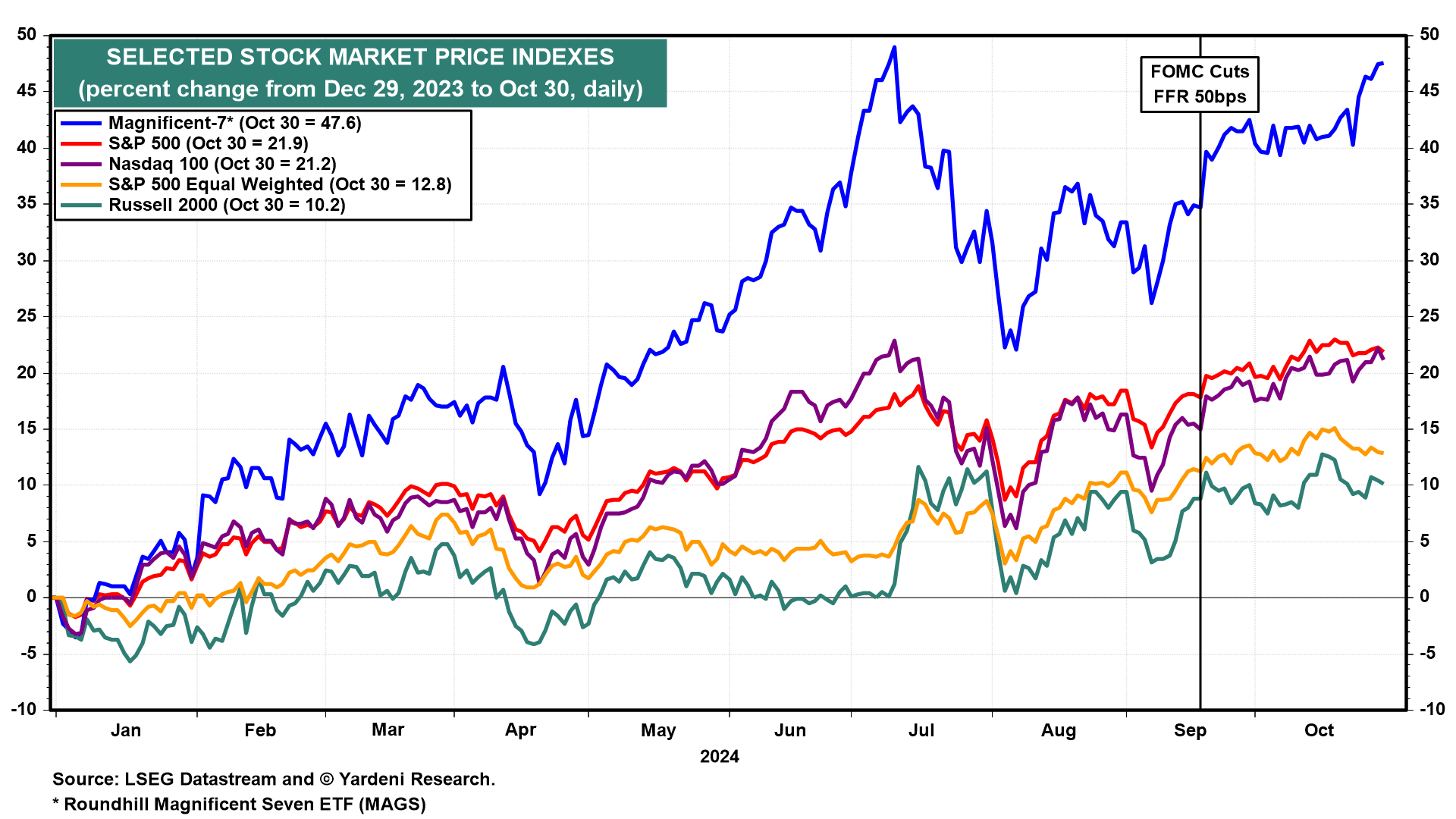

The S&P 500 equal-weighted index has been going nowhere fast since the Fed cut the federal funds rate (FFR) by 50bps on September 18 (chart). The same can be said for the Russell 2000. The stock market rally has stopped broadening since the Fed's rate cut! Why is that given that the current earnings season has been mostly upbeat?

