The S&P 500 rose to a new record high of 5308.15 following today's economic numbers. It could easily reach our yearend target of 5400 well ahead of schedule! For now, we are sticking with this target, as well as 6000 for 2025 and 6500 for 2026. That's consistent with our Roaring 2020s scenario (60% subjective probability). If the market continues its near-vertical ascent, we might have to increase the odds of a replay of the 1990s meltup (currently at 20%), while reducing the odds of a replay of the 1970s (currently also at 20%).

Here are our key takeaways from today’s bullish data:

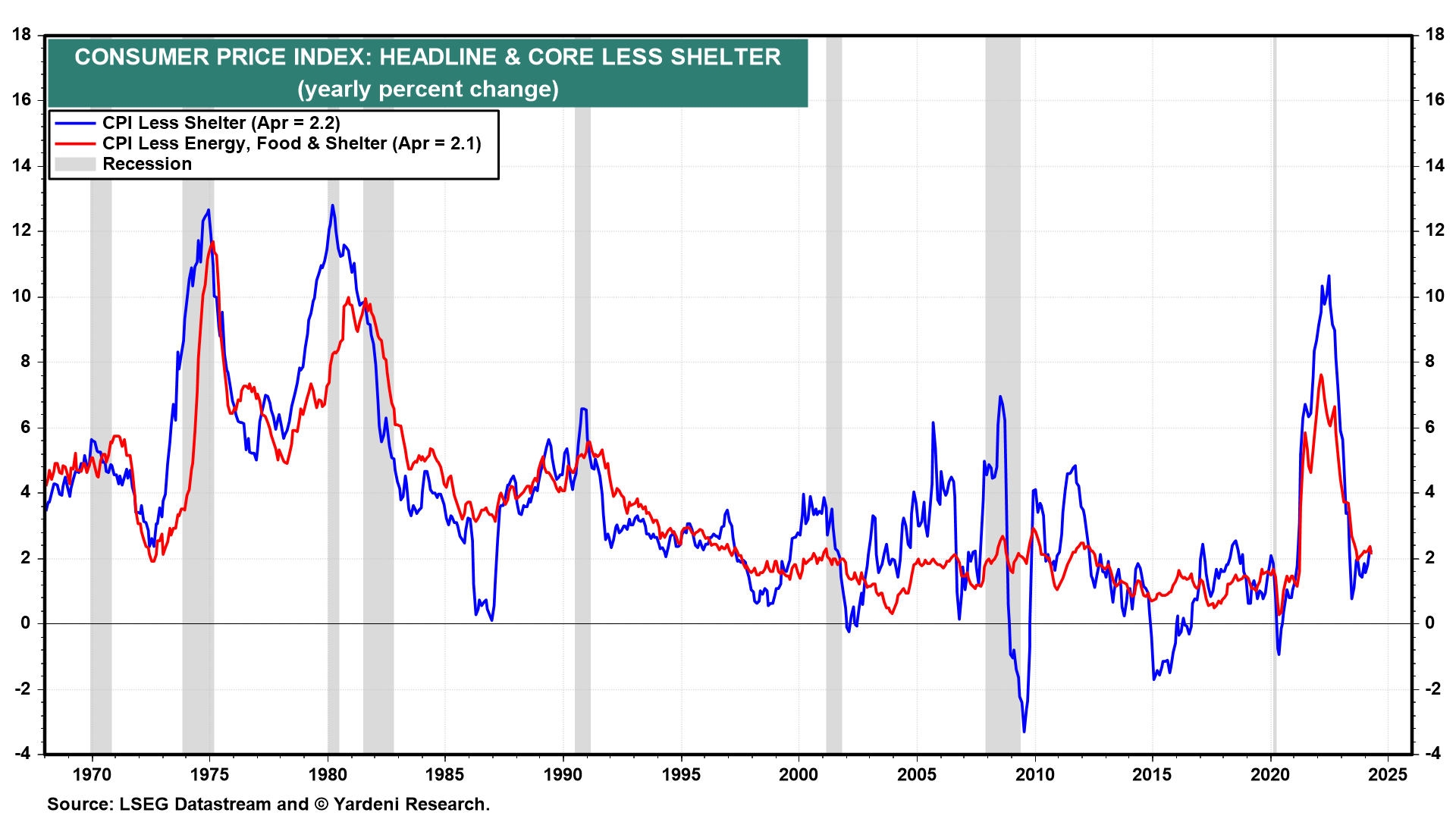

(1) The headline and core CPI excluding shelter were up 2.2% and 2.1% y/y last month (chart). This suggests that the PCED inflation rate is on track to fall to the Fed's 2.0% target by the end of this year, as long as rent inflation continues to moderate.

