Inflation has soared around the world over the past year. At first, last spring, it was attributed to “transitory” supply-chain problems that have turned out not to be transitory but persistent. Then all last year, excessively stimulative US fiscal policy fueled a demand boom that worsened the global supply shock caused by the pandemic. Early this year, Russia’s invasion of Ukraine exacerbated energy and food inflation around the world.

Until recently, the major central banks responded to the pandemic with ultra-easy monetary policy, which poured gasoline on the various inflationary flare-ups. In other words, inflation hasn’t been solely a monetary phenomenon.

With this context in mind, let’s briefly review the latest inflation data for the Eurozone and the US:

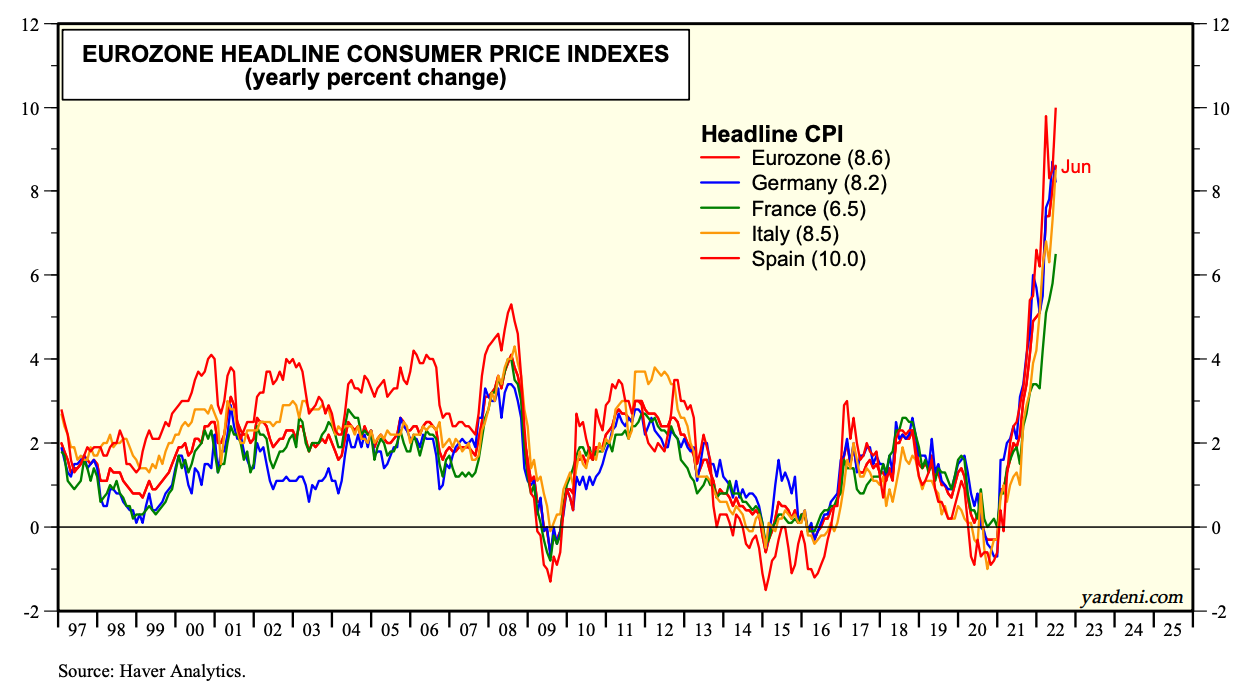

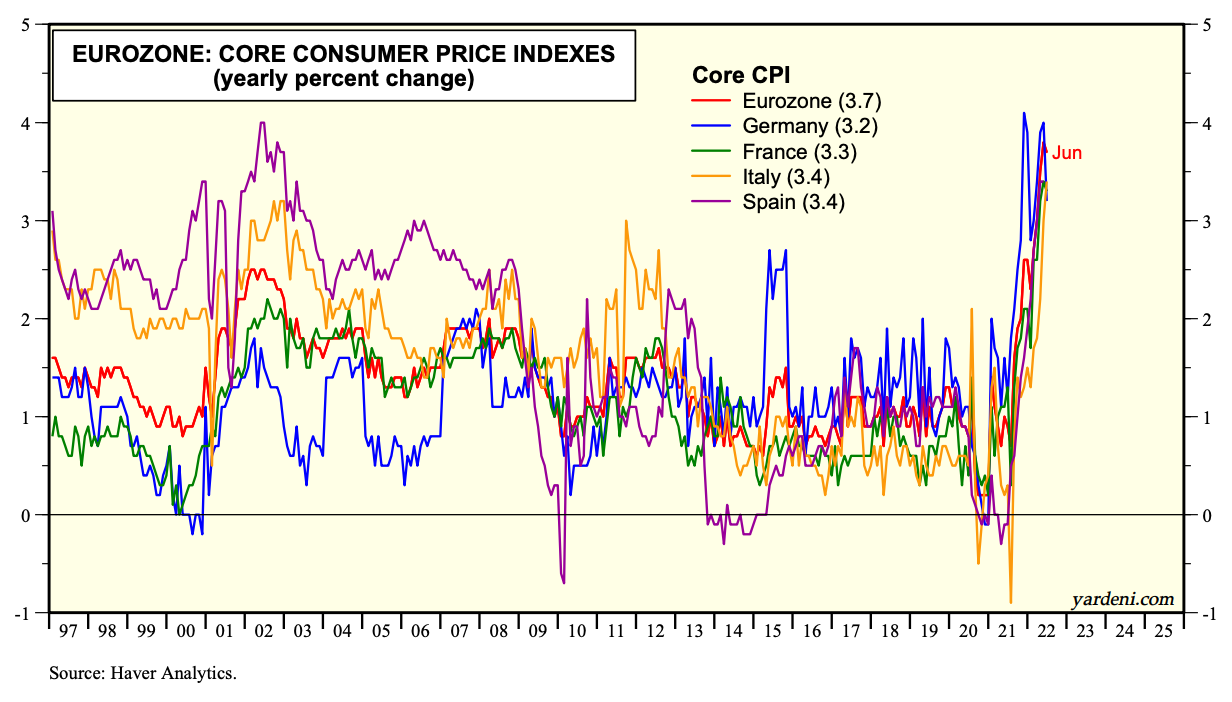

(1) In the Eurozone, the inflation problem over the past year is more than half attributable to soaring energy and food prices, which were boosted by the consequences of Russia’s invasion. The charts below show that the Eurozone’s headline CPI inflation rate for June was 8.6% y/y, but its core CPI rate for June was only 3.7% y/y.

(2) In the US, June’s headline CPI was also 8.6% y/y, but the core rate was 6.0%. Fiscal stimulus significantly boosted consumer durable goods inflation. Easy money fueled a housing boom that is boosting rent inflation because home buying has become a less affordable option as both home prices and mortgage rates have soared. (Got that? Higher mortgage rates may be inflating rents in the CPI!)

(3) There isn’t much that central banks can do about high energy prices, food prices, and rents other than depressing demand with tight monetary policies. They are moving to do so, and that’s pushing their economies closer to recessions. Meanwhile, a few signs suggest that high prices also are depressing demand for—as well as boosting supplies of—some key items in CPIs around the world.