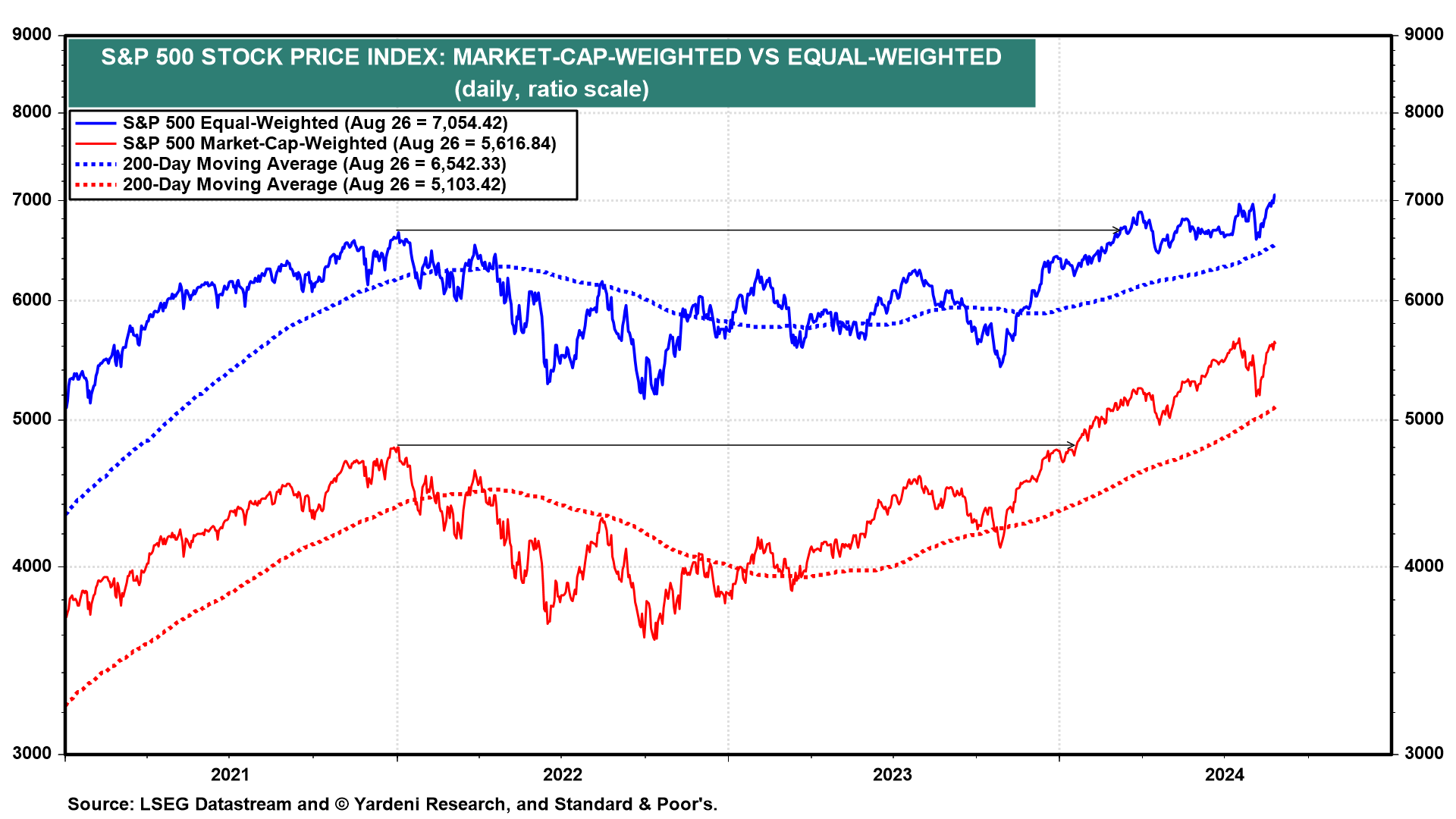

The world is getting more dangerous. That doesn't seem to be having any impact on the US stock market. The S&P 500 is less than 1% below its July 16 record high, while the equal-weighted version of the index is at a record high (chart).

The biggest risk to the bull market in stocks is a recession, according to most strategists. We don't share that concern, especially now that the Fed is focusing on keeping the unemployment rate down. Instead, we continue to monitor geopolitical developments as perhaps the biggest risk to the bull market:

(1) Middle East. Imagine a country where two rival governments fight over their central bank. Today's Bloomberg reported: "Libya's eastern government said it will shut down crude output and exports, as a struggle with its Tripoli-based rival for control of the central bank and the nation's oil riches threatens a new round of conflict." The country produced 1.15 million barrels a day last month.

Brent crude jumped as much as 3.2% to above $81 a barrel on the news that the eastern authorities issued a statement on Facebook that a "force majeure" applies to all fields, terminals and oil facilities (chart).

Contributing to the jump in the oil price was a preemptive strike by Israel against Hezbollah on Sunday. Around 100 Israeli jets hit dozens of Hezbollah launch sites in southern Lebanon, destroying thousands of rockets the military said were aimed at Israel.

