Stock prices are falling because Trump Turmoil 2.0 is making investors dizzy. Just today, President Donald Trump confirmed that 25% tariffs will be imposed on Canada and Mexico tomorrow. He also said that the US will impose tariffs on agricultural products on April 2. The President ordered a pause on all US military aid to Ukraine, three days after he kicked Ukrainian President Volodymyr Zelensky out of the White House following a heated Oval Office meeting between the leaders.

Exacerbating today's stock market swoon were news reports that Nvidia's latest Blackwell chips are reaching China and that Dell and Super Micro may be violating US export restrictions in shipping servers that may contain Nvidia chips from Singapore to Malaysia. Malaysia is reportedly a hub of chip smuggling to China.

Also unnerving investors is the recent batch of weak economic indicators that has caused the Atlanta Fed's GDPNow tracking model to cut the Q1 real GDP growth rate from 2.3% (q/q, saar) to -1.5% on Friday and to -2.8% today. We explained in our previous research note today why we believe that February's batch of economic indicators will show a rebound in economic activity.

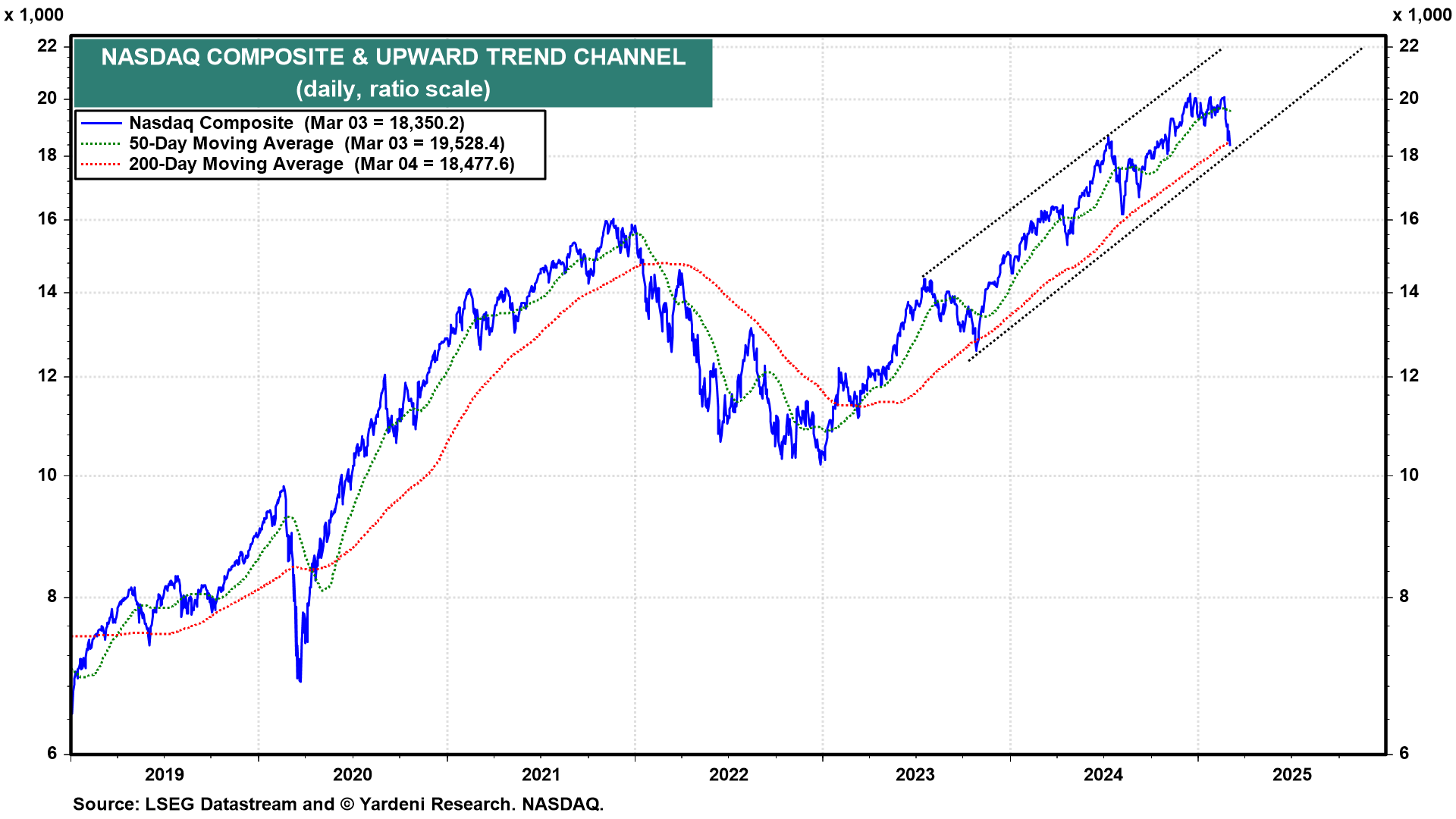

Such a rebound would help to stabilize the stock market and push bond yields back up a bit. However, there's nothing we can do to calm jitters about the impact of Trump Turmoil 2.0 on the economy and financial markets. They may continue to make for a choppy stock market through mid-year (chart). By the second half of this year, we expect the bull market to resume.

