Every now and then, the economy is widely described as being a "Goldilocks" economy. Like Goldilocks' preferred porridge, it is not too hot and not too cold, but just right and bullish for stocks. We often agreed with that assessment, but we also noted that three bears did show up at the end of this cautionary tale.

Once again, the economy is just right for Professor Goldilocks, the economist with long blond hair. Today's economic indicators were all just right too:

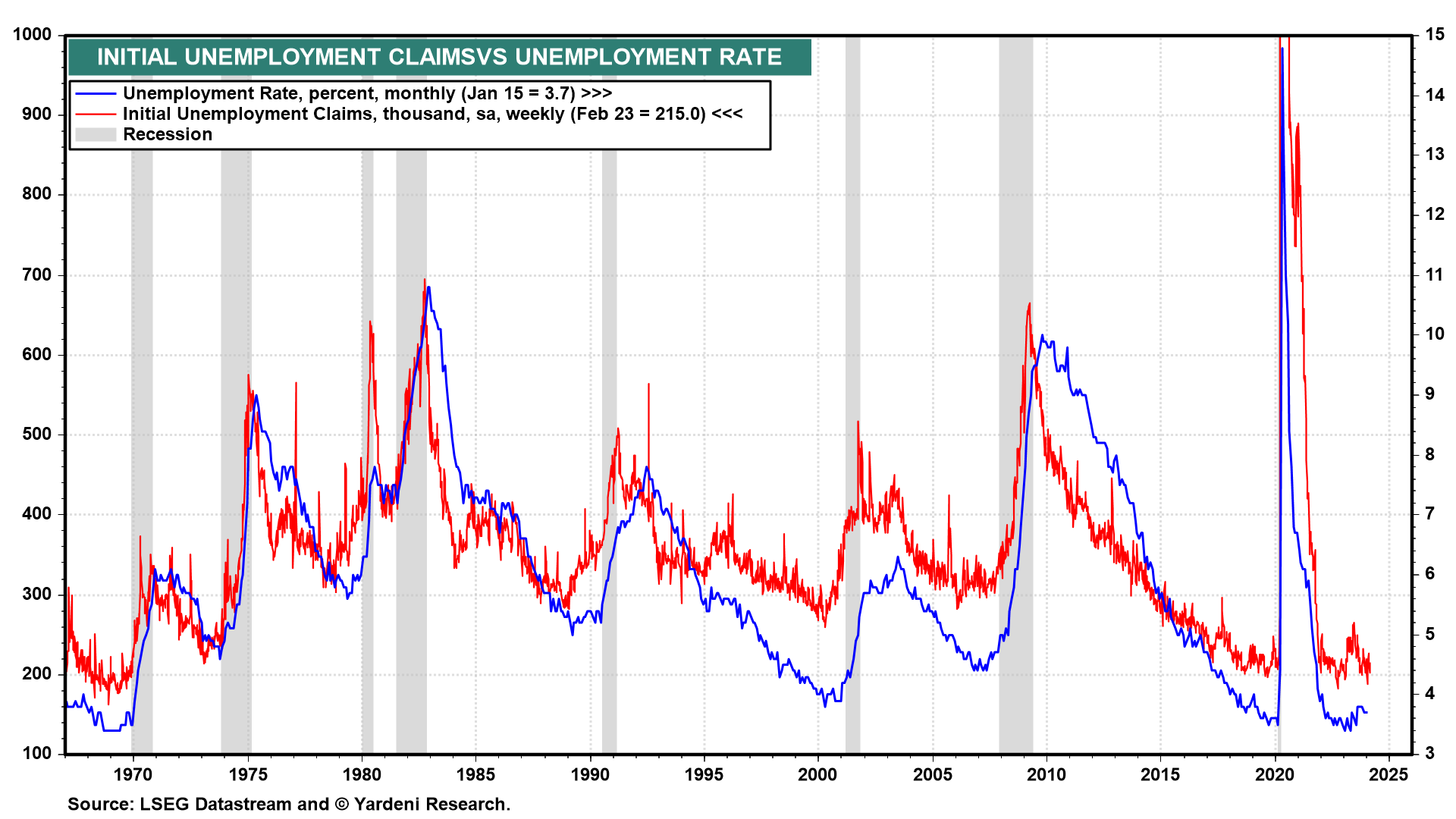

(1) Initial unemployment insurance claims. Jobless claims during the February 23 week were only 215,000. This suggests that February's unemployment rate remained below 4.0% for the 25th month in a row (chart). The labor market remains tight.