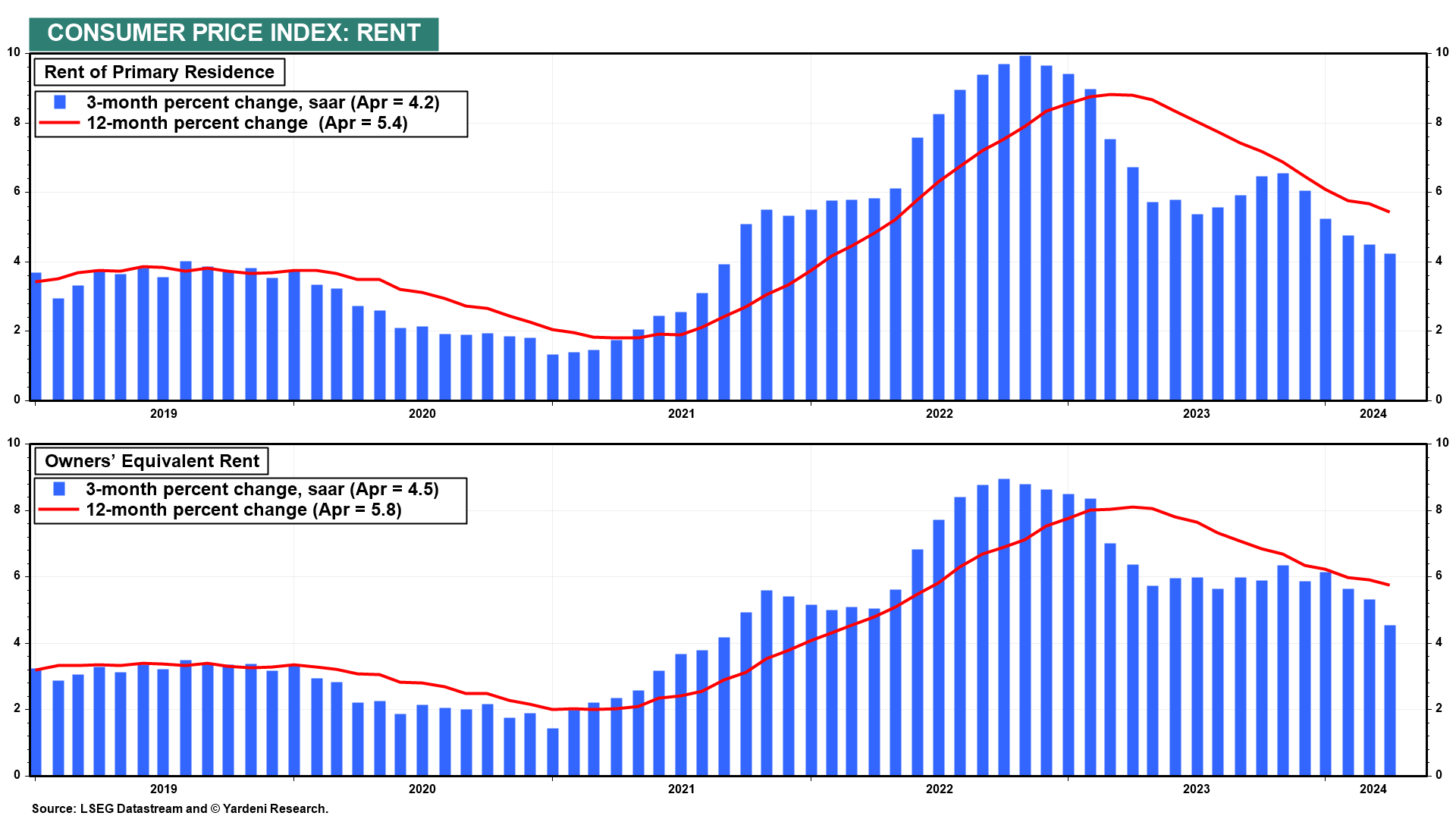

(2) Both rent of primary residence and owner’s equivalent rent continued to disinflate in April (chart).