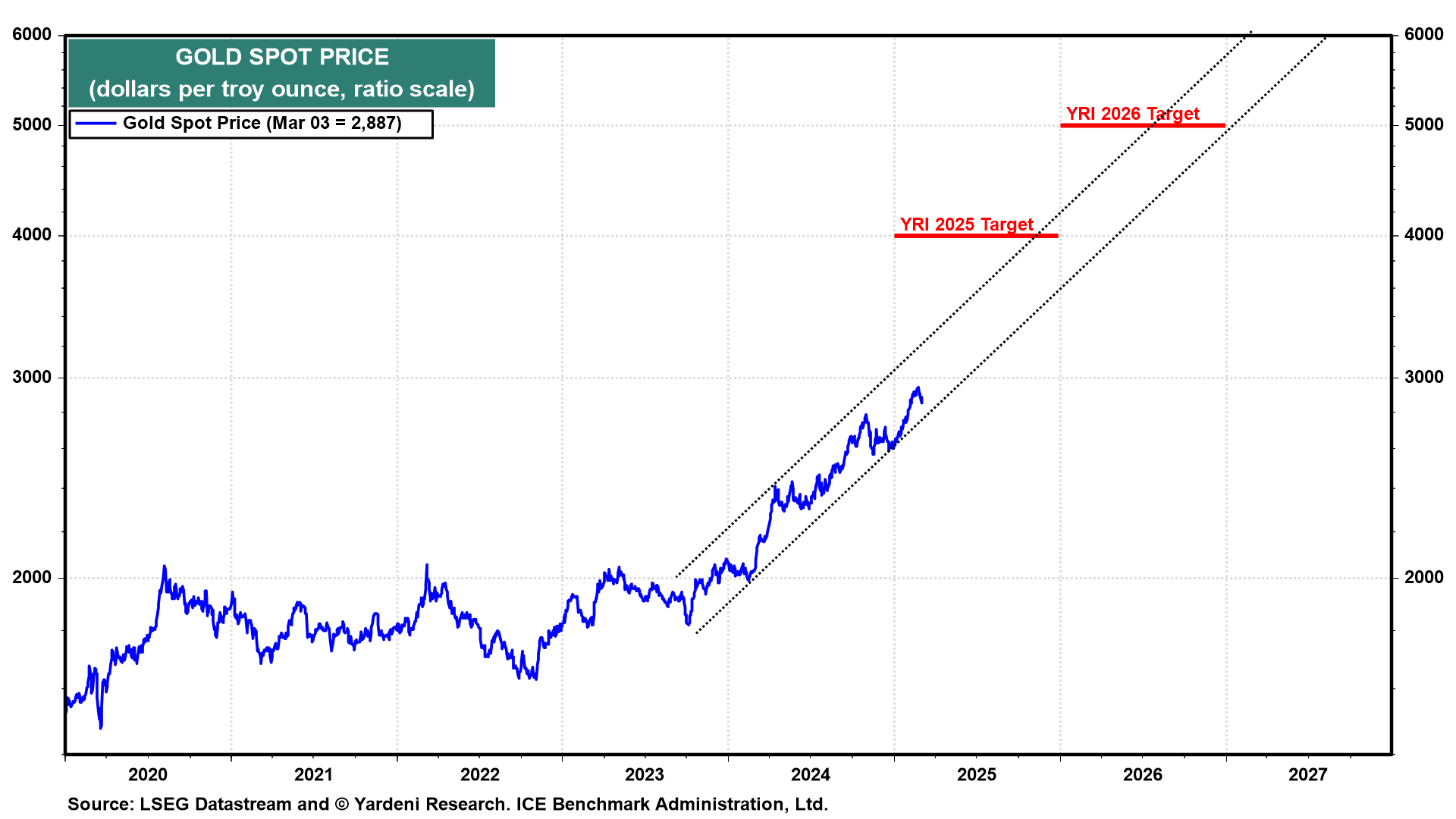

Meanwhile, the price appreciation of gold has been remarkably steady since late 2023 (chart). The recent pullback has been very moderate so far. We are targeting (not promising) a gold price of $4,000 per ounce by the end of this year and $5,000 by the end of 2026.

Those projections are based mostly on our expectation that central banks will continue to accumulate gold reserve assets. IMF data show that the national valuation of those reserves rose to a record $2.0 trillion in December (chart).