The flash S&P global PMIs for July suggest that the global economy continues to avoid a hard landing, while falling into a soft landing. That's a relatively bullish scenario for stocks and bonds since it suggests that inflation should continue to moderate around the world allowing the major global central banks to stop tightening their monetary policies. Let’s review the data:

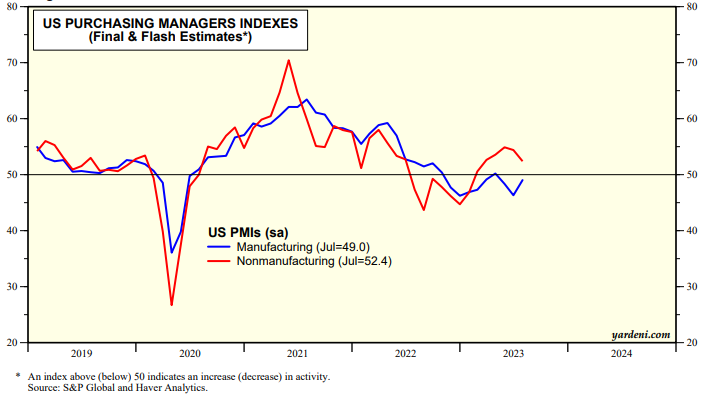

(1) US PMIs. The S&P Global M-PMI for the US edged up in July to 49.0 (chart). It has been mostly below 50.0 since November 2022, as consumers have pivoted from buying goods to buying services. The NM-PMI edged down to 52.4 in July, remaining above 50.0 since February.

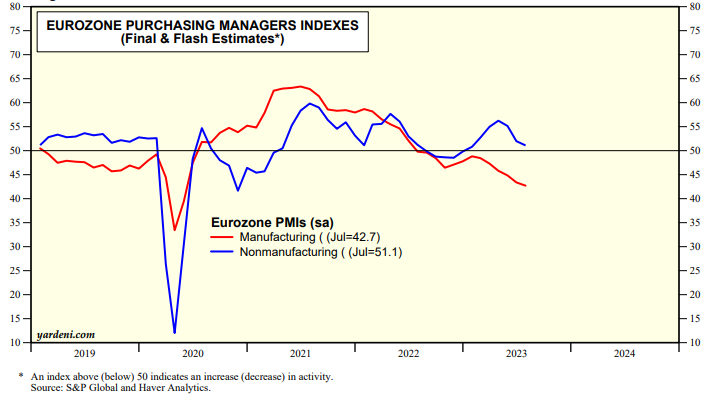

(2) Eurozone PMIs. The Eurozone M-PMI has been below 50.0 since July 2022 (chart). It was 42.7 in July, the lowest since May 2020. The region’s NM-PMI was 51.1 during July, the weakest since January.

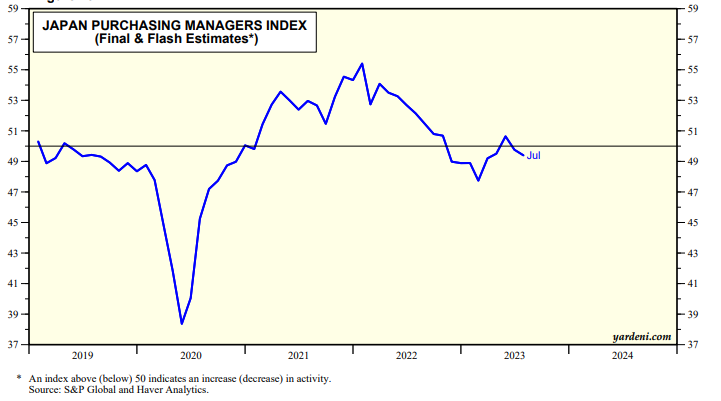

(3) Japan PMI. During July, Japan’s M-PMI edged down to 49.4 from 49.8 in June (chart). It has been mostly below 50.0 since November 2022.