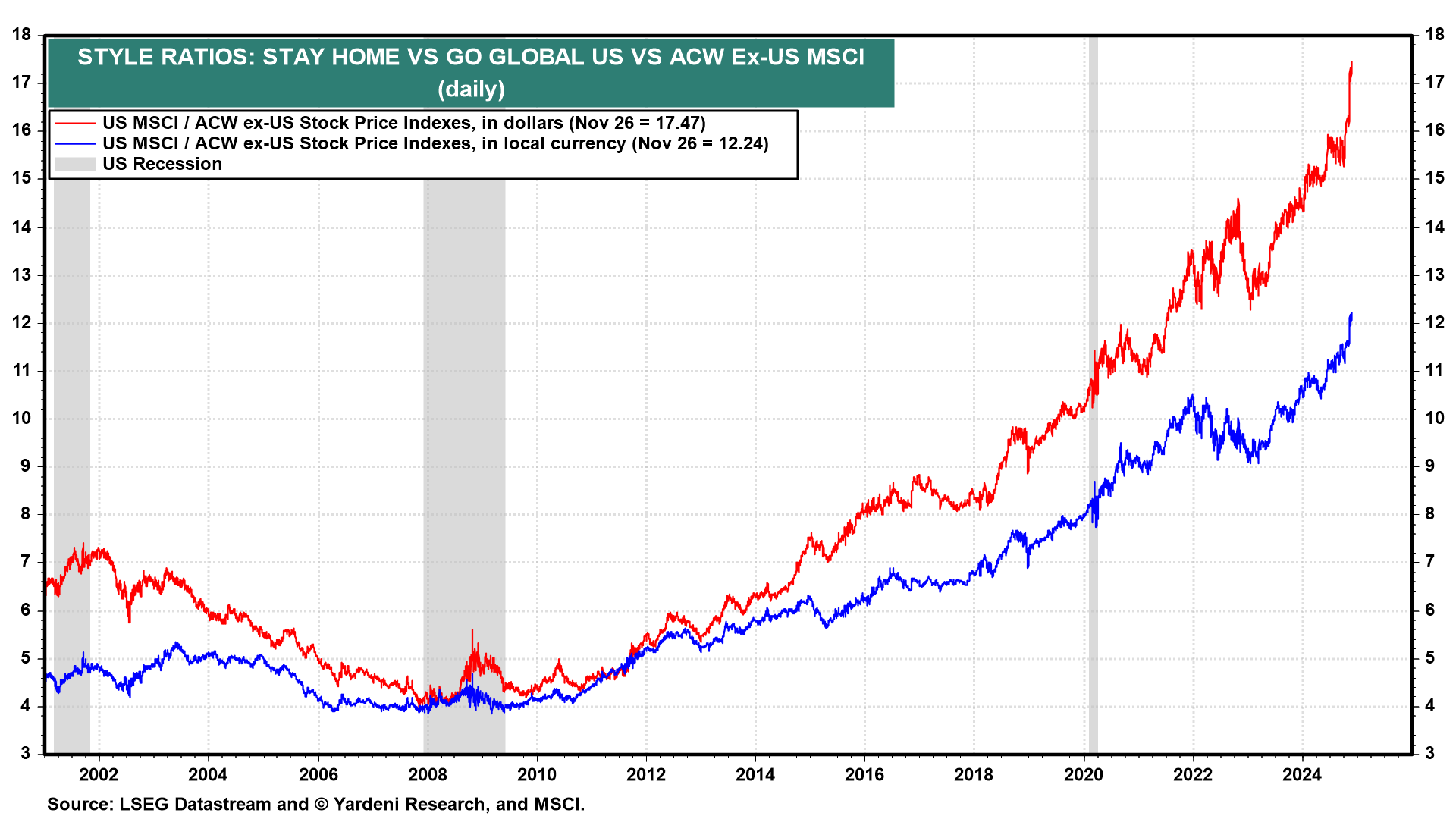

This is the time of the year when we all count our blessings. The Yardeni Research team thanks you for your interest in our research. We wish you a great Thanksgiving tomorrow with your family and friends at your home or theirs. Since 2010, we've been recommending a Stay Home investment strategy, i.e., overweighting the US in global equity portfolios, rather than a Go Global strategy. So far, so good (chart).