(2) Ukraine and Russia war. Russia launched a massive missile and drone attack aimed at energy infrastructure across Ukraine overnight into Monday. That was the biggest air attack since the war began, according to Ukrainian officials. Ukraine has been bracing for a major Russian attack for weeks, in response to Kyiv's shock incursion into the border region of Kursk in Russia. Meanwhile, there has been a significant buildup of Belarusian forces and equipment on Ukraine's northern border.

(3) South China Sea tensions. The Philippine government accused China today of "repeated aggressive, unprofessional and illegal" actions in the South China Sea following a series of clashes and incidents on air and at sea over the past week. The Philippines and the US have a mutual defense treaty. Washington has pledged to aid the Philippines against armed attacks on its vessels and soldiers in the South China Sea. (Last week, the US Navy announced a plan to remove the crews from 17 Navy support ships due to lack of qualified mariners to operate the vessels.)

(4) China and Taiwan. The Taiwanese defense ministry confirmed the Japanese military's report on Saturday that a total of 38 Chinese military aircraft, including drones, were flying around Taiwan in the 24 hours to 6 a.m. on Saturday. Meanwhile, 12 Chinese naval vessels were detected operating around the island.

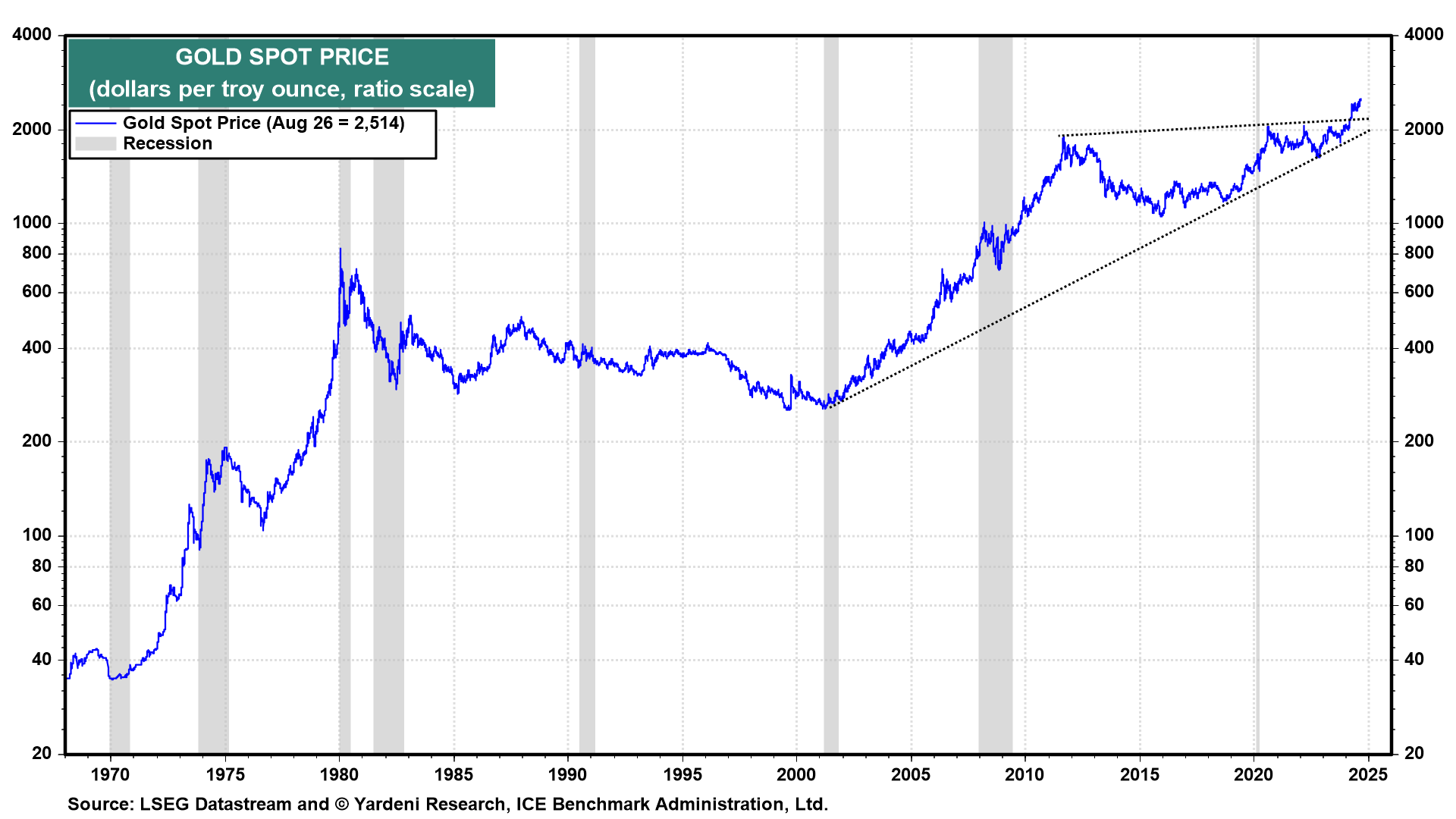

(5) Gold. We continue to recommend overweighting oil and gold in portfolios as geopolitical shock absorbers. Easier monetary policies of the major central banks should also benefit these two commodities, as well as other ones.

The price of gold firmed today, nearing its recent record high, amid widespread expectations of a September interest-rate cut following Fed Chair Jerome Powell's dovish remarks on Friday and the latest geopolitical shocks (chart).