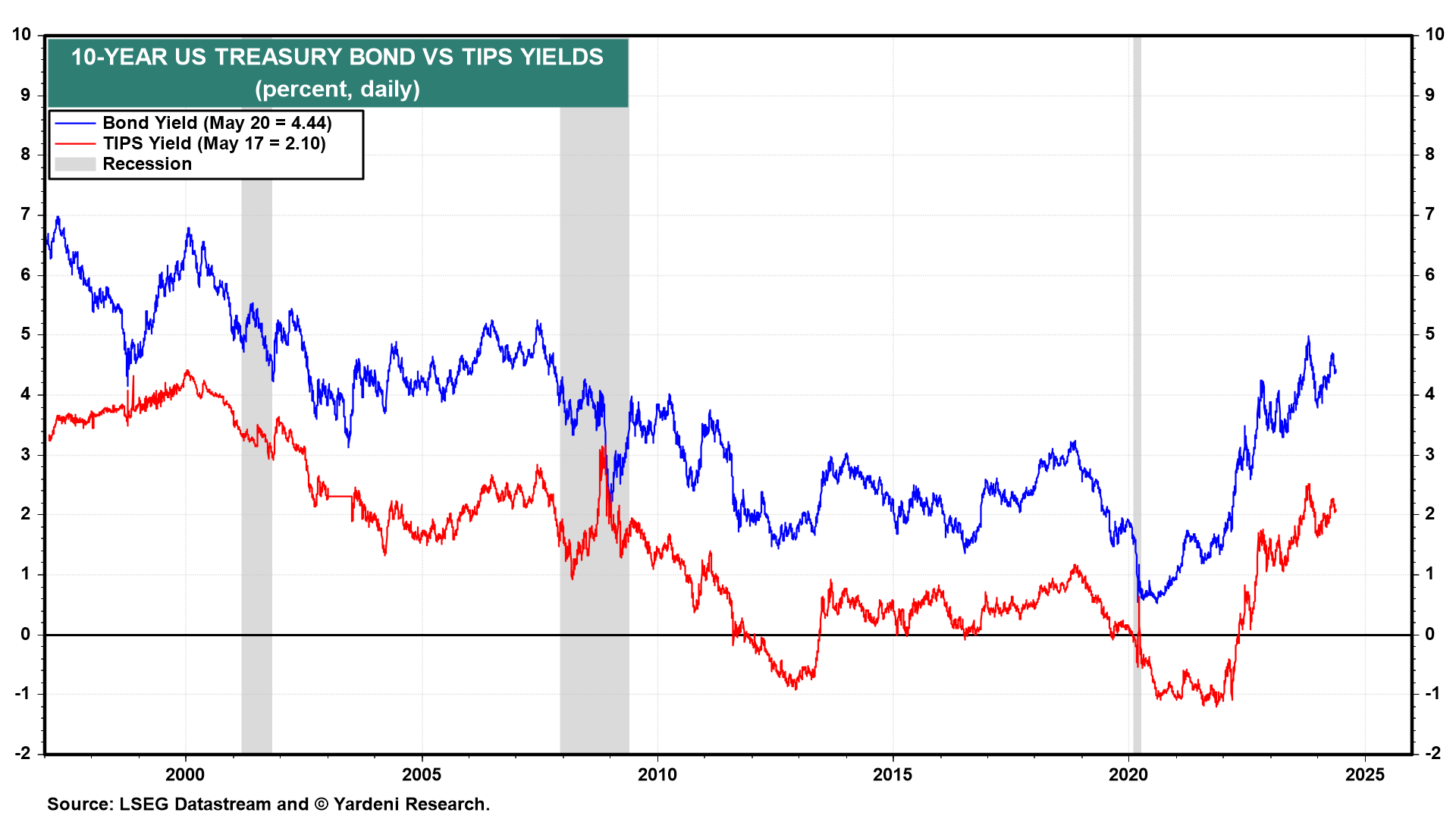

We expect that the 10-year US Treasury bond yield will remain rangebound between 4.00% and 5.00% for the foreseeable future. We expect to see it more often below 4.50% (the mid-point of the range) than above it. This is consistent with our view that interest rates have normalized: They are back to where they were prior to the "Great Abnormal" period from the Great Financial Crisis (GFC) through the Great Virus Crisis (chart).

The 10-year nominal bond yield is equal to the 10-year TIPS yield plus the spread between the two yields, which is a widely used market-based proxy for expected inflation over the next 10 years. We expect that the TIPS yield will continue to hover around 2.00%-2.50% for a while as it did before the GFC.

We expect that the inflation proxy will continue to hover between 2.00% and 2.50% (chart). We observe that this variable is highly correlated with the price of a barrel of Brent crude oil. Barring a geopolitical crisis causing oil prices to soar, there seems to be ample supply of oil to meet global demand for now.