July's survey of consumer expectations (SCE), conducted by the Federal Reserve Bank of NY, had some good news for Fed Chair Jerome Powell and the financial markets too:

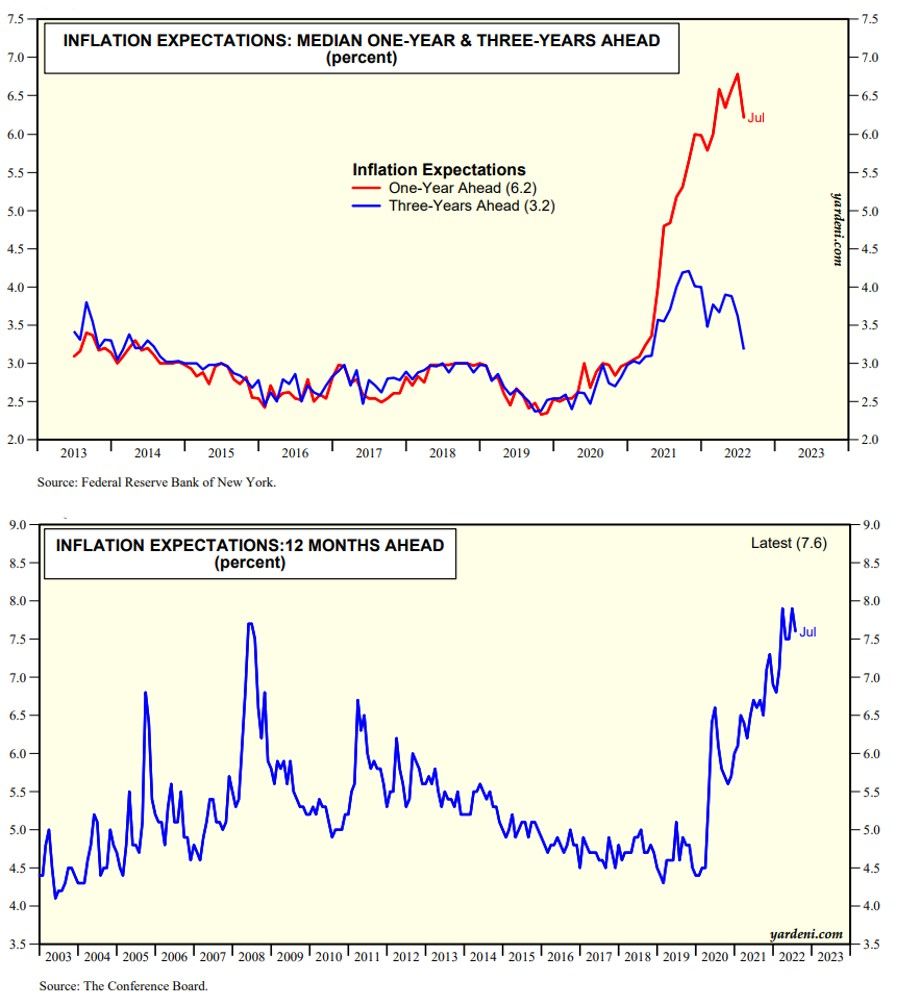

(1) Median one- and three-year-ahead inflation expectations both declined sharply in July, from 6.8% and 3.6% in June to 6.2% and 3.2%, respectively. The press release noted: "Both decreases were broad-based across income groups, but largest among respondents with annual household incomes under $50,000 and respondents with no more than a high school education."

(2) In addition, median five-year ahead inflation expectations, which have been elicited in the monthly SCE core survey on an ad-hoc basis since the beginning of this year, also declined to 2.3% from 2.8% in June. Especially encouraging is that expectations about year-ahead price increases for gas and food fell sharply.

(3) While the FRB-NY data suggest that inflationary expectations might have peaked, the Conference Board's consumer survey shows that 12-months ahead inflation expectations remained elevated at 7.6% during July.