Nothing in today's data deluge changes our positive outlook for the US economy and stock market. Q3's real GDP was unrevised at 2.8% (saar). Q4's real GDP is tracking at 2.7%, according to GDPNow. Real incomes are rising to record highs and the labor market is in good shape. Inflation has moderated significantly, but may be stuck above the Fed's 2.0% target. Let's dig in:

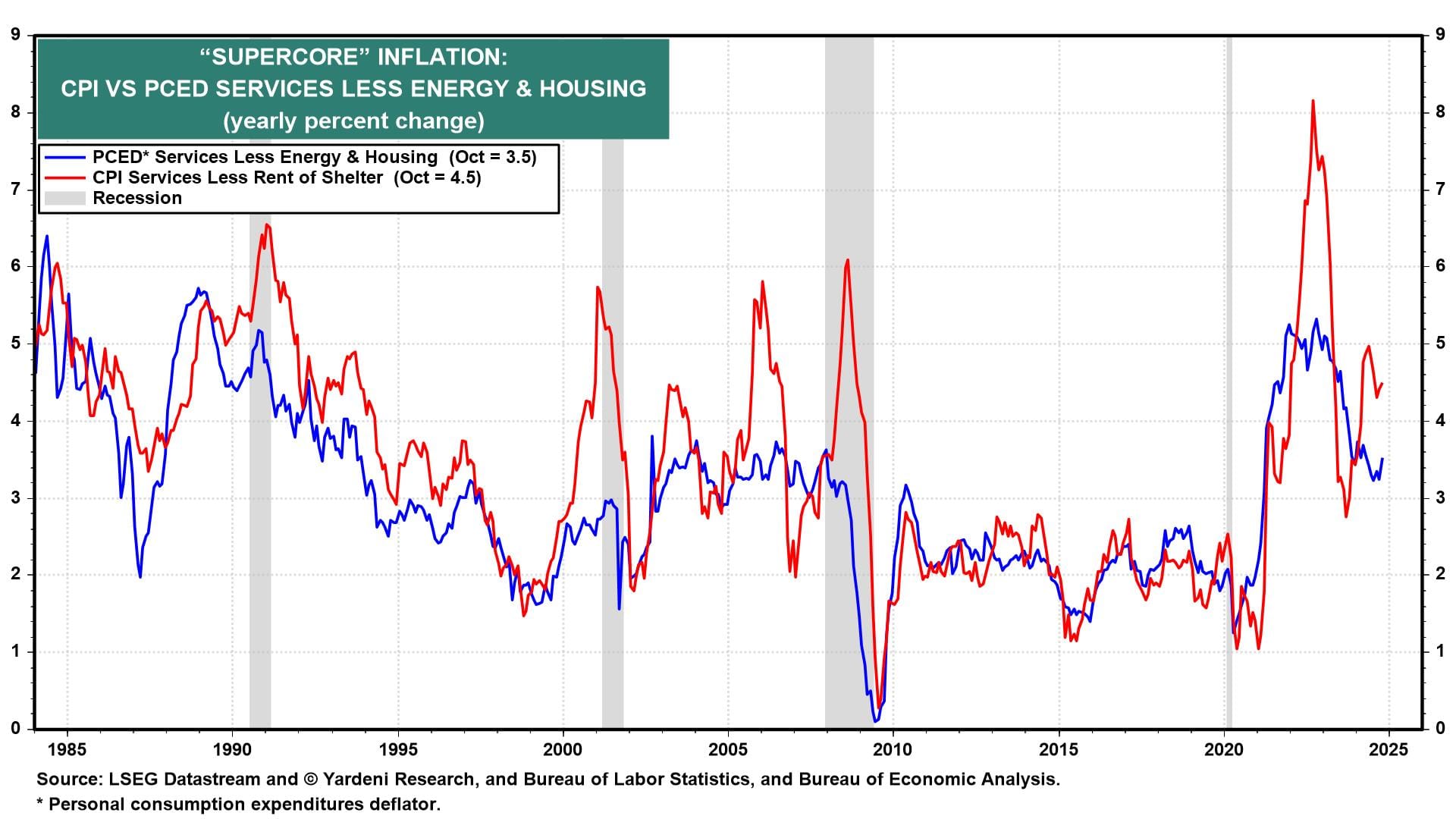

(1) PCED inflation. The Fed's preferred inflation gauge, core PCED, rose 0.3% m/m and 2.8% y/y in October. That was the same increase on a monthly basis and up from 2.7% y/y in September. However, October's supercore (core services excluding housing) PCED inflation rose to 3.5% y/y (chart). Two years ago, Fed Chair Jerome Powell said this was the best gauge of underlying inflation. Today, it's 150bps north of the Fed's 2.0% target for the overall core PCED. We think that Fed officials will pause their rate cutting. If not, they risk overheating the economy and fueling a stock market meltup.

