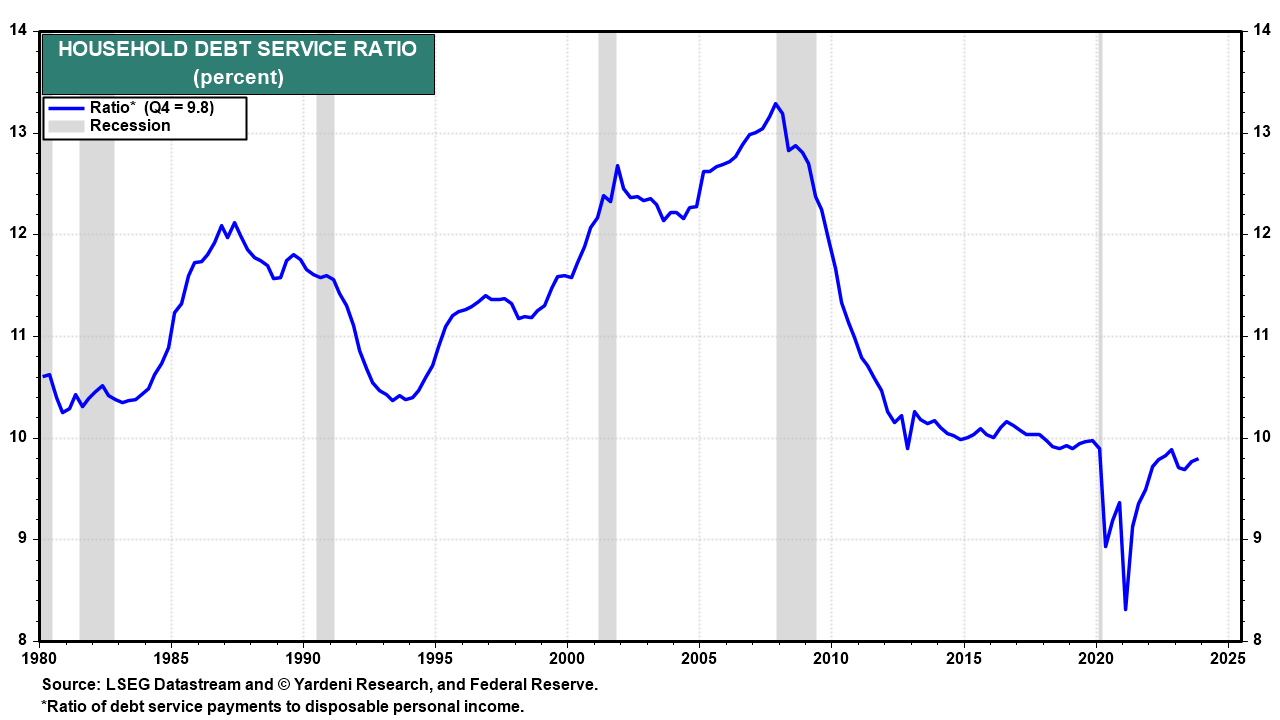

The strength of the US consumer has underpinned much of the current bull market in stocks. In recent months, rising real disposable income (DPI) has fueled consumer spending even as the excess saving accumulated during the pandemic was depleted. Debt service payments have remained below 10% of nominal DPI from Q1-2020 through Q4- 2023. That's relatively low because many households cleaned up their balance sheets following the Great Financial Crisis (GFC) (chart). Many also refinanced their mortgages at record low interest rates during the pandemic.

