We've been in the higher-for-longer camp regarding the outlook for the federal funds rate (FFR) since the end of last year. That outlook was confirmed by the release of January's FOMC minutes yesterday and today's speech by Fed Vice Chair Philip Jefferson. The Fed wants to see more progress bringing inflation down and is in no rush to ease given the strength of the economy. Stocks soared despite this bearish news because Nvidia's earnings report was awesome. In addition, initial unemployment claims remained near 200,000, confirming that the labor market is still strong. So it was a great day for our Roaring 2020s scenario. Consider the following:

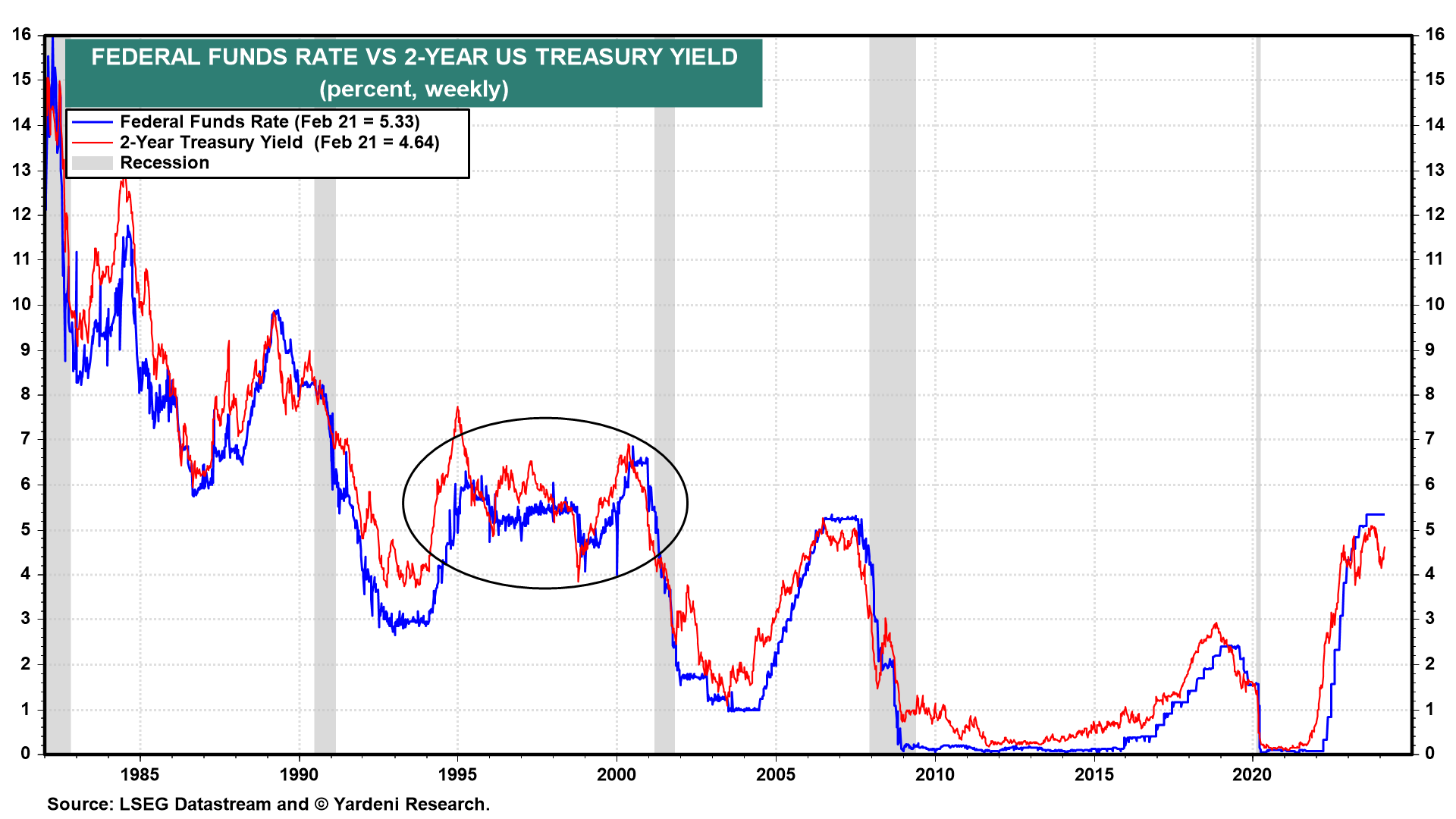

(1) The two-year Treasury yield tends to reflect the market's expectations for the federal funds rate in a year from now (chart). It fell to 4.14% in mid-January, implying five 25bps cuts in the FFR. Today it was back up to 4.72%, implying three such rate cuts. We are considering the possibility that the second half of the 1990s might be the most likely scenario for the FFR over the rest of the current decade. Back then, stock prices soared. The positive wealth effect boosted economic growth. Inflation was subdued by rapid productivity growth, implying that the 5%-6% FFR was in line with the so-called "neutral" FFR.