Did the Fed just guarantee every bank deposit in America? That's really not the Fed's job; it's up to the FDIC to insure deposits up to a maximum of $250,000. By law, the Fed's job is to keep unemployment and inflation down.

In addition to its legal "dual mandate," the Fed is ultimately responsible for maintaining financial stability. Our central bank was established in 1914 to do just that as the so-called "lender of last resort." On Sunday, the Fed effectively agreed to guarantee 100% of deposits for 100% of all depositors. That was in response to the bank run on Silicon Valley Bank last week.

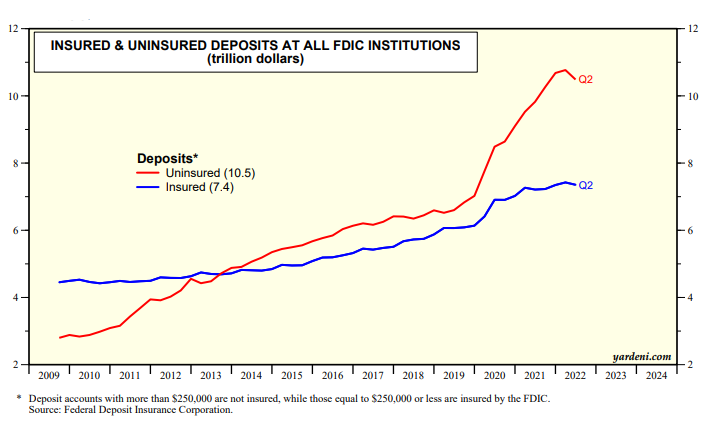

More than 90% of SVB's deposits were not insured by the FDIC. Depositors were spooked when the bank revealed that it had to sell some of its bonds at a loss of $1.8 billion to raise cash. FDIC data show that during Q2-2022, deposits totaled $17.9 billion with $7.4 trillion insured and the remaining $10.5 trillion uninsured (chart).

To reduce the risk of additional bank runs by uninsured depositors (and mitigate the adverse consequences if they do happen), the Fed issued a press release on Sunday titled “Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.”

That certainly sounds like a guarantee to protect all depositors! The Fed announced the creation of a new emergency lending facility called the “Bank Term Funding Program” (BTFP). It will offer “loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

Also: “[d]epository institutions may obtain liquidity against a wide range of collateral through the discount window, which remains open and available. In addition, the discount window will apply the same margins used for the securities eligible for the BTFP, further increasing lendable value at the window.” (Here is a link to the term sheet.)

Our conclusion is that the Fed Put is back. This time, it’s aimed at stabilizing the banking system, which should also stabilize the financial markets. Under the circumstances, the Fed may pass on a rate hike at the FOMC meeting next week. Or if it goes with a 25bps rate hike to 4.75%-5.00%, it might use the SVB debacle as proof that the federal funds rate then would be restrictive enough and opt to hold it there for a while.