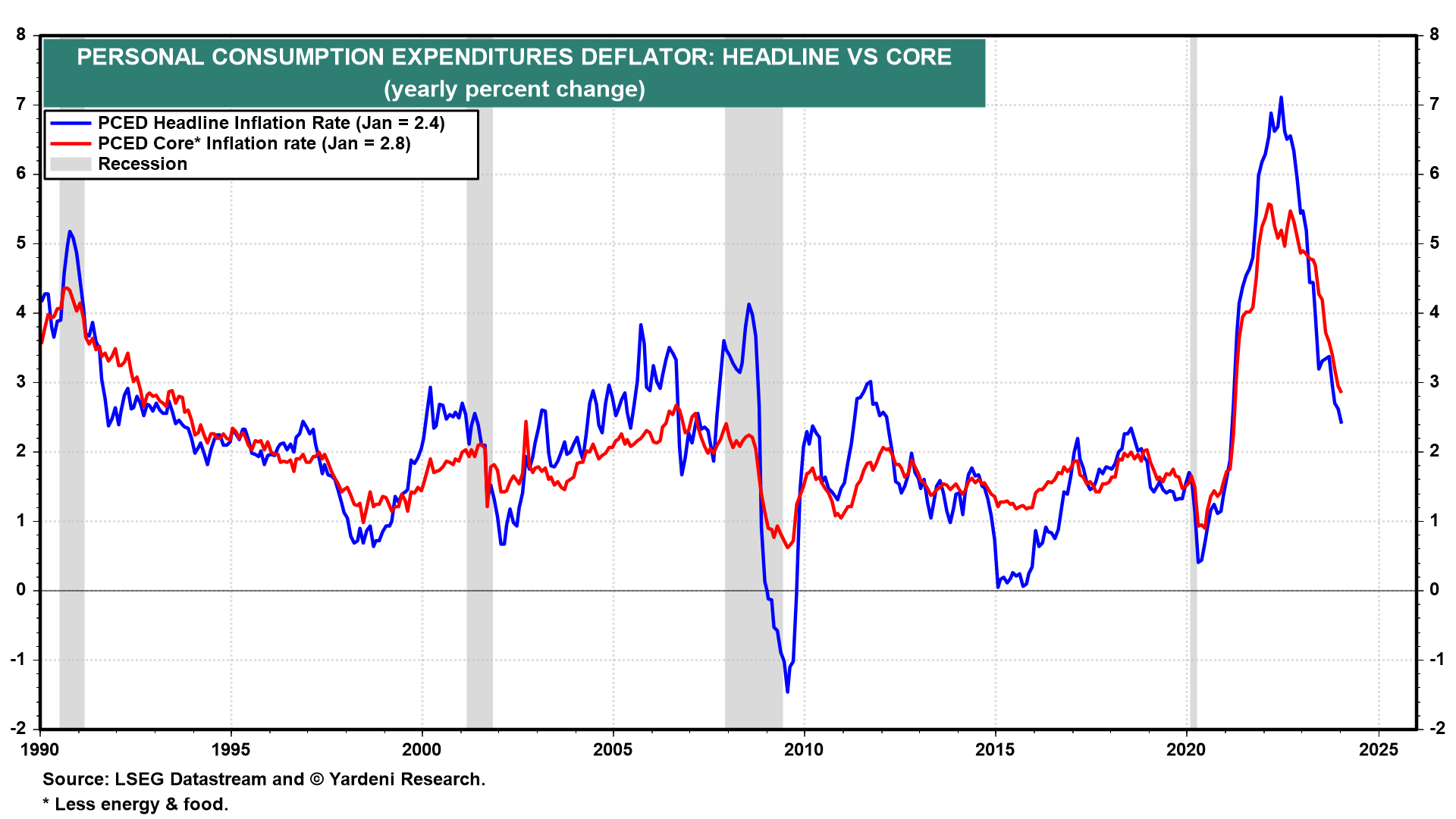

(2) PCED inflation. Inflation continues to cool off according to January's PCED. The headline and core PCED inflation rates fell to 2.4% and 2.8% (chart). They both have "2 handles" for the first time since March 2021.