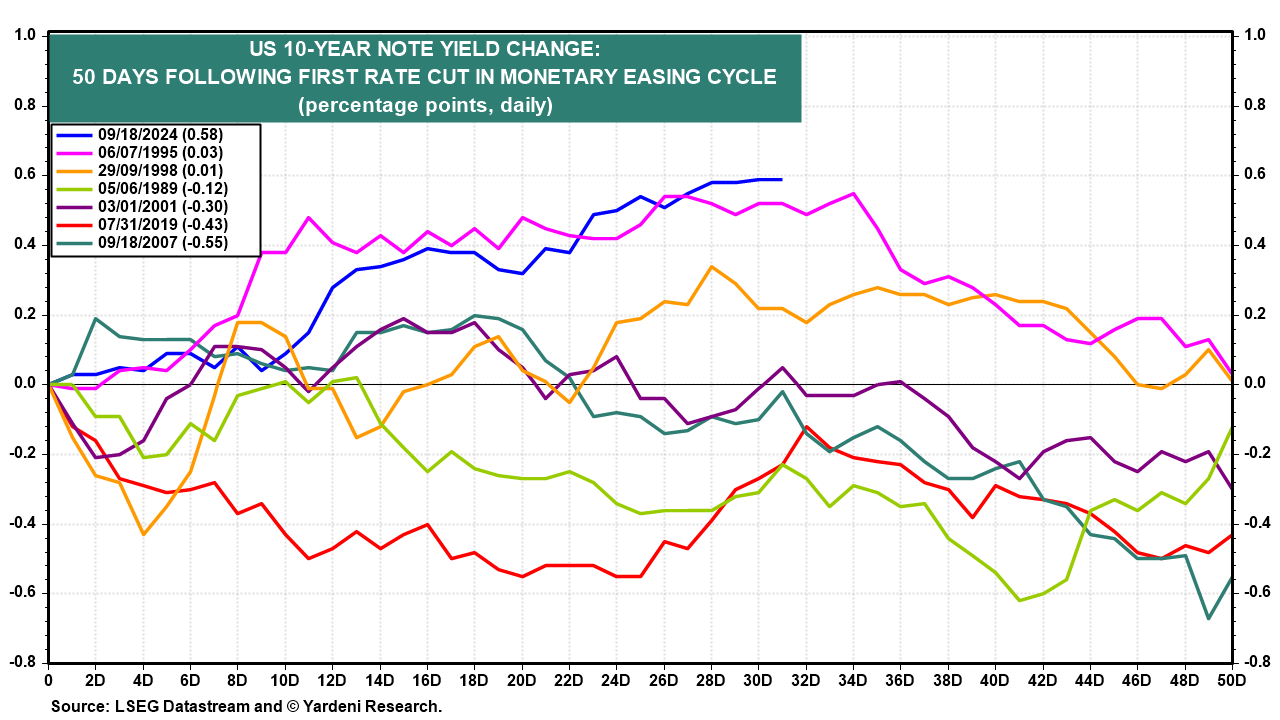

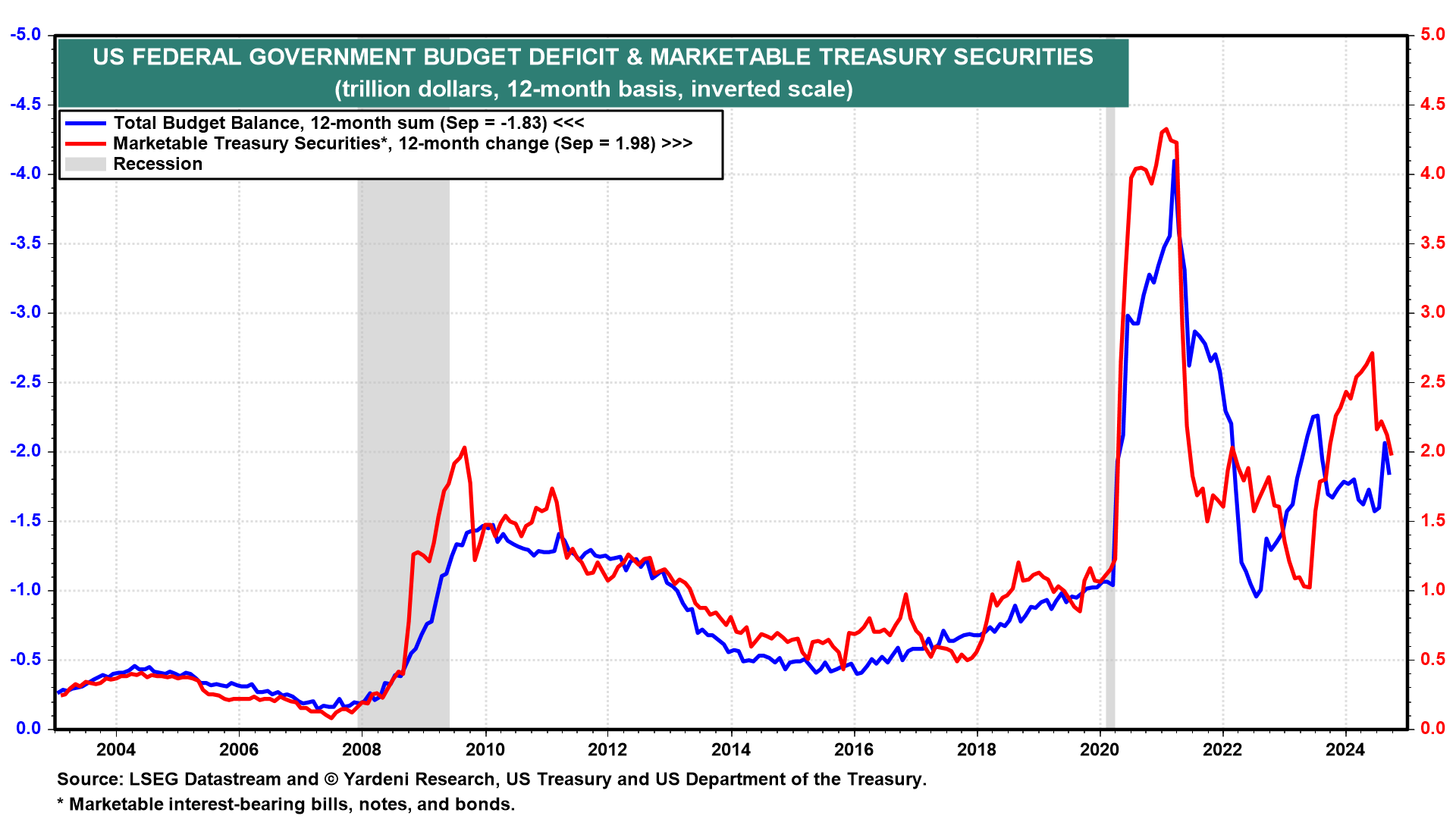

The problem is that the bond yield has been rising and tightening credit conditions ever since the Fed eased credit conditions! That's a rather unusual response to the first rate cut in a monetary easing cycle (chart). The bond market agrees with our opinion that the Fed cut the FFR too much, too soon. Indeed, the latest economic indicators have been strong, as we expected. In addition, the US Treasury Department plans to raise a whopping $1.3 trillion over the next six months.

The S&P 500 is up 3.8% since September 18. We expect that it might go nowhere fast over the rest of this year too, hovering around 5800. The outlook for fiscal policy will probably remain unsettling after the election and the Fed might not lower the FFR over the rest of this year after all.

