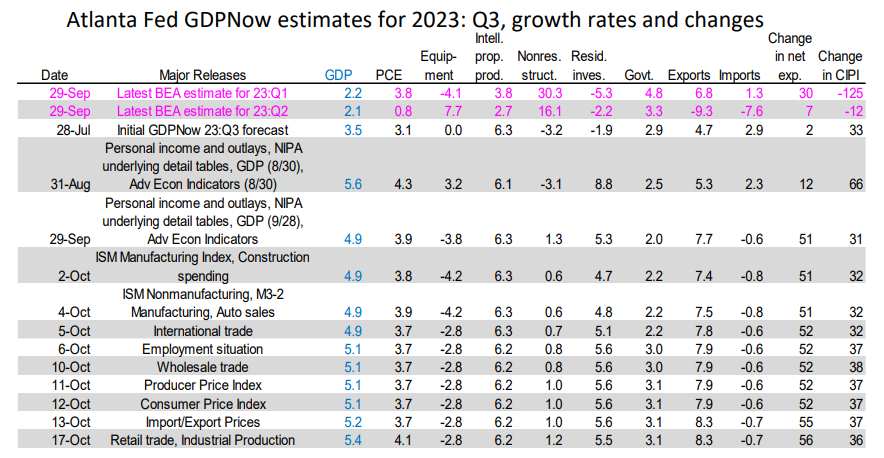

Today's September reports for retail sales and industrial production were better than expected. The Atlanta Fed's GDPNow tracking model shows real GDP grew 5.4% (saar) during Q3, up from 5.1% on October 10. Leading the estimate higher is real consumer spending with a 4.1% increase (table).

That's good news for the stock market. It confirms our forecast that S&P 500 earnings per share probably rose to a record high during Q3. The economy has been resilient because consumers have continued to spend despite fears that they were running out of excess saving accumulated during the pandemic. However, they haven't run out of job openings.

Meanwhile, inflation has continued to moderate despite the strength of the economy. That should be good news too. However, bond yields rose today since most investors and investment strategists are skeptical that inflation can continue to decline without a significant economic slowdown. Even better would be a recession, in their opinion. In our opinion, inflation can continue to moderate in a growing economy, especially if productivity growth makes a comeback, as we expect.