Fed officials have been saying that they are aiming to raise the federal funds rate from an accommodative level to a restrictive one to bring inflation down. In their latest Summary of Economic Projections (SEP) released by the FOMC on June 15, they indicated that they believe that the neutral federal funds rate is 2.50%, which is the upper end of the current target range. Odds are that it will be raised by 75bps to 3.25% tomorrow.

Presumably, at the neutral federal funds rate, monetary policy is neither accommodative nor restrictive. Tell that to the folks in the housing industry, where the mortgage rate has more than doubled since the start of this year to 6.39%, causing new and existing home sales to tumble.

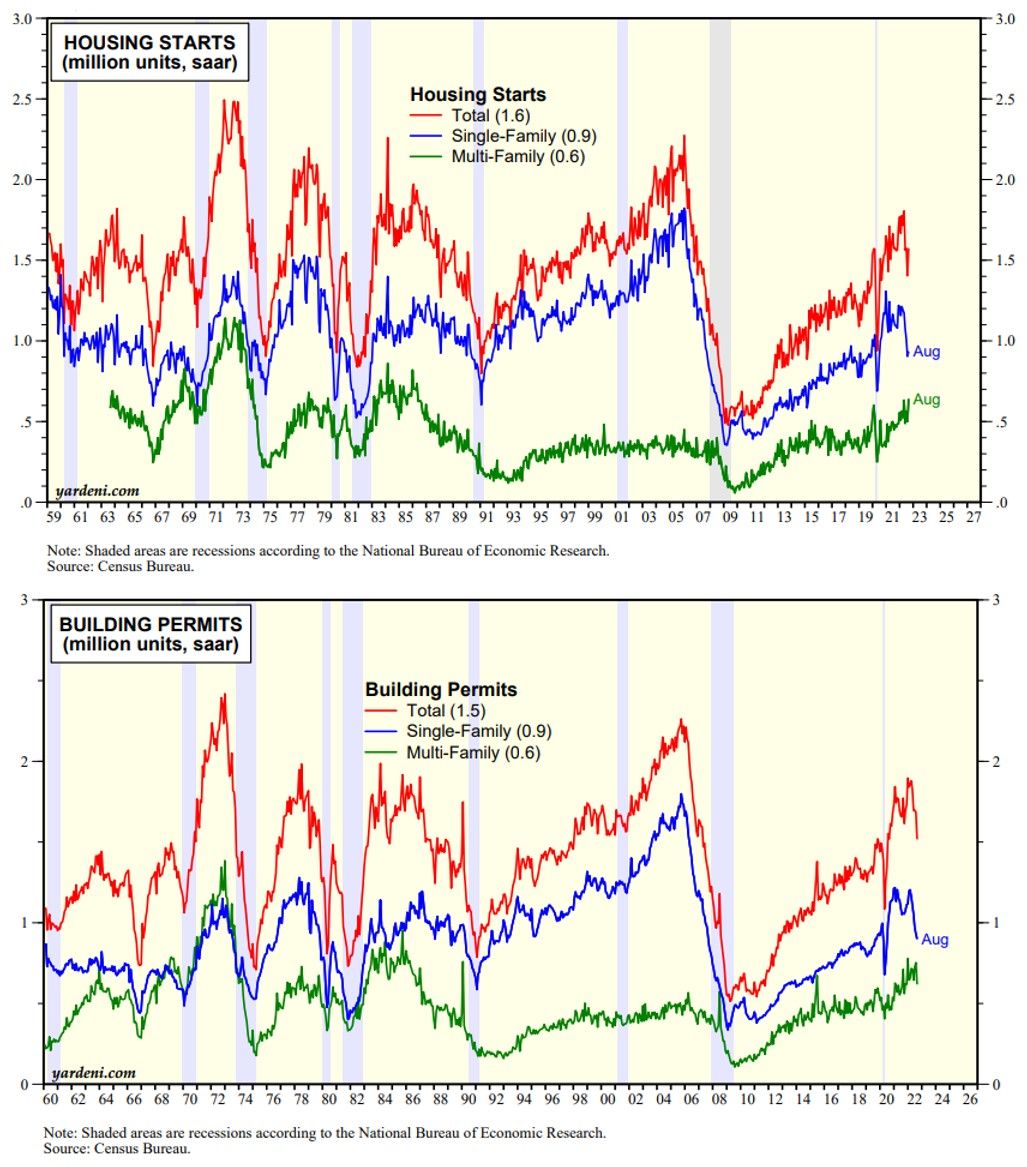

The single-family housing market is in a recession, which has caused a "growth recession" for the overall economy, with real GDP growing at rates close to zero since the start of 2022. Housing starts did rise in August, but that was attributable to multi-family starts. Single-family starts remained depressed (chart below).

Building permits for both single-family and multi-family houses fell sharply in August (chart below). Total building permits is one of the 10 components of the Index of Leading Economic Indicators.