Let's dive into today's relevant developments:

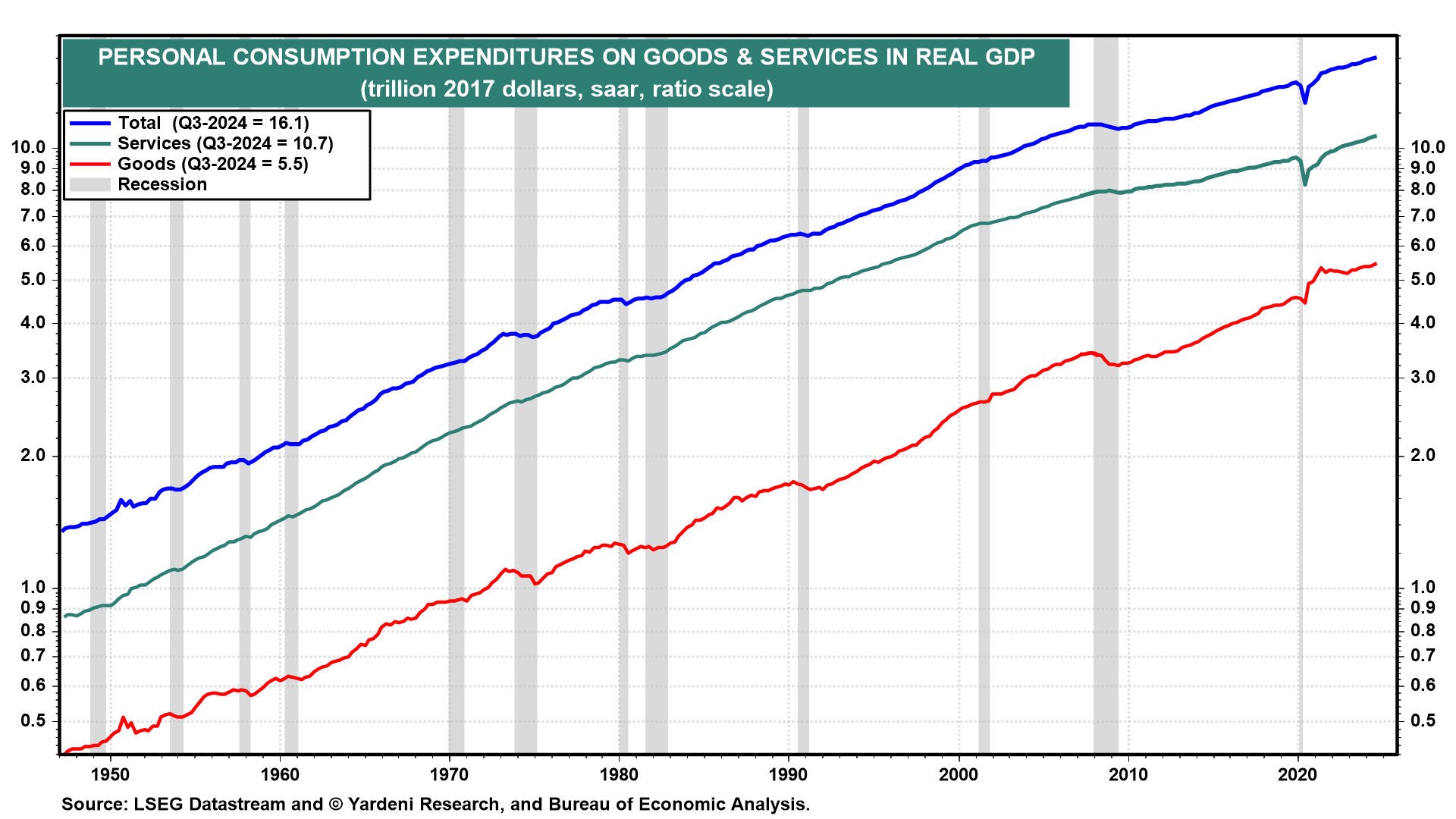

(1) GDP. Q3 real GDP grew 2.8% (saar) to a new record high (chart). Though the first estimate of Q3 growth was a tad softer than the 3.0%+ we were expecting, the 3.2% increase in real final sales to private domestic purchasers suggests the two-year streak of strong quarterly growth is on solid footing. Consumer spending rose 3.7%, the strongest quarterly increase since Q1-2023, led by a 6.0% rise in goods spending.