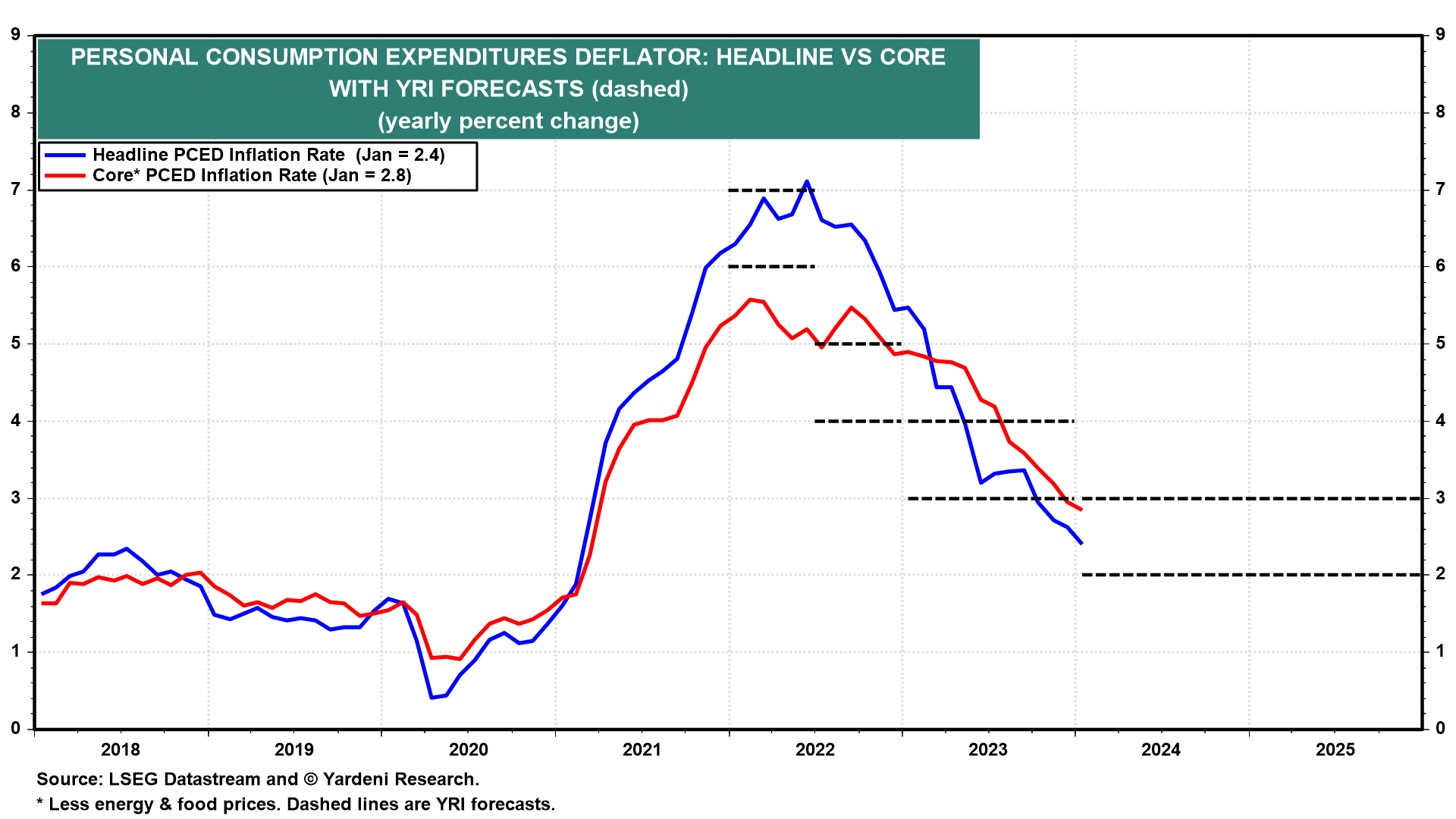

So far so good: The following chart shows our forecasted trajectories for the headline and core PCEDs since mid-2022. Contrary to the widely feared alternative scenario, high inflation has turned out to be transitory, while low unemployment has turned out to be persistent. The Philips Curve tradeoff between the two has been a no-show relationship because productivity is making a comeback in a tight labor market!