We monitor numerous indicators to assess the outlook for consumer spending including credit usage and inflation expectations. New data released by the Fed today provide insights on both fronts. Here's our take:

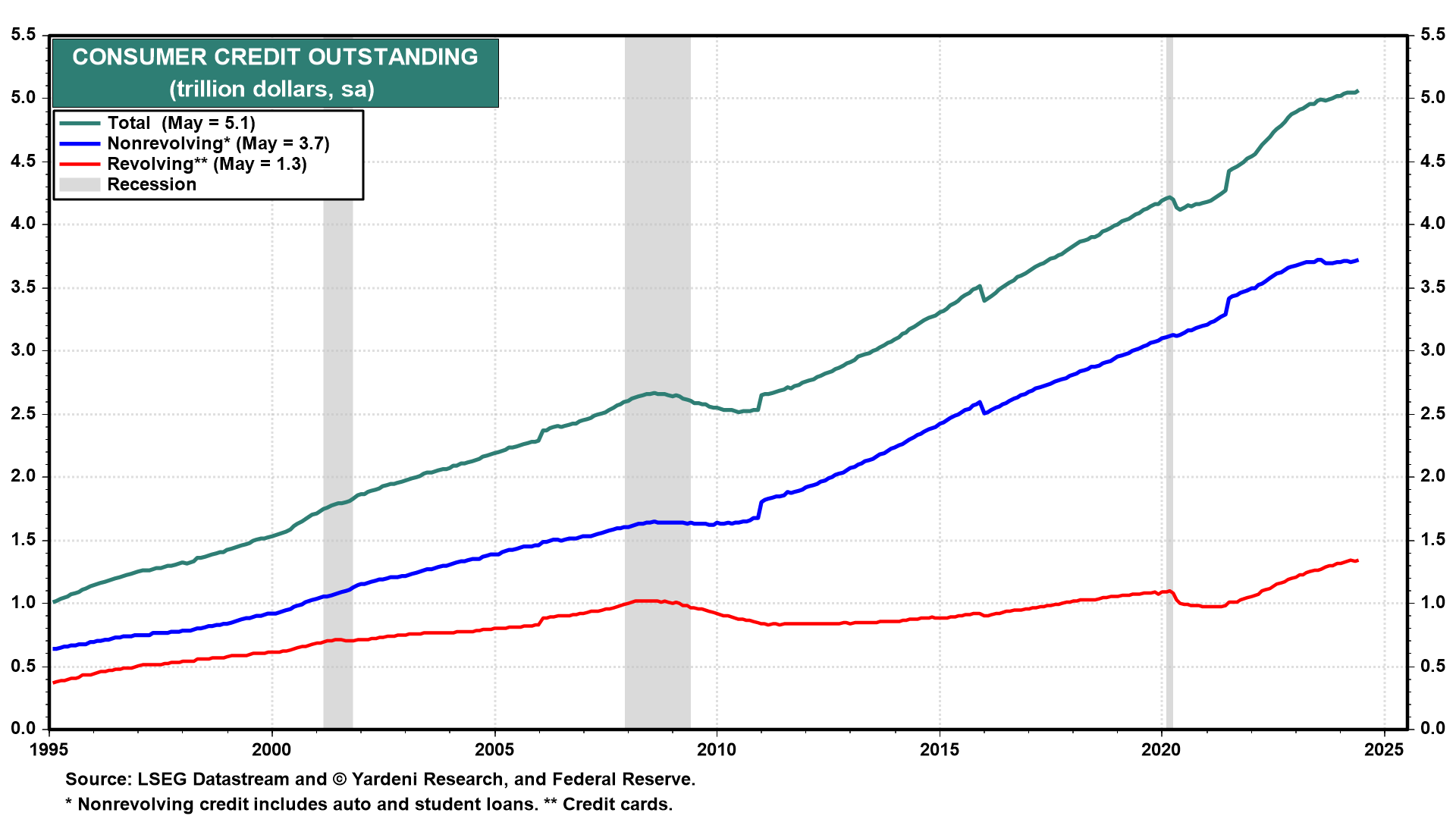

(1) Credit. Consumer credit outstanding increased by 2.7% y/y in May. That was led by a 6.3% y/y rise in revolving credit (i.e., credit cards), which brought revolving credit to a new record high of $1.3 trillion in May (chart).

