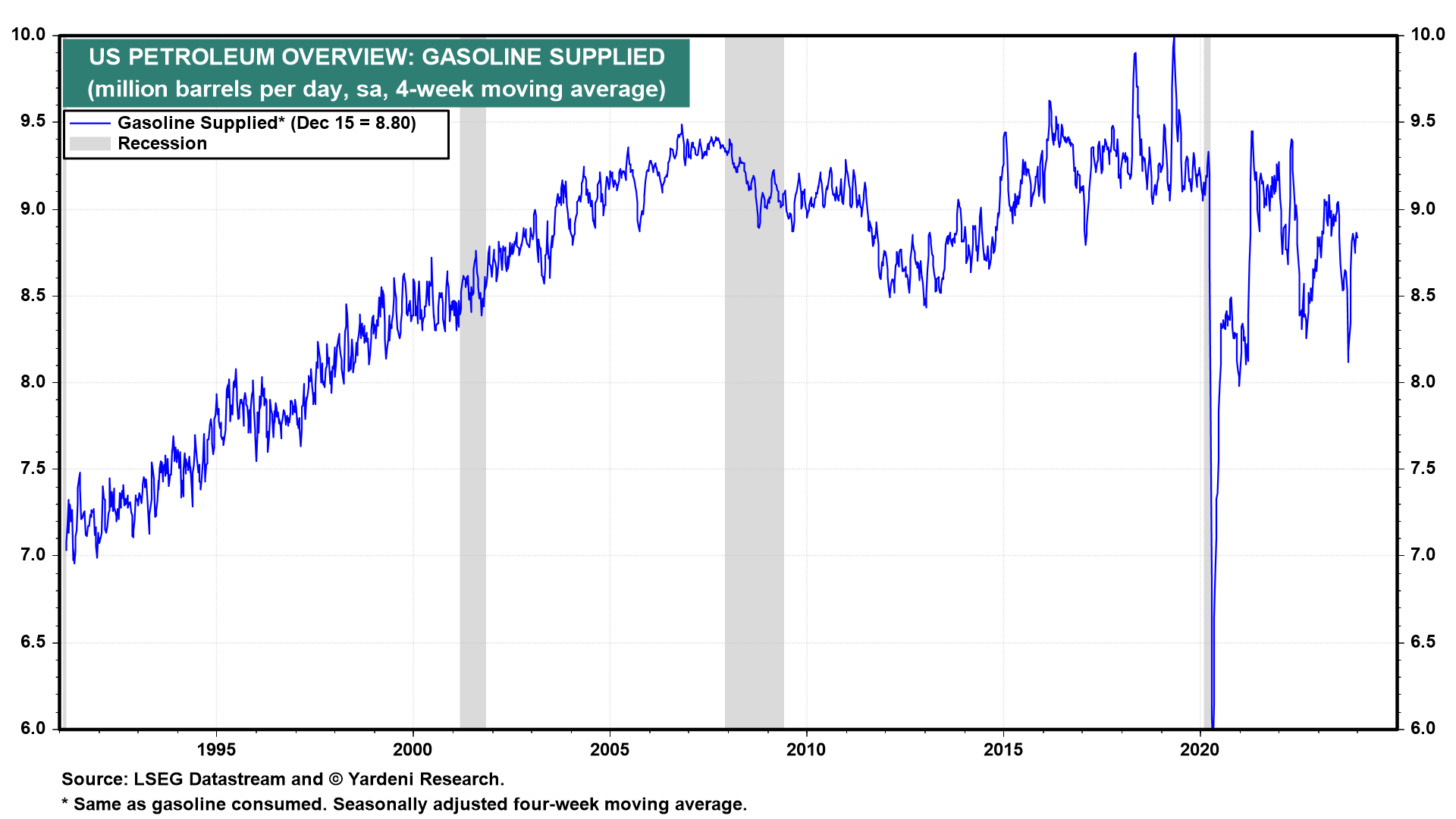

Additionally, lots of Americans are working from home or commuting less often to work than before the pandemic. So gasoline consumption is down (chart).

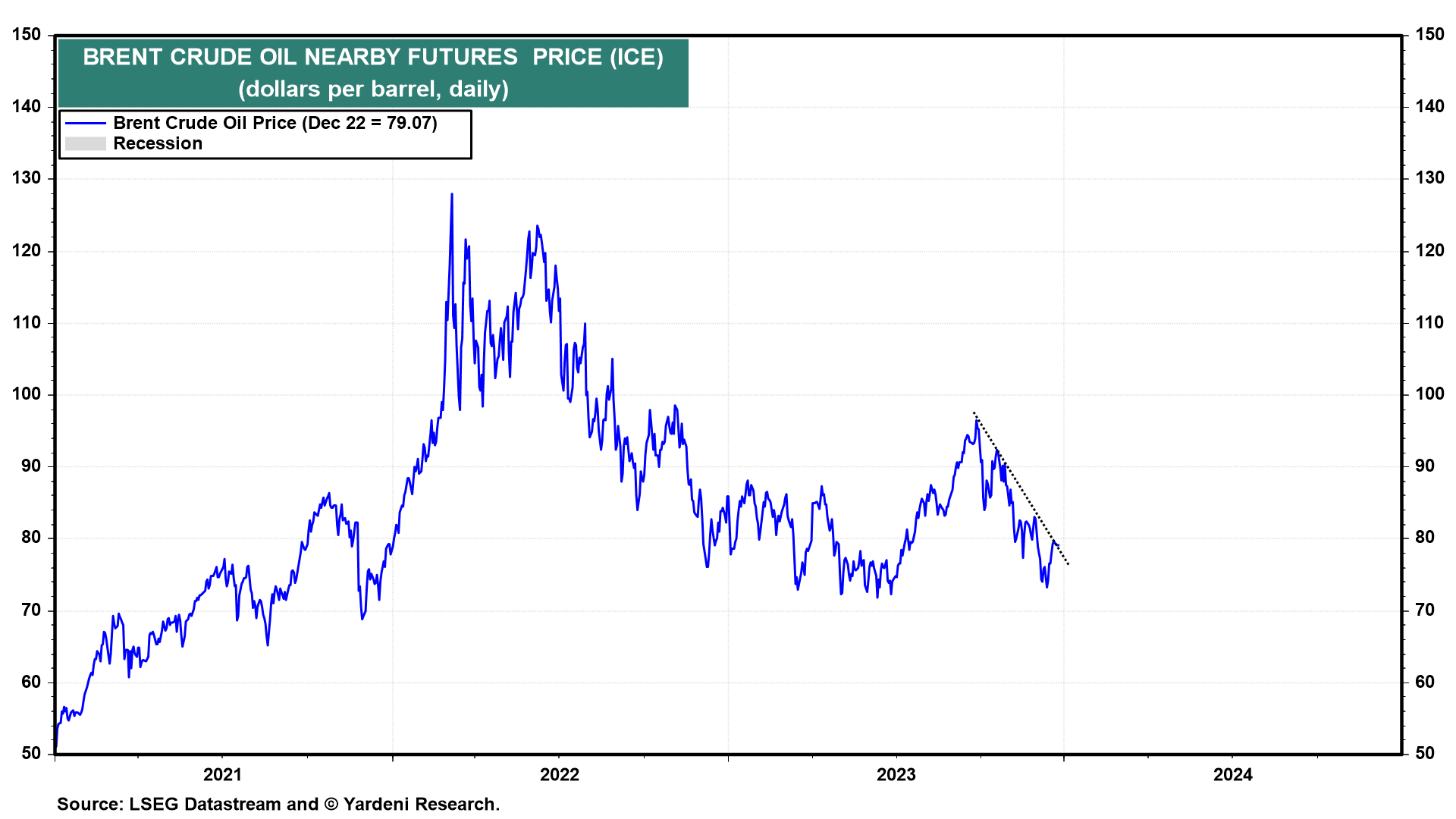

Nevertheless, the price of a barrel of brent crude oil is up 8.8% since December 12 (chart). We will be monitoring it for a signal that the regional war in the Middle East has the potential to disrupt the global economy.

That’s not hard to imagine given that in 2021, a ship stuck for a week in the Suez Canal snarled global trade for months. The Houthi attacks and rising insurance shipping costs are forcing vessels hauling everything from oil to grains to autos to sail around Africa. The extra costs and delays pose risks to the global economy, just as inflation looked set to be cooling. Stay tuned.