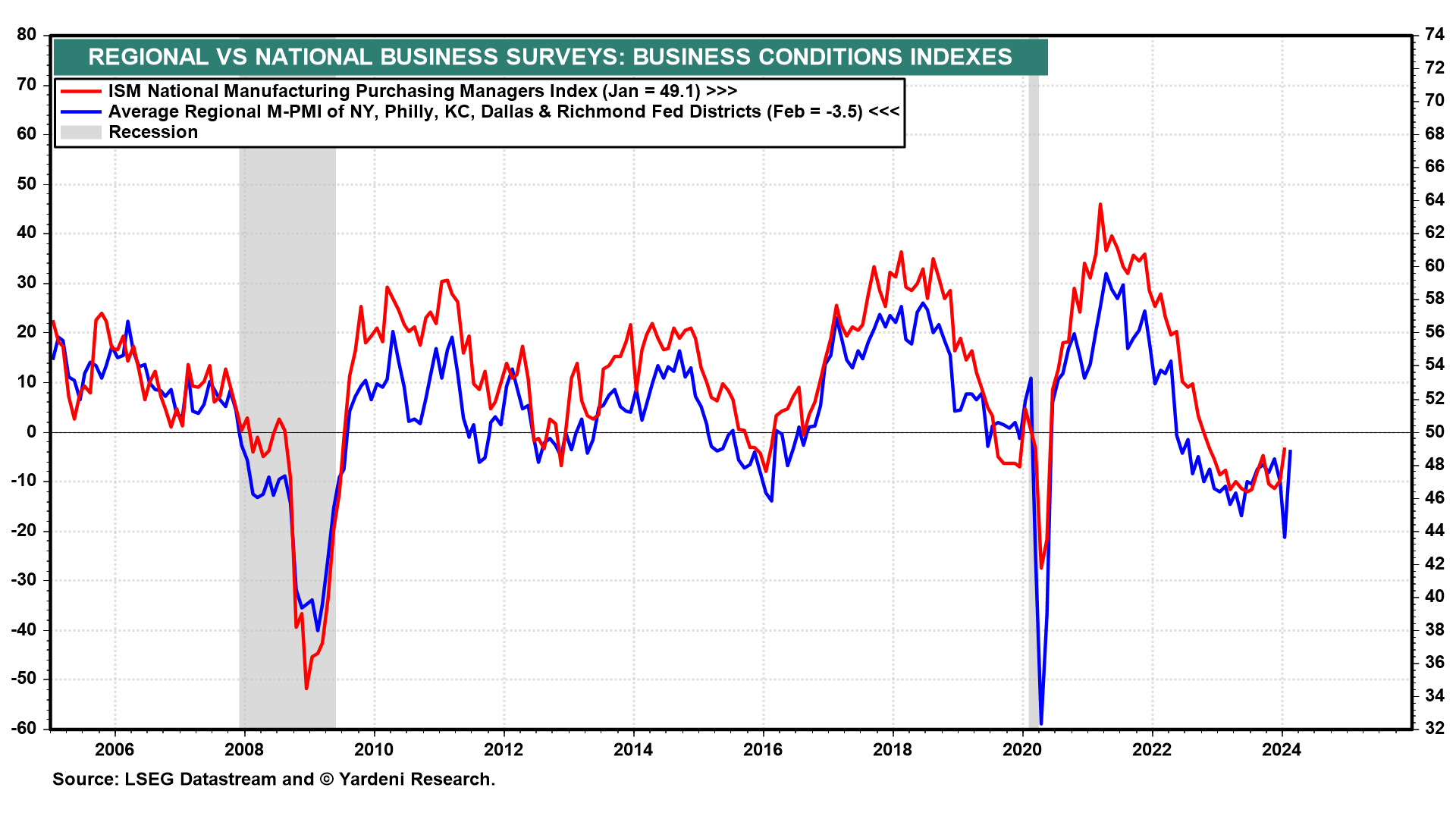

(3) Regional business surveys. The regional business surveys conducted by 5 of the 12 Federal Reserve district banks show a sharp rebound during February, confirming that January's plunge was weather related (chart). They also suggest that February's national M-PMI might continue to rebound closer to 50.0. This confirms our view that the rolling recession in the goods sector is bottoming.

We will worry about the three bears another time.