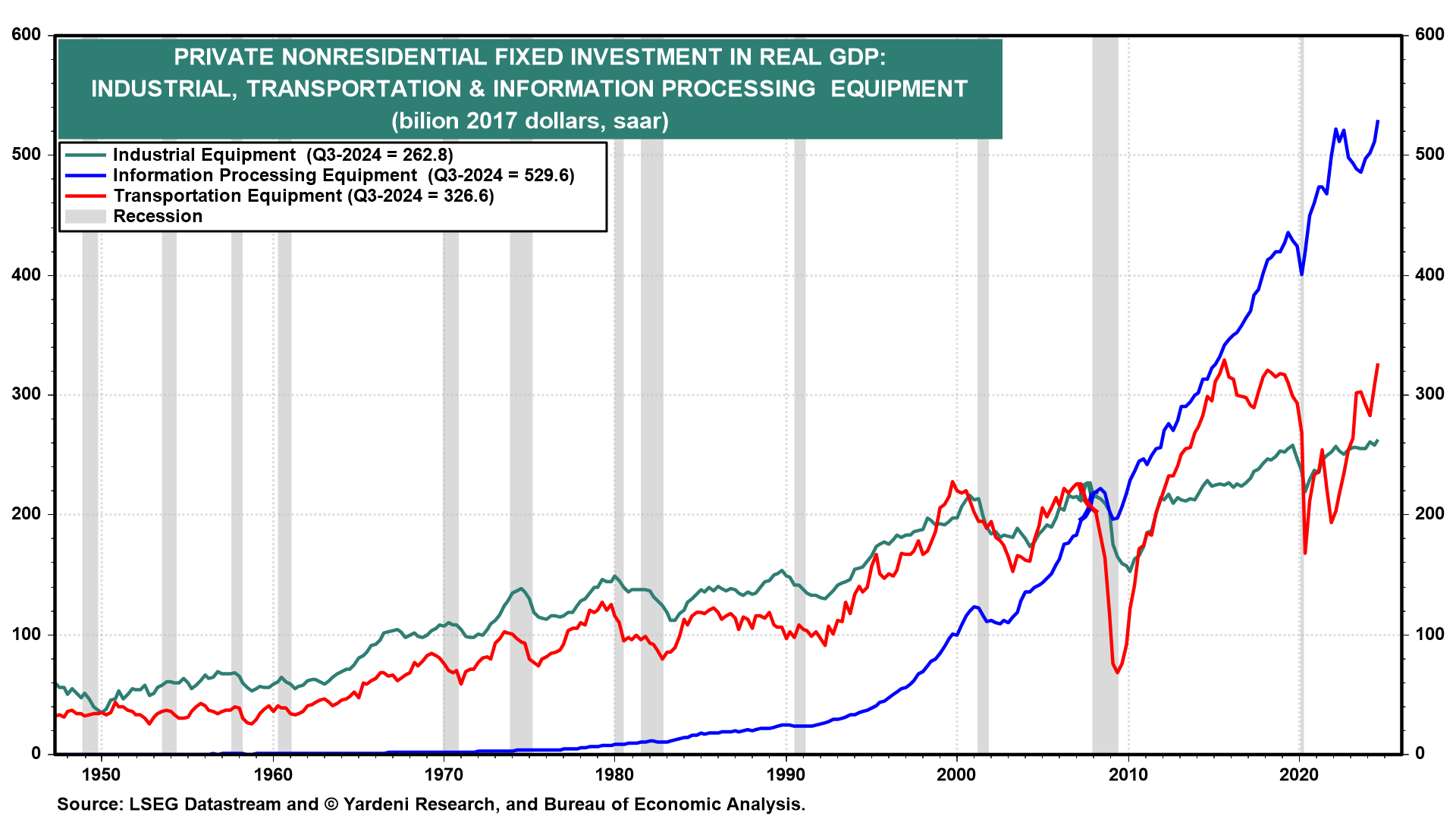

Investment in business equipment jumped 11.1%, following a strong 9.8% increase in Q2. That was led by a new record high in information processing equipment investment and rising transportation equipment investment (chart).

