Disappointing forward guidance from Walmart weighed on the stock market today. The company's shares fell 6.5% today despite a very strong Q4, mostly because the company's 2025 earnings expectations fell short of analysts' estimates.

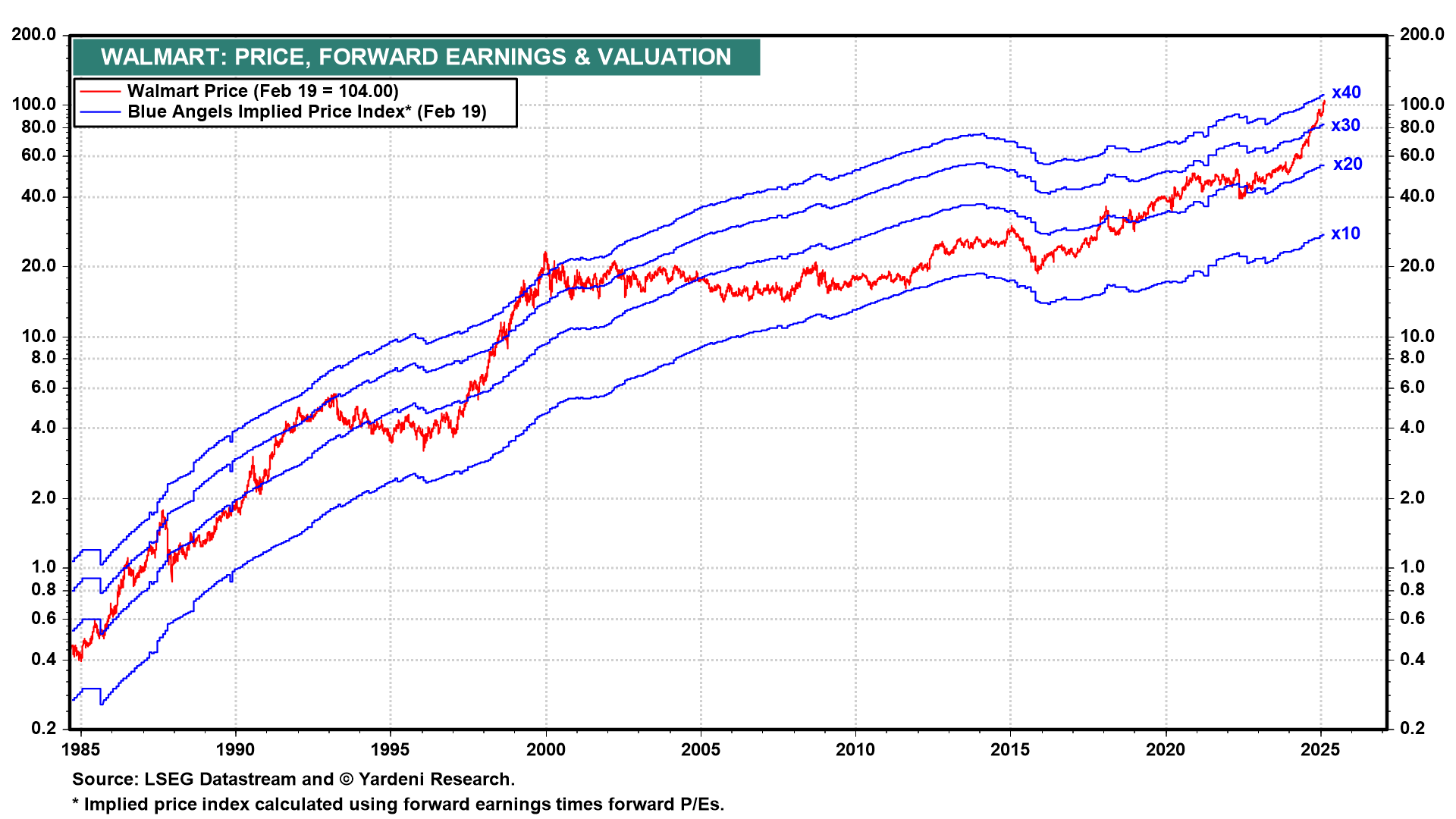

Part of the worry came from comments on the possible negative impact of tariffs. Management’s guidance also reflected negative currency impacts and a hit from acquisitions. On balance, the results and comments weren't too troublesome, in our opinion. What may have been a bigger issue is that Walmart stock was trading at roughly 38 times forward earnings, so any chance that earnings growth could slow sparked a downward rerating of the valuation multiple (chart).