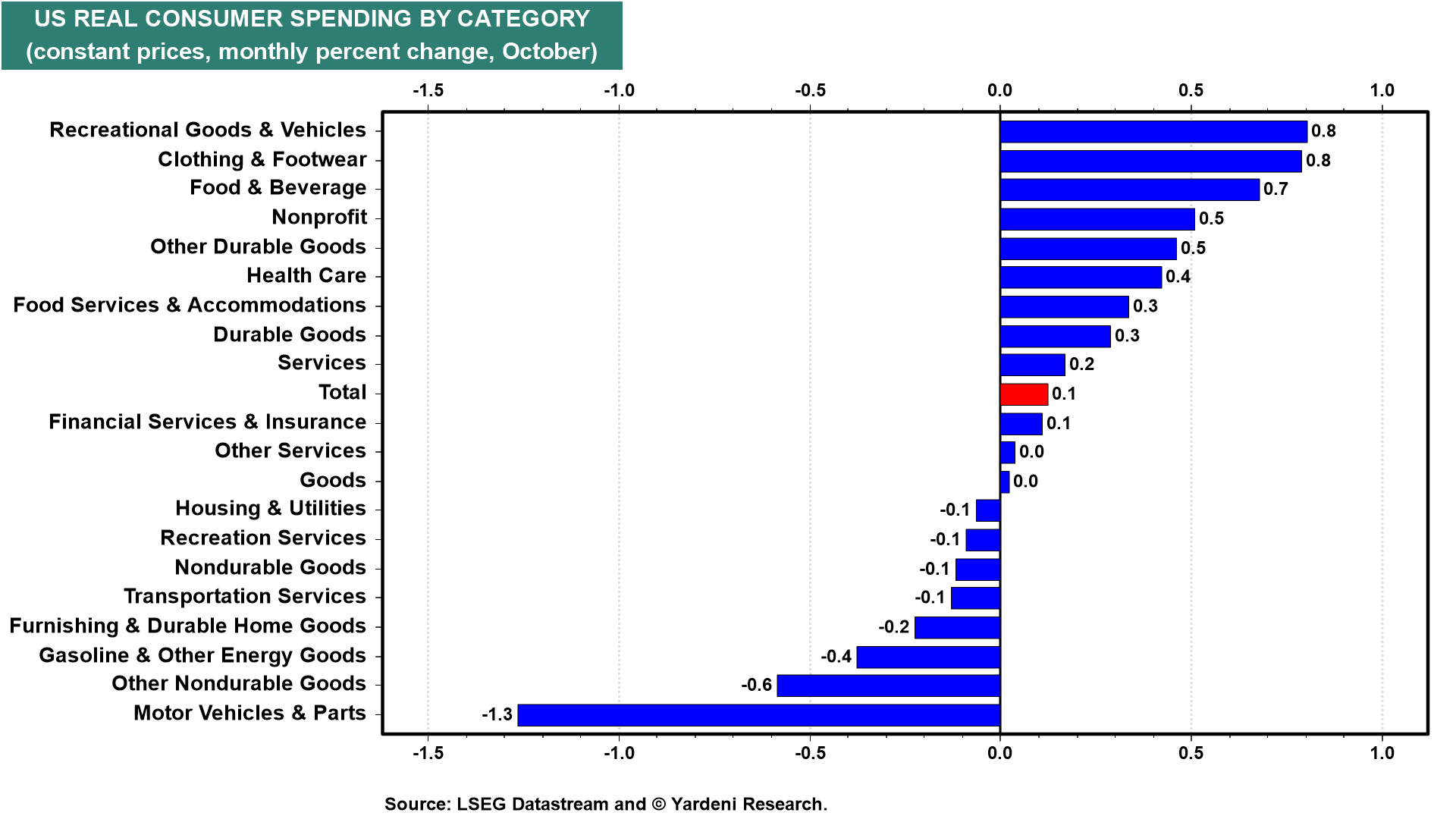

(2) Personal income & outlays. Real disposable personal income rose 0.4% m/m during October. The 0.1% increase in real personal consumption expenditures in October reflected an increase of less than 0.1% in spending on goods and an increase of 0.2% in spending on services (chart). That was enough to boost GDPNow's Q4 estimate for real consumption from 2.8% to 3.0%.