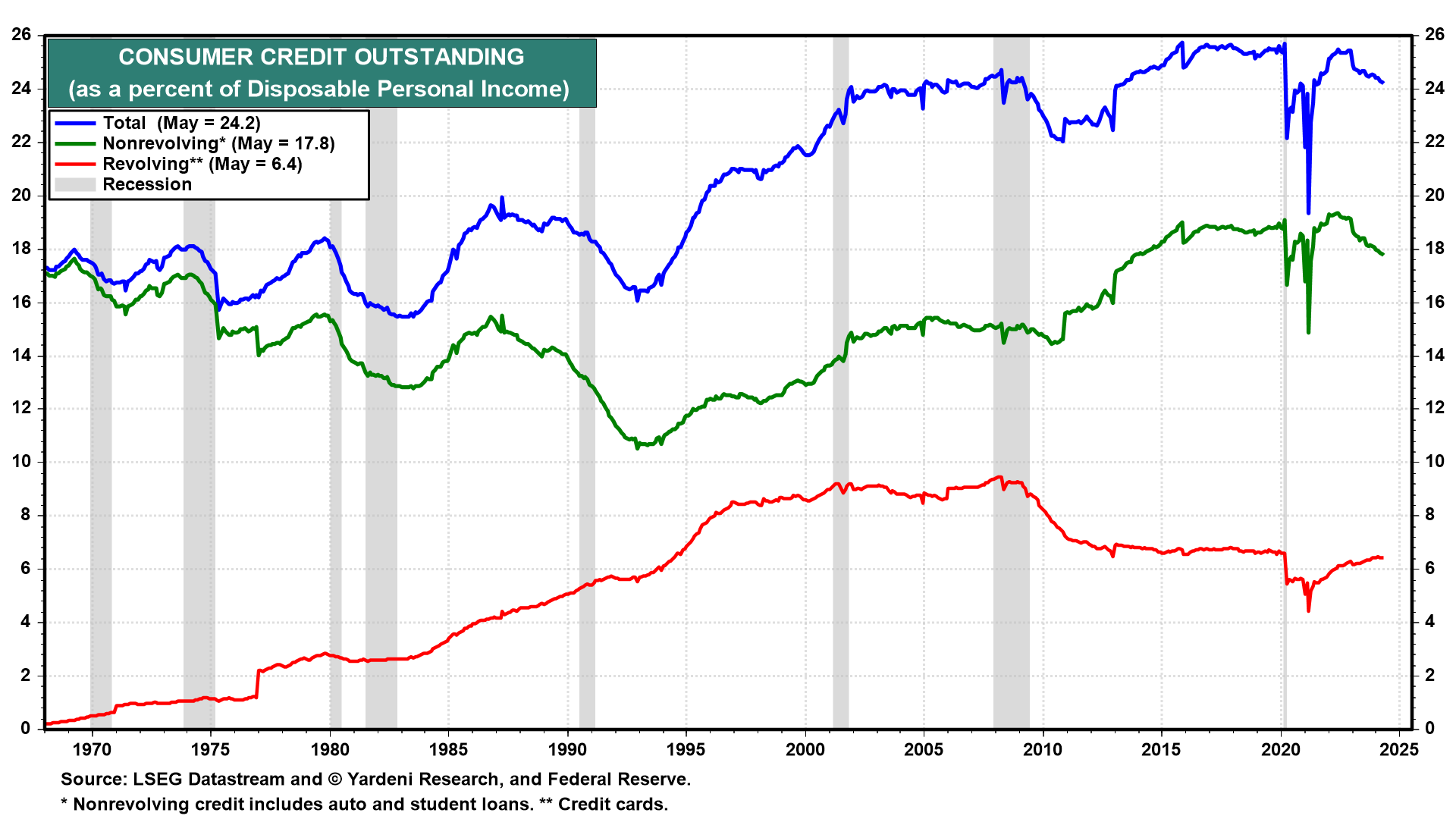

Relative to DPI, consumer credit is in good shape. Consumer credit outstanding fell to 24.2% of DPI in May, the lowest since August 2021 (chart). Student debt relief has played a role, helping shrink nonrevolving credit (which also includes auto loans) to 17.8% of DPI. Meanwhile, revolving credit as a percentage of DPI was 6.4% during May, remaining just below its pre-pandemic readings and well below its pre-GFC readings.