With the Fed in easing mode and US economic growth remaining resilient and even robust, we are still wondering what could possibly go wrong. We remain optimistic on the economic outlook and bullish on the outlook for stocks. We continue to monitor the geopolitical risks that might revive inflation and depress global growth. On Friday, JPMorgan Chase CEO Jamie Dimon said that these risks are "treacherous and getting worse."

In Asia, China is attempting to stimulate its economy out of a property calamity while getting more aggressive toward its neighbors in the South China Sea. In Europe, the Russia-Ukraine war is nearing its thousandth day. And in the Middle East, Israel and Iran (and its proxies) are at war. Let's briefly discuss the latest global developments:

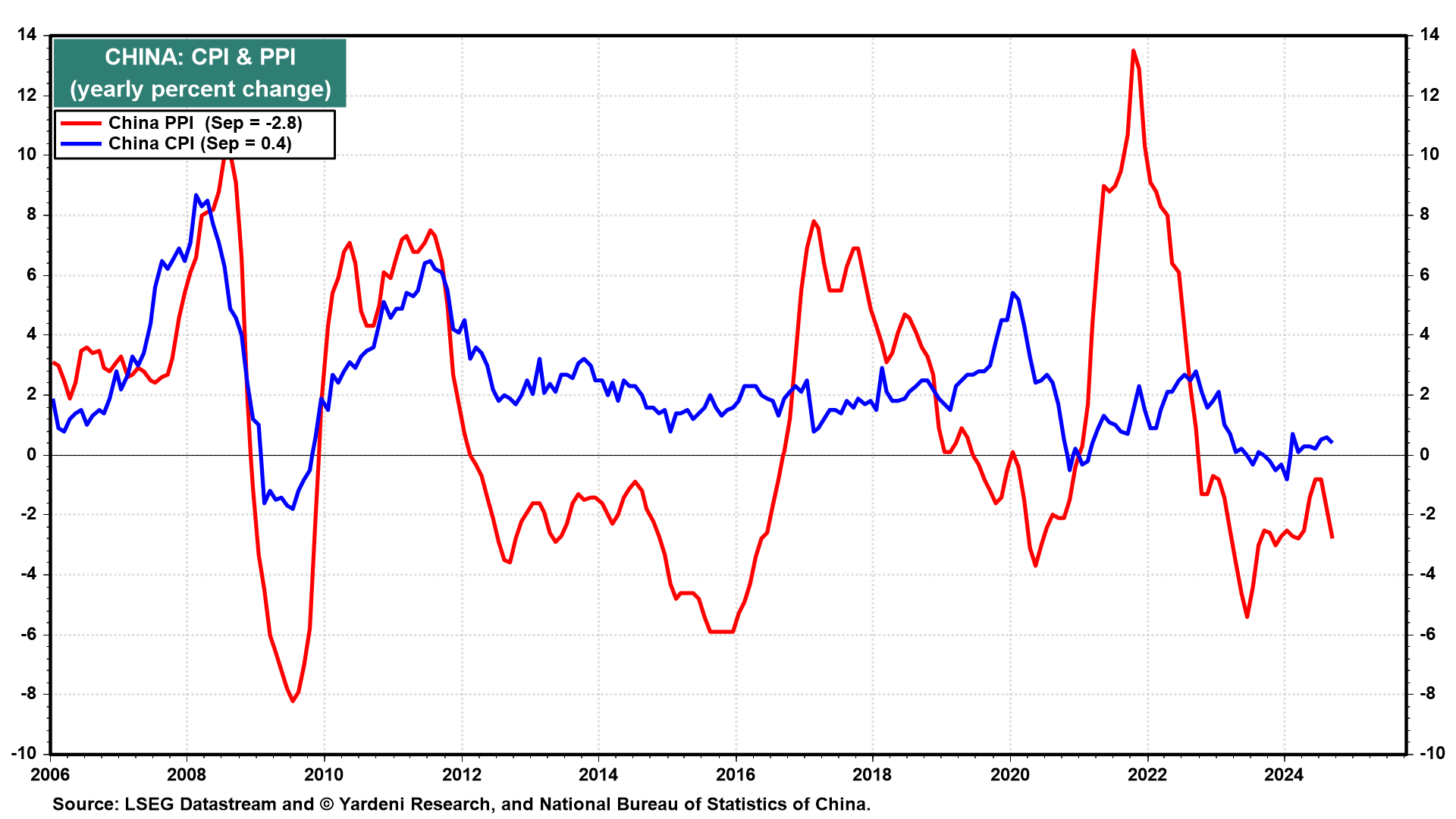

(1) China. The Chinese government is attempting to spur domestic consumer spending by resuscitating asset prices for stocks and real estate. We doubt that will work. Fiscal stimulus could boost consumer spending with "helicopter money" similar to the three rounds of checks the US government handed out to millions of American households. But that might be too radical for the Chinese government. Meanwhile, China's producer prices deflated further in September while consumer prices barely rose (chart). China continues to export deflation to the rest of the world.

The Chinese government announced a stimulus package of monetary and credit measures on September 24. It is no surprise this announcement came less than a week after the Fed's 50bps rate cut. High US interest rates limit how much China is able to ease without risking foreign capital fleeing the country. That's what happened when global central banks hiked rates in 2022 and 2023. The US bond market now expects far fewer Fed rate cuts in the next 12 months today than a few weeks ago, perhaps leading to the disappointing follow-up press conferences from Chinese officials on Saturday.