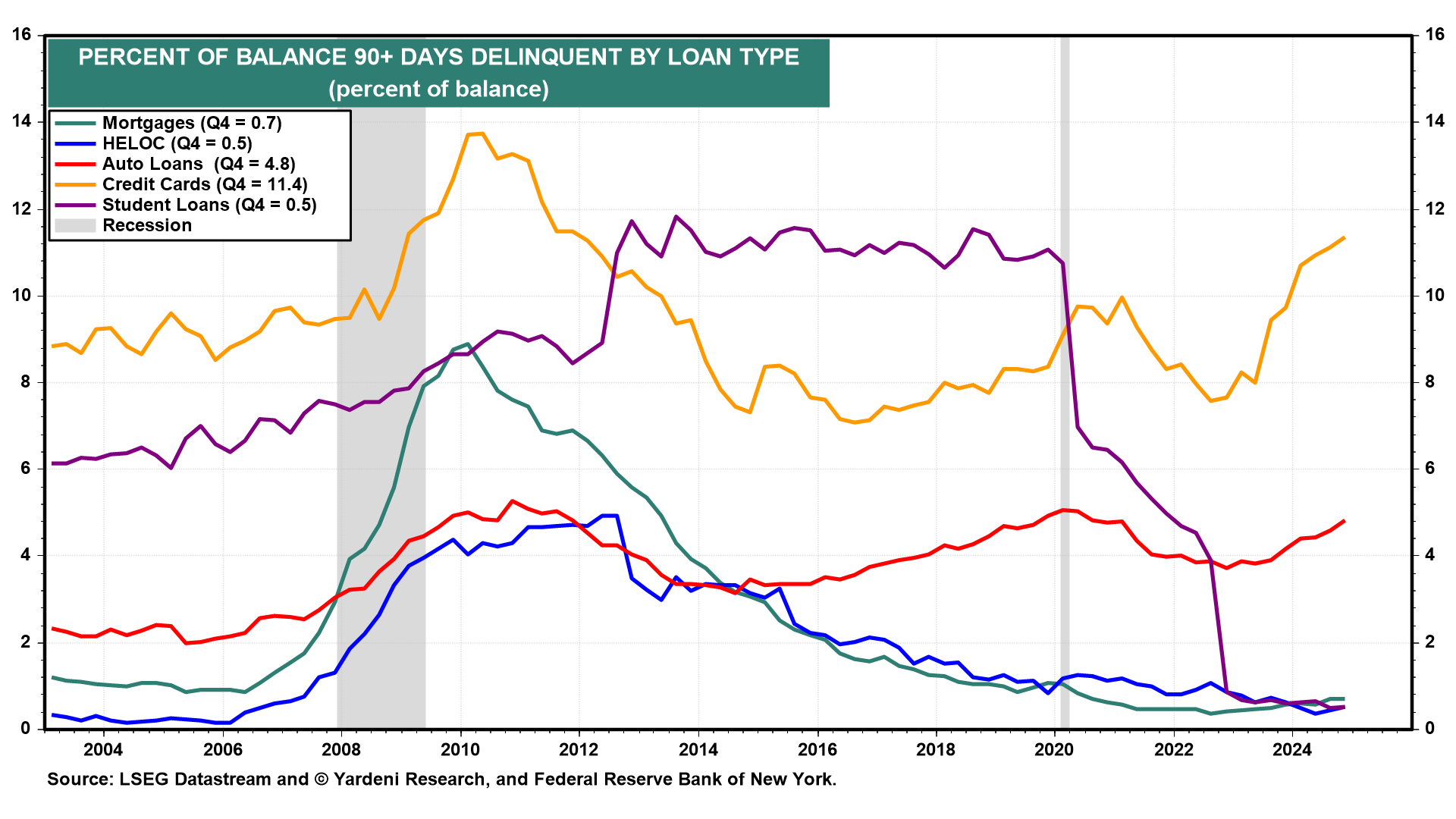

Nevertheless, stocks prices of Financials such as JPMorgan and Goldman Sachs fell around 4% today on worries about the consumer. Alarmists have been warning about rising consumer-credit delinquencies (chart). For now, we aren't alarmed.

The economic data released today corroborated our overall optimistic outlook and should benefit retailers like Walmart over the rest of the year. Here's more: