This morning's July PPI was cooler than expected, rising just 0.1% m/m and 2.2% y/y. The markets responded by betting on a swifter Fed interest rate cutting cycle, sinking the 2-year Treasury yield to 3.956% and the 10-year yield to 3.856%. Stocks rallied in response to the data.

The low inflation print supports our view that the US economy has left inflation in the rearview mirror without any flat tires causing it to swerve into a ditch. Today's July NFIB survey of small business owners confirmed the economy's disinflationary trend and showed a sharp rebound in their optimism. This all confirms our Immaculate Disinflation scenario (i.e., moderating inflation without a recession). Here's more:

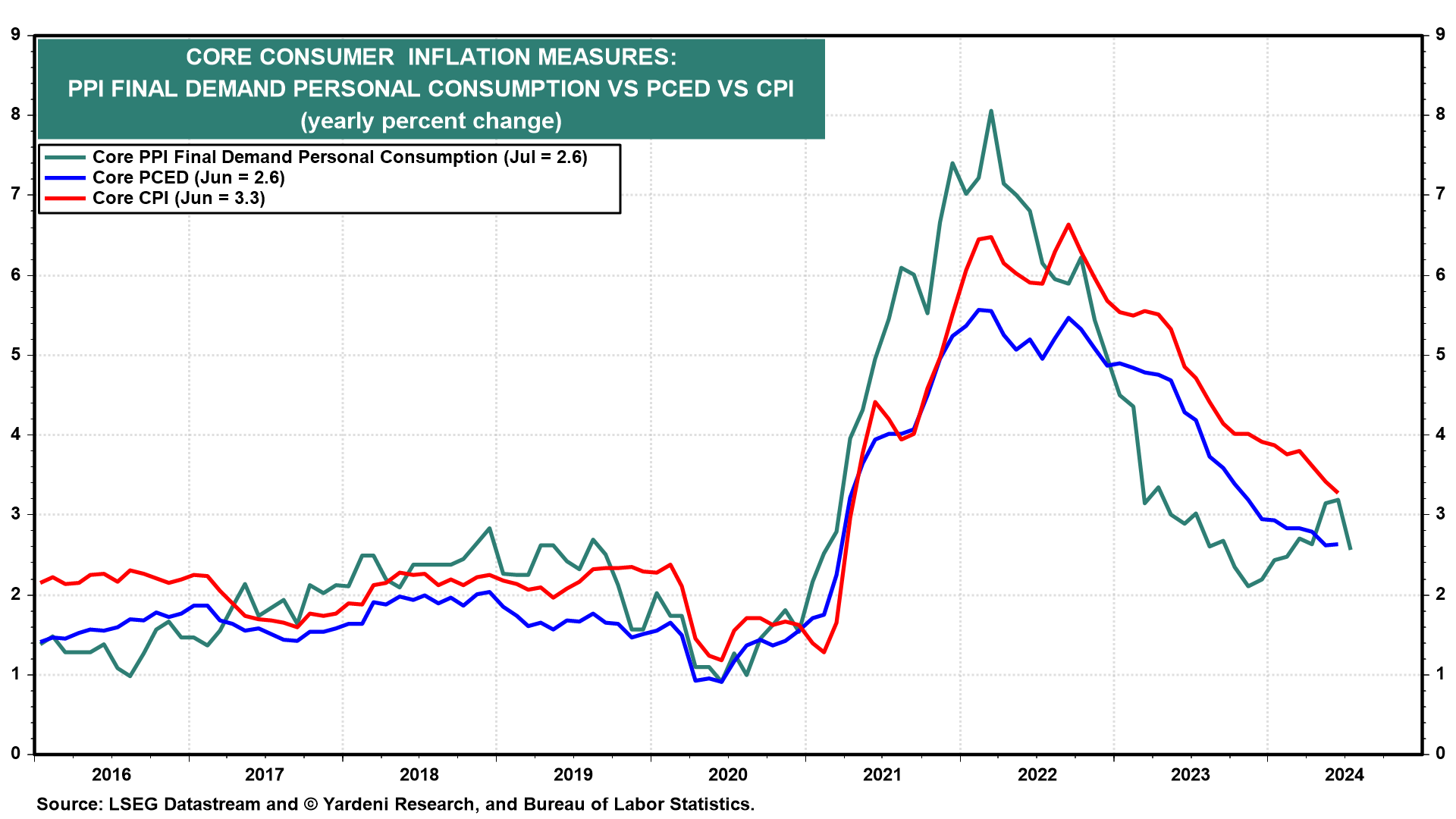

(1) PPI Inflation. The core PPI final demand for personal consumption rose 2.6% y/y during July (chart). It suggests that the core CPI probably fell below June's 3.3% reading last month.