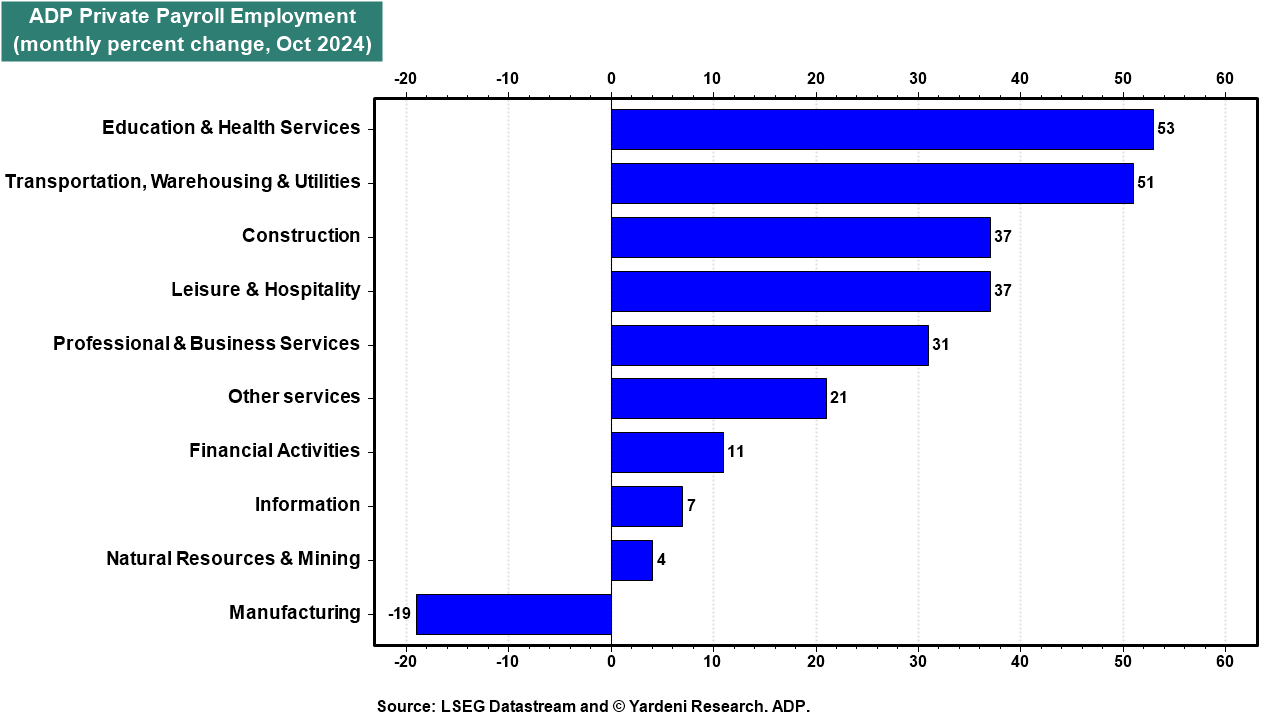

(2) Employment. ADP said private companies hired 233,000 new workers in October, up from an upwardly revised 159,000 in September and far surpassing expectations. It was the best monthly increase in the ADP series since July 2023.

A few economists predict that layoffs by Boeing and Stellantis, along with Hurricanes Helene and Milton, will combine with a cyclical slowdown to lead to the first negative payrolls print since the pandemic on Friday. ADP's data did show that private manufacturers reported 19,000 in job losses this month. However, all other sectors reported gains (chart). Private wages also increased 4.6% y/y.

(3) Treasury borrowing. Today, the Treasury Department's quarterly refunding announcement (QRA) showed that Treasury auctions are expected to remain at a record pace during a period of economic growth (chart).

What can we expect when the current debt limit suspension ends on January 2? A divided government could force the Treasury to use extraordinary measures (as it did early last year) to fund the government while Congress debates the ever-increasing debt limit. It may take a debt crisis in the bond market to rein in Washington's fiscal excesses.