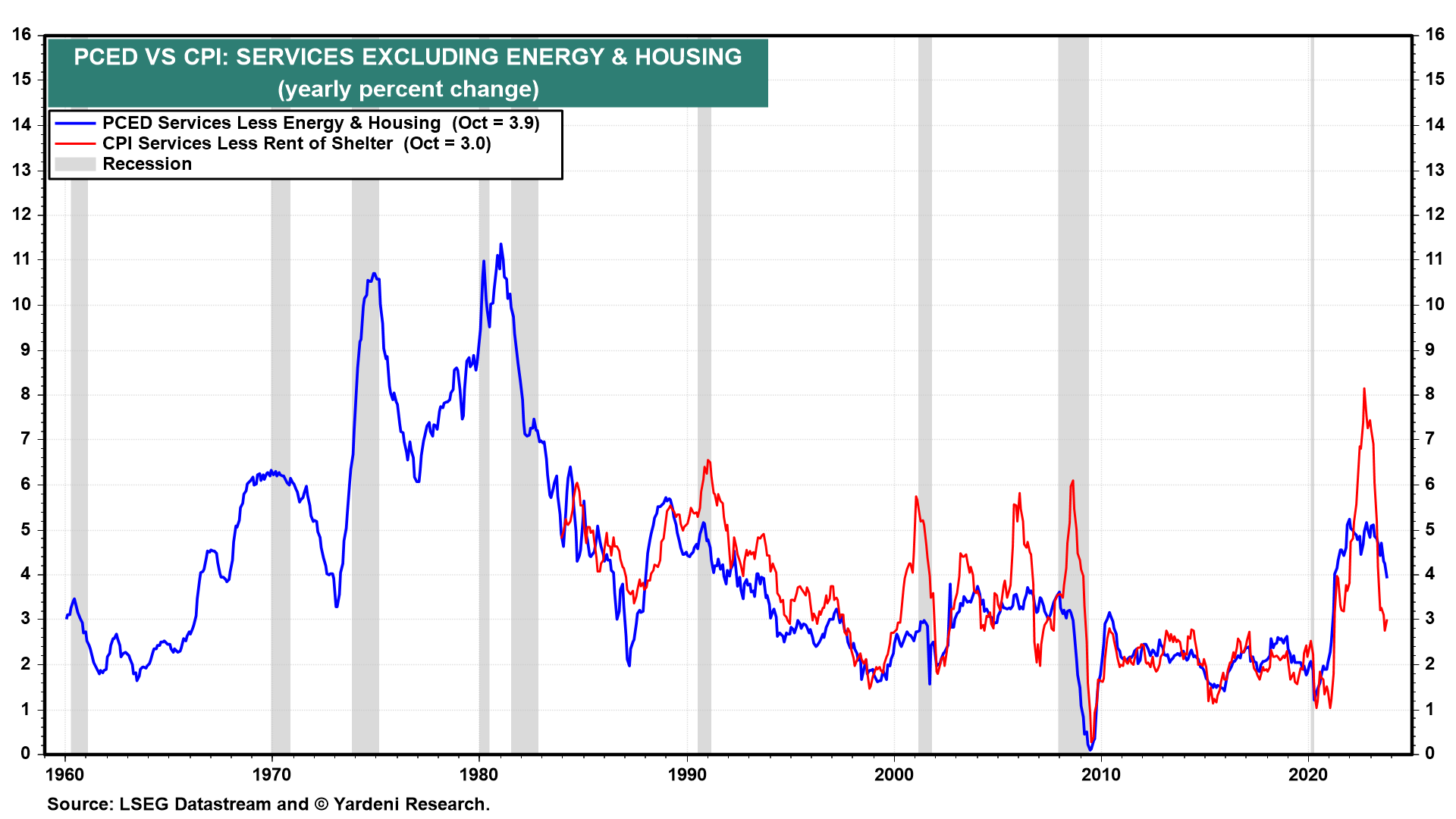

Stocks rallied today as October's PCED inflation rate continued to moderate. Most importantly, the inflation rate of PCED services excluding energy and housing is falling. It has been stuck around 5.0% in 2022 and earlier this year. But it was down to 3.9% y/y in October (chart). Fed Chair Jerome Powell and his colleagues have said that they are concerned about the stickiness of this "super-core" measure of inflation. Now, they should be less concerned as it seems to be coming unstuck.

Also cooling off is the growth rate of consumer spending. The Atlanta Fed's GDPNow tracking model shows that real consumer spending is rising at a 2.7% saar during Q4, that's down from Q3's 3.6% pace. Real GDP is tracking at a 1.8% pace down from 5.2% during Q3.