Within goods, the largest contributor to the increase was recreational goods and vehicles. Within services, the largest contributor to the increase was health care (both hospitals and outpatient services), followed by food services and accommodation. This pattern is consistent with our view that retired Baby Boomers are spending more on restaurants, travel, and health care.

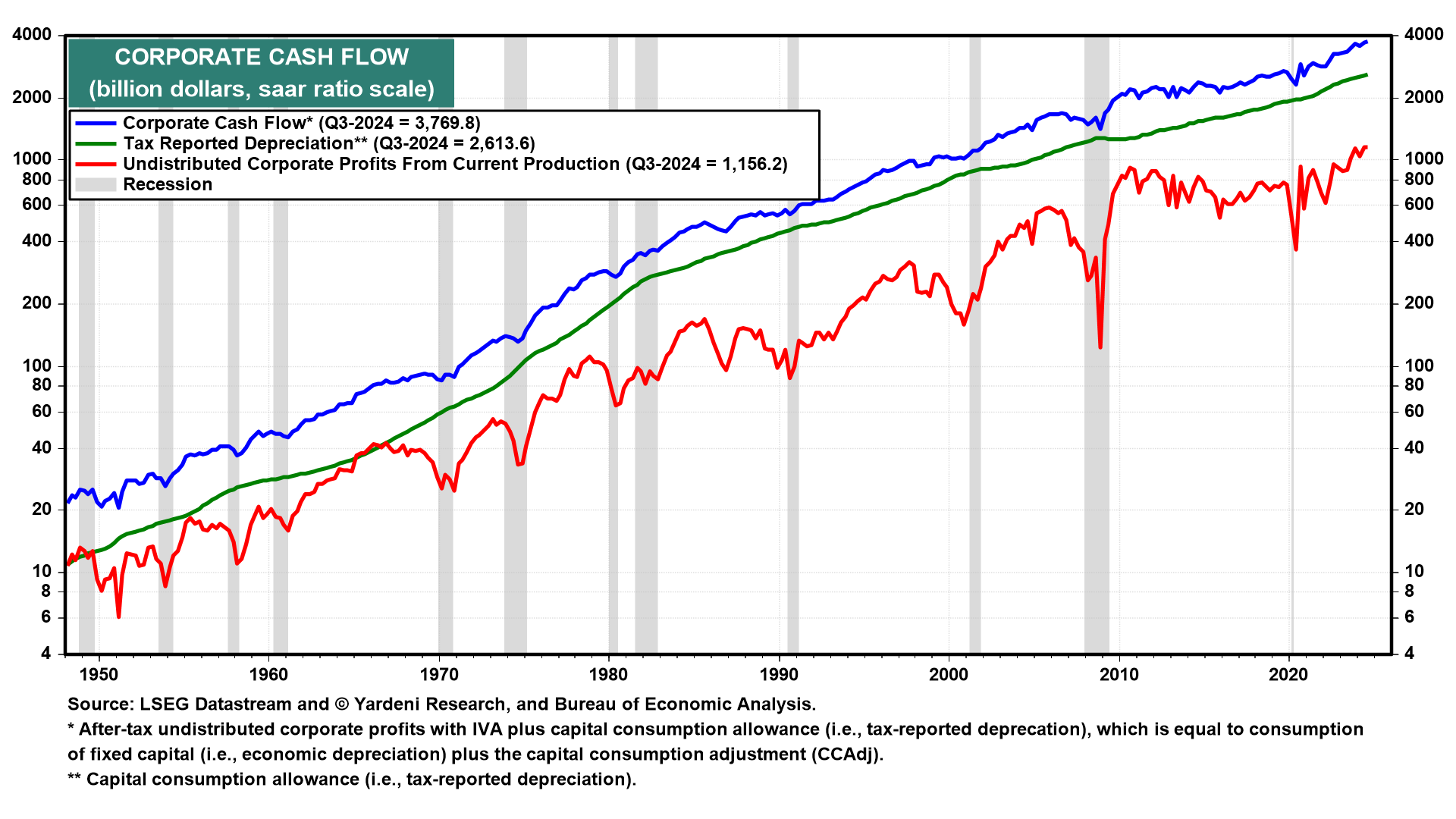

(3) Corporate profits. Q3's corporate profits from current production remained close to its Q3 record high. Corporate cash flow rose to a record $3.8 trillion last quarter (chart). Corporations have plenty of cash to finance record capital spending, especially on technology.

(4) Unemployment claims. Initial jobless claims were flat at 213,000 in the week ended November 23. Continuing claims fell by 1,000. There's still no sign of layoffs as the labor market remains in good shape.