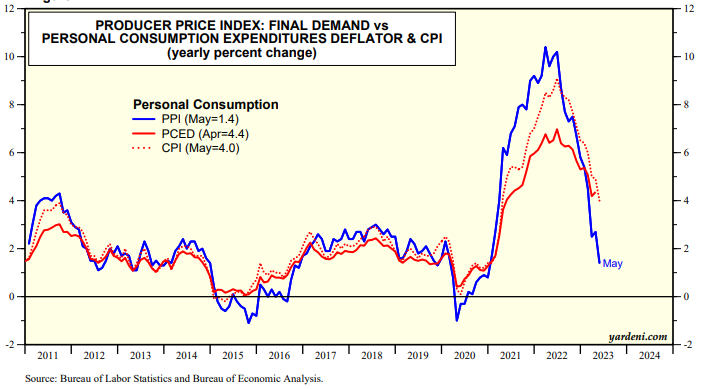

The pandemic was a shock. It caused lots of aftershocks including an inflation problem which was widely expected to be transitory, but has seemed to be more persistent. It may turn out to be transitory after all according to today's May PPI report.

We usually focus on the inflation rate of the final demand PPI for personal consumption (chart). It tends to coincide with the inflation rates for the CPI and PCED. They've diverged recently as follows: PPI (1.4% in May), CPI (4.0% in May), and PCED (4.4% in April). That's mostly because the PPI does not include rent, which has been persistently high, but seems to be moderating as we observed recently.

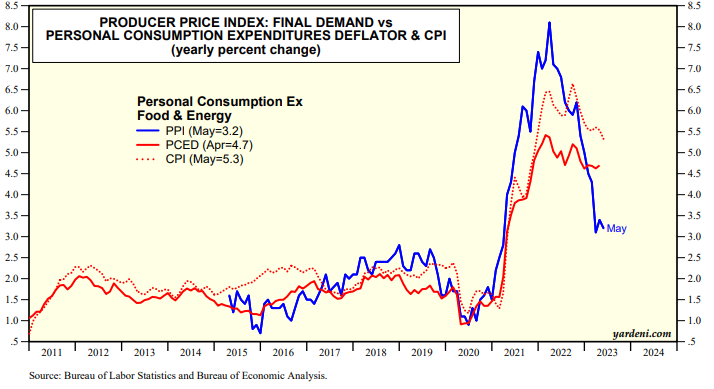

The inflation rate of the final demand PPI for personal consumption excluding food and energy has been stickier around 3.0% over the past few months, but that's still well below the comparable CPI inflation rate (5.3% in May) and PCED (4.7% in April) (chart).

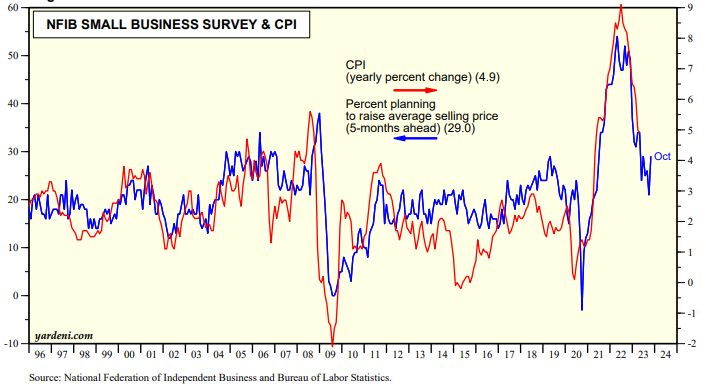

The headline CPI was up 4.9% y/y during May. It could be down to 3.0%-4.0% by this fall according to its relationship with the five-month ahead "percent planning to raise average selling price" in May's NFIB survey of small business owners (chart). We are still forecasting that the headline PCED will fall to 3.0%-4.0% later this year.

That would be good for